On April 23, 2018, the U.S. Department of Labor (DOL) Again Attempts to Clarify Social Investing Rules for Plan Fiduciaries

On April 23, 2018, the U.S. Department of Labor (DOL) released a Field Assistance Bulletin intended to give further guidance to address questions that may arise from plan fiduciaries and other interested parties about Interpretive Bulletin 2016-01 and Interpretive Bulletin 2015-01. These earlier bulletins clarified the context within which fiduciaries, subject to the Employee Retirement Security Act of 1974 (ERISA), can consider pension plan investments selected for their collateral economic and social benefits in addition to their investment risks and returns. They were widely applauded when issued as a welcome step in advancing sustainable investing practices in the U.S. in that the Bulletins clarified that the selection of plan investments with collateral economic or social benefits were not prohibited on their face.

DOL Focused on Three Key Areas

While the motivations for the latest communication are unclear, the DOL in this latest Bulletin provided further clarification along the following lines:

- Plan fiduciaries are not permitted to sacrifice investment returns or take on additional investment risk when making investment decisions involving plan assets used to promote collateral social policy goals. Such collateral social policy goals, according to the DOL, refer to socially responsible investing, sustainable and responsible investing, environmental, social and governance (ESG) investing, impact investing and economically targeted investing (ETI). At the same time, plan fiduciaries are not precluded from doing so if all other economic considerations are otherwise equivalent when choosing between two investments.

- Engagements with companies on environmental or social factors in the form of negotiations with a company’s board or management or proxy voting activities, either directly or through the plan’s investment manager, should not incur significant expenses to advance public policy preferences.

- Investment options that form part of 401(k) type plans in particular, including qualified default investment alternatives (QDIA), are designed to offer plan participants a broad range of investment alternatives qualified on the basis of their diversification and risk and return attributes, and the addition of any investment alternative that constitutes ESG themed investments should not be implemented at the expense of maintaining a prudent menu of investment options from which to choose and invest.

Plan Fiduciary Obligations Under The Employee Retirement Security Act of 1974 (ERISA)

DOL’s comments reinforce the obligation of a plan fiduciary under the provisions of ERISA to run a plan solely in the interest of participants and beneficiaries and for the exclusive purpose of providing benefits and paying plan expenses. Fiduciaries must act prudently, avoid conflicts of interest and must diversify the plan’s investments in order to minimize the risk of large losses. In addition, they must follow the terms of plan documents to the extent that the plan terms are consistent with ERISA. Such obligations impose on plan fiduciaries the duty to make investment decisions on the basis of their risk, return, diversification and expense characteristics and not factor in any values based, social-based on ethical or moral based considerations. A hypothetical but still relevant example of this could be a plan that decides to pursue a goal of divesting from fossil fuel reserve owners much in line with announcements made earlier this year by both New York City and New York State to divest their public pension funds from fossil fuel companies. Public pension funds, however, are not covered by ERISA and are not directly subject to the DOL Bulletin.

Guidance Seems to Conflate Collateral Economic and Social Benefits with ESG Integration

The guidance seems to confuse collateral social policy goals, including ESG investing, with the concept of ESG integration. When referenced in the DOL’s Bulletin, ESG investing seems to suggest linkage to values-based considerations, such as social, moral, ethical, religious and economically targeted goals. In the writer’s opinion, this conflates the idea of ESG integration which represents the systematic and explicit consideration of relevant and material ESG factors or risks rather than the cursory inclusion of one or more of them. Put another way, the focus is on the consideration of ESG issues for the purpose of achieving a more complete investment analysis and better-informed investment decisions regardless of how the investments may be labeled. This is no different, for example, than assessing companies to determine their intrinsic value using such metrics as price-to-earnings or price-to-book. And in much the same way as definitions and approaches to determining value vary, the same can be said for the integration of ESG given the variety of approaches in use today.

DOL Guidance May Slow Addition of Sustainable Investing Options in 401(k) Plans

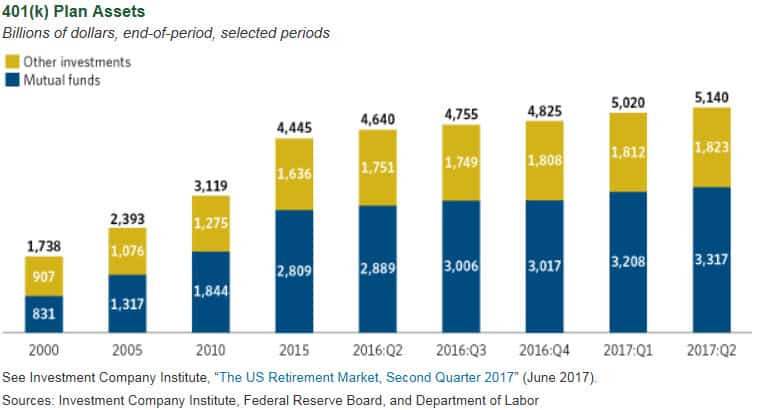

Last week’s guidance will likely give some pause to plan sponsors who might be considering now or in the future the addition to sustainable investment options to an existing 401(k) plan. This is a huge market with $7.5 trillion in assets as of June 30, 2017 held in employer-based defined contribution retirement plans. Of this sum, $5.1 trillion is held in 401(k) plans while the rest is sourced to other private-sector defined contribution plans ($575 billion), 403(b) plans ($949 billion), 457 plans ($297 billion) and the Federal Employees Retirement System’s Thrift Savings Plan (TSP) ($526 billion)[1]. Refer to Chart 1.

Chart 1: Defined Contribution Plan Assets-$7.5 Trillion in Assets

Yet an analysis by the US SIF Foundation of the holdings that 2,390 private sector retirement plans reported as of year-end 2014 to the Department of Labor found that less than 1% of the assets were invested in funds that explicitly market themselves as socially responsible investments (SRI). An earlier survey by the US SIF Foundation and Mercer, which specifically focused on sponsors of defined-contribution plans, found that while 14% of the 421 DC plan sponsors responding to the survey offered one or more SRI options, SRI options represented a low percentage of assets (around 1%). Until the DOL in late 2015 clarified the relationship between the compatibility of sustainable investing and a plan sponsor’s fiduciary duty under the Employee Retirement Income Security Act of 1974 (ERISA) this factor inhibited companies from introducing sustainable investing options in 401(k) plans. Following the latest Bulletin, however, plan sponsors will likely have a more difficult time offer sustainable investments.

Closer Scrutiny May be Focused on Expenses linked to Shareholder Engagement and Proxy Voting Activities

The guidance might also attract further scrutiny on the expenses incurred by sustainable mutual funds active in shareholder engagement and proxy voting activities when such funds are offered as retirement plan options specifically or even when such investments are made by investors in their capacity as fiduciaries.

[1] Like a 401(k) plan, a 403(b) is a retirement plan that’s designed for public schools and other nonprofits while a 457 plan is 457 Plan is a retirement savings benefits for governmental employees.