Bloomberg Signs Principles for Responsible Investment (PRI)

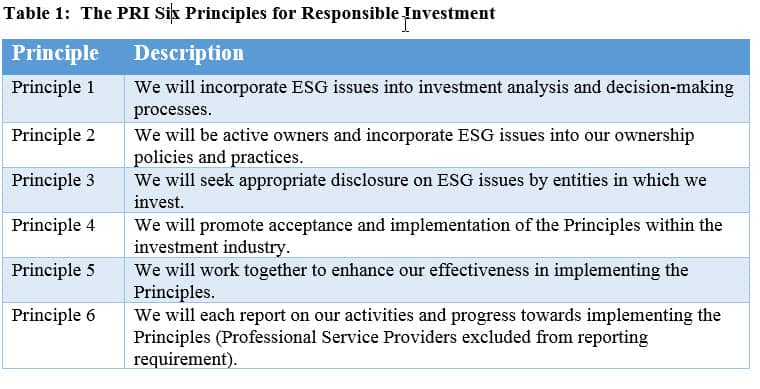

Last week, Bloomberg L.P., a privately held global information and technology company, announced that the firm, in its capacity as a US corporate retirement plan sponsor, was becoming a signatory to the Principles for Responsible Investment (PRI). The PRI, which was conceived in 2005 and launched by the United Nations in 2006 along with a number of large institutional investors, now operates as an independent UN sponsored advocate for responsible investment to promote its six Principles for Responsible Investment. At this juncture, these represent both a voluntary and aspirational collection of investment principles that offer a menu of possible actions for incorporating environmental, social and governance (ESG) issues into investment practices. Refer to Table 1. As a signatory, Bloomberg became the first US corporate retirement plan sponsor to sign on to the PRI principles, and one of about 1,750 signatories across 50 countries accounting for some $70 trillion in assets under management. In the process, Bloomberg also noted that it had reviewed opportunities to integrate environmental, social and governance considerations into the company’s global retirement plans and that this included adding an ESG-themed equity fund to its US 401(k) menu of plan investment options. While not the first company to do so, Bloomberg is still in the minority with respect to companies that have added a sustainable investing option to a defined contribution (DC) retirement plan[1]. This, however, is likely to change in time as an alignment of investor beliefs and interests and company values combine to stimulate further development and availability of effective sustainable investment product offerings.

$7.5 Trillion Held in Employer-Based Defined Contribution Retirement Plans

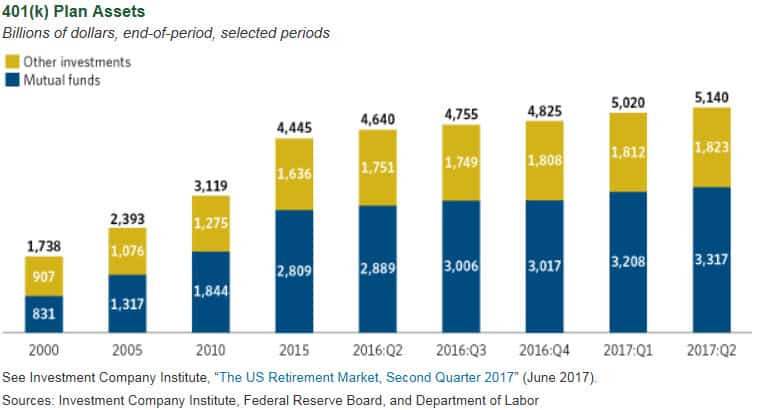

Based on data as of June 30, 2017, $7.5 trillion is held in employer-based defined contribution retirement plans. Of this sum, $5.1 trillion is held in 401(k) plans while the rest is sourced to other private-sector defined contribution plans ($575 billion), 403(b) plans ($949 billion), 457 plans ($297 billion) and the Federal Employees Retirement System’s Thrift Savings Plan (TSP) ($526 billion)[2]. Refer to Chart 1. About 65% of the assets held in these plans, or $3.3 trillion, are managed through mutual funds. The most common type of funds held in 401(k) plans are equity funds, followed by hybrid funds which also include target date funds. At the same time, sustainable investment options in 401(k) plans are quite limited, in terms of assets, number and type.

Chart 1: Defined Contribution Plan Assets-$7.5 Trillion in Assets

Less Than 1% of Retirement Plan Assets Invested in Sustainable Investments

An analysis by the US SIF Foundation of the holdings that 2,390 private sector retirement plans reported as of year-end 2014 to the Department of Labor found that less than 1% of the assets were invested in funds that explicitly market themselves as socially responsible investments (SRI). An earlier survey by the US SIF Foundation and Mercer, which specifically focused on sponsors of defined-contribution plans, found that while 14% of the 421 DC plan sponsors responding to the survey offered one or more SRI options, SRI options represented a low percentage of assets (around 1%). Until recently, uncertainty about the compatibility of sustainable investing and a plan sponsor’s fiduciary duty under the Employee Retirement Income Security Act of 1974 (ERISA) was a factor in inhibiting companies from introducing sustainable investing options in 401(k) plans. Guidance in late 2015 issued by the Department of Labor, however, has substantially clarified this issue and made it easier for plan sponsors to offer sustainable investments.

DC Plans Primary Mechanism for Retirement Saving and Investing

DC plans have become the primary mechanism by which American workers save and invest for retirement. Notwithstanding the emergence of defined contribution plans such as 401(k) as an anchor in helping workers achieve financial security during retirement, supported by numerous tax and savings advantages, data from the U.S. Department of Labor indicates that about 30% of eligible workers don’t participate in their employer’s retirement investment plan. Auto enrollment, the process by which new employee workers are automatically enrolled in the plan unless they opt out, leads to higher rates of participation, with more than 90% electing to remain in the plan. On the other hand, this approach has led to lower levels of savings. According to the Employee Benefit Research Institute, based on data as of 2011, an estimated 40% of new workers at companies that automatically enroll workers in a 401(k) plan end up saving less than they would if they had signed up voluntarily.

A variety of factors affect participation levels, including the complexity of plans and participation mechanics, planning time horizon and the reality that more pressing short-term needs take precedent relative to long-term retirement savings considerations, and the lack of financial literacy, to mention just a few. While not intended as a silver bullet, perhaps actuating a growing interest in sustainable investing on the part of individual plan participants by incorporating investing options through funds that pursue a positive societal outcome without compromising financial performance results could motivate employees to higher levels of participation and savings in company sponsored plans.

Individual Investors Would Like Investments to Reflect Their Personal Values

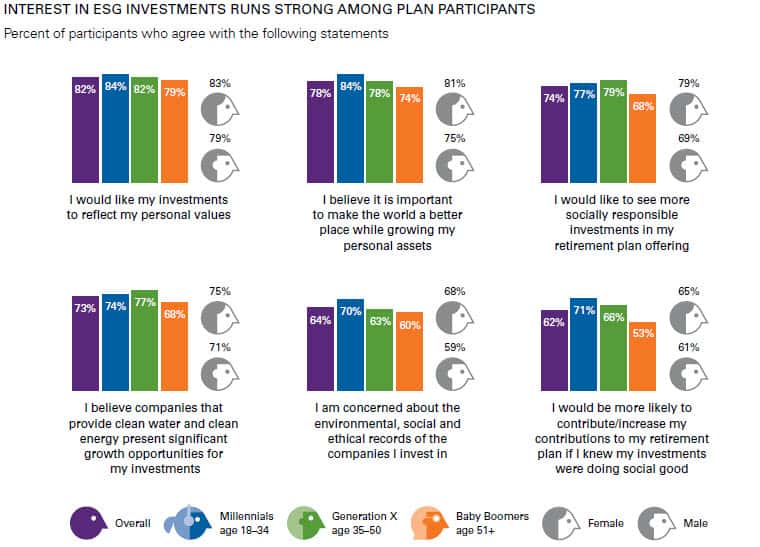

Surveys conducted by financial institutions lead to the observation that individual investors are interested in sustainable investing and millennials, in particular, are 2X more likely than other individual investors to invest in companies or funds that target specific social or environmental outcomes. This, according to research conducted by Morgan Stanley in 2015[3]. Similarly, a survey conducted by Natixis in 2016 with results published to coincide with the firm’s launch of the first of its kind ESG focused target date retirement product for 401(k) plans in the US, concludes that interest in ESG investments runs strong among plan participants. According to the survey, 84% of respondents across varying age groups, both male and female, said that they would like their investments to reflect their personal values. Refer to Chart 2 for survey results relating to interest in ESG investments.

Chart 1: Natixis Global Asset Management 2016 Survey of Defined Contribution Plan Participants: Interest in ESG Investments

Source: Natixis Global Asset Management 2016 Survey of Defined Contribution Plan Participants

Adding Sustainable Investing Options to Retirement Plans Can Potentially Drive Higher Levels of Participation and Savings

Adding sustainable investing options to retirement plans can potentially tap into these attitudes and help motivate employees to achieve higher levels of participation and savings. Doing so can also serve to align a company’s mission and corporate values. That said, adding sustainable investment options to an existing line-up of investments through additional mutual fund offerings, either as a one-off or single offering within a dominant asset class, such as domestic large cap equities, or in a way that provides exposure to a balanced and diversified sustainable investment option may be challenging given the limitation of offerings in the space today.

Regardless, companies will have to go through a formal due diligence evaluation process that likely includes the following action steps:

1.Formulating the rationale for the idea and determining the level of interest within the company or entity, such as educational institution or municipality.

2.Seeking input from plan participants. This is an important step because when it comes to investing in line with personal values or desired societal outcomes, no two individuals are likely to be exactly alike. Some are passionate about mitigating climate change while others might be averse to high CEO pay. Some might have an aversion to investing in firms engaged in the production of alcohol, guns, gambling, and tobacco while others may not hold such views. Still, others may gravitate to companies that provide clean water and clean energy while others may be less committed to these sectors. While it may be impossible satisfy all points of view, engaging and seeking inputs from plan participants will help identify the best way of meeting the diversity of opinion on this subject.

3.Evaluating the potential alignment of sustainable investment options within the context of the current plan offerings.

4.Reviewing and updating, as appropriate, the plan’s investment policy statement.

5.Establishing selection criteria and evaluating and selecting the proper investment options and funds.

6.Expanding periodic plan communications beyond financial results and plan/fund related material developments to include summaries of societal impacts achieved by the sustainable investment funds.

7.Monitoring funds, not only to ensure adherence to managerial and financial guidelines but also sustainability outcomes that could, in turn, be communicated back to plan participants.

1] Sustainable investing is an umbrella term that encapsulates social investing, SRI investing and ESG investing. Sustainable investing refers to the idea that investing in sustainable companies permits investors to achieve long-term competitive financial returns while at the same time attaining a positive societal impact. While it’s been changing somewhat, this concept captures a range of four prominent investment approaches or strategies. These are: (1) Screening out or excluding companies from investment portfolios for a variety of reasons, (2) Impact investing and thematic investing or investing to achieve a targeted social or environmental objective that is measurable, (3) Integrating environmental, social and governance (ESG) considerations as a proactive and integral component of the investment research and portfolio construction processes, and (4) Shareholder and bondholder advocacy and engagement in an effort to influence corporate behavior. For further information, refer to The ABCs of Sustainable Investing

[2] Like a 401(k) plan, a 403(b) is a retirement plan that’s designed for public schools and other nonprofits while a 457 plan is 457 Plan is a retirement savings benefits for governmental employees.

[3] Morgan Stanley Institute for Sustainable Investing, “Sustainable Signals: The Individual Investor Perspective” (February 2015).