Summary

Sexual harassment reports and assaults against women in the workplace and elsewhere may have reached an important inflection point in our culture. These are less likely to occur when companies are well managed and have positive morale and high employee satisfaction. For investors interested in seeking out investment options that focus, in particular, on gender diversity, a number of options are available that should be considered within the context of their overall goals and objectives and risk tolerances. These include five available thematic funds that offer exposure to companies selected on the basis of practices intended to promote gender diversity. That said, these funds are relatively new and their performance results to-date are mixed.

Sexual Harassment Reports and Assaults Against Women May Have Reached an Important Cultural Inflection Point

The recent and continuing flood of sexual harassment reports and assaults against women in the workplace and elsewhere and, to a much more limited extent, against men, may have reached an important inflection point in our culture. In the months since the first allegations of sexual misconduct by Harvey Weinstein, co-founder of The Weinstein Company (TWC), were widely reported in September of this year, millions of working women according to The Wall Street Journal have shared their experiences of sexual harassment instigated by high-profile men in entertainment, media, politics and business via the social media movement #metoo. As observed in a recently published Barron’s article, these developments are a piercing wake-up call for corporations and investors. “Companies that tolerate or cover up sexual harassment, perpetuate a culture that fosters it, or fail to provide proper avenues for employees to report concerns and offenses, could pay in multiple ways, from difficulties in attracting, retaining, and motivating talented workers to customer defections, ruined business deals, and lost revenue and profit.[1]” Indeed, in addition to the many and serious social consequences affecting women, in particular, we have also observed in recent months that corporate culture and corporate behavior of top employees can impact profits, stock prices, a company’s competitive position and, in extreme cases, lead to the disintegration of the company. This appears to the case with The Weinstein Company that was reported to be on the verge of bankruptcy. The Barron’s article goes on to note that while sexual harassment has many causes, it tends to flourish when workplace culture is poor and corporate governance is weak. Conversely, this is less likely to occur when companies are well managed and have positive morale and high employee satisfaction. Further, it is believed that such companies are more likely to perform well over the long-run.

Options For Investors Seeking Out Investments Focused On Gender Diversity

For investors interested in seeking out investment options that focus, in particular, on gender diversity, a number of options are available that should be considered within the context of their overall goals and objectives and risk tolerances. They can, for example, consider investments in (1) stocks and bonds of companies that are well-governed and promote diversity and gender equity practices in the workplace, supply chains and communities in which they operate, (2) investment products offered by management firms that have telegraphed their broad commitment to evaluate corporate governance, including approaches to environmental and social concerns, (3) various product offerings, such as actively or passively managed sustainable mutual funds, exchange-traded funds (ETFs) or separate accounts, to mention just a few, that have explicitly adopted sustainable investing strategies which recognize and take into account gender diversity factors in their assessment of social and governance considerations, and/or (4) thematic oriented funds that offer US investors a focused exposure to companies that are selected on the basis of practices intended to promote gender diversity.

Increasingly Investment Management Firms Paying More Attention to Gender Diversity

Increasingly, investment management firms in the US are paying more attention to gender diversity, even if that is through the prism of board diversity. Recently, for example, F. William McNabb III, Chairman and Chief Executive Officer of Vanguard, noted in his letter to shareholders dated October 13, 2017 that “a growing body of research has demonstrated that greater diversity on boards can lead to improved governance and company performance.[2]” In this connection, Vanguard is advocating that boards incorporate diverse perspectives and experiences into their strategic planning and decision-making. One example offered by Vanguard to illustrate its commitment to more diverse boards is the firm’s participation in the 30% Club, a global coalition working to increase the representation of women in boardrooms and leadership roles.

Funds Pursuing Sustainable Investing Strategies

For some investors, the level of engagement implemented by a firm like Vanguard may be satisfactory while others may seek to invest with management firms and funds offering designated sustainable funds, actively or passively managed, that include explicit gender diversity considerations at the portfolio level. An example is the Neuberger Berman Investment Advisers managed Neuberger Berman Socially Responsive Fund. The fund discloses that gender diversity is an explicit consideration that takes into account factors such as the number of women on the board of directors, women in the C-suite, as board chairs and/or executive management with P/L responsibility, established diversity programs, established supply-chain diversity programs and products and services that benefit women. In addition, the fund has published white papers on this subject, it engages with corporations on this topic, and votes its proxies accordingly. Further, Neuberger Berman publishes a fund specific sustainable profile/impact report that covers selected portfolio focused environmental, social and governance metrics, including the number of holdings by weight that have at least one woman on the board and the number of holdings by weight that have been recognized for favorable workplace practices. Not all sustainable funds, however, offer this level of transparency. Consider, for example, the PIMCO Total Return ESG Fund which in early January 2017 adopted a set of exclusionary practices, an ESG integration strategy and issuer engagement approaches to improve ESG practices. With regard to ESG integration, the funds notes that it may avoid investment in the securities of issuers whose business practices with respect to the environment, social responsibility, and governance (ESG) are not to PIMCO’s satisfaction. In determining the efficacy of an issuer’s ESG practices, PIMCO will use its own proprietary assessments of material ESG issues and may also reference standards as set forth by recognized global organizations such as entities sponsored by the United Nations. Further details around gender diversity, however, are not provided; and subsequent reporting by PIMCO in the form of its first semi-annual report following adoption of its ESG integration strategy is no more transparent on this or related subjects.

Five Funds Offer Focused Exposure to Companies Selected Based On Practices Promoting Gender Diversity

For investors interested in funds that offer focused exposure to companies that are selected on the basis of practices intended to promote gender diversity, five relatively new options offered by five management firms are available today. These funds, the earliest of which was introduced in 2014, have attracted $577.2 million in net assets as of November 30, 2017. Included are two exchange-traded funds with a combined total of $386.4 million that account for 67% of the segment’s total net assets, two mutual funds, an actively managed fund as well as an index fund with two share classes, and one exchange-traded note (ETN). A sixth firm, Impact Shares, recently announced plans to launch a sixth fund in January 2018, the Impact Shares YWCA Women’s Empowerment ETF (NYSE Arca: WOMN). The ETF will hold stocks of companies that empower women, including promoting women’s health and women’s advancement initiatives in line with the Equileap North American Women’s Empowerment Index.

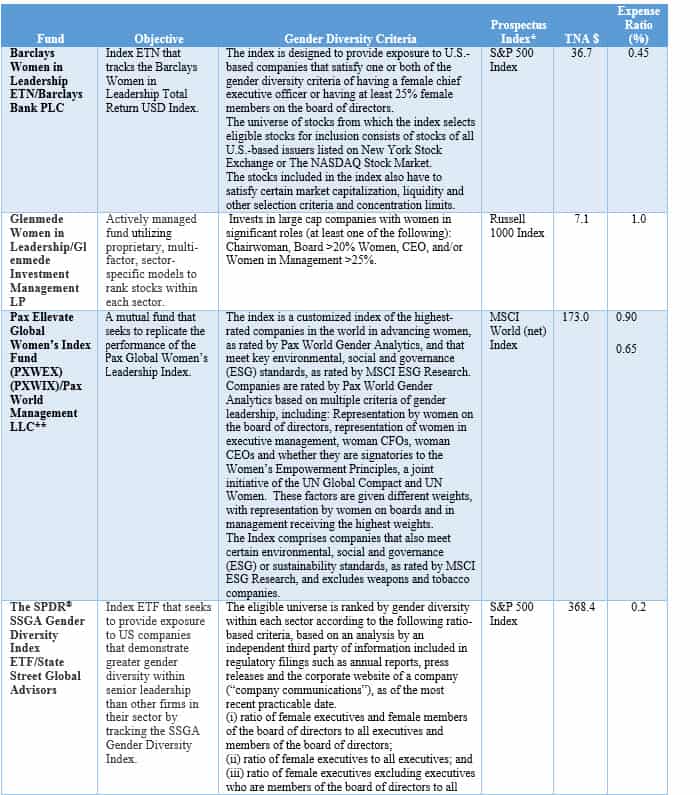

Each of these funds relies on key performance indictors and screening criteria focused on gender diversity factors, such as the ratio of female executives and female members of the board of directors or equal employment opportunity disclosures in publicly available documents. These data points are easier to collect and evaluate than trying to qualify a company’s corporate culture or even effective governance. Refer to Table 1 for a listing of funds offering focused exposure to companies selected based on practices intended to promote gender diversity.

Table 1: Funds With Focused Exposure to Companies Selected Based On Gender Diversity

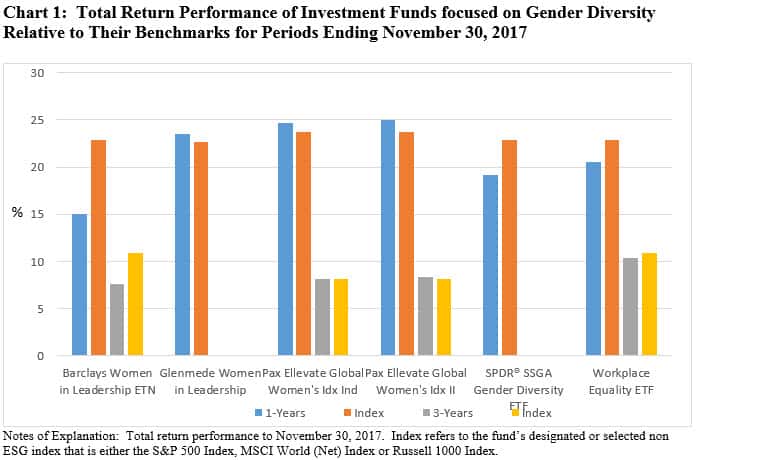

Performance Interval has been short and results to-date are mixed

Since these funds are relatively new, with one exception, their performance track record is limited to one year intervals and their investment results to-date have been mixed. Pax Ellevate Global Women’s Index Fund, which invests in companies in the US as well as developed markets outside the US is the longest running offering since its merger in 2014 with the Pax World Global Women’s Equality Fund. It is one of two funds that outperformed its designated or prospectus benchmark, the MSCI World (Net) Index, during the twelve month interval ended November 30, 2017. Its institutional share class has also outperformed the index by a slight margin over the last three year period. The fund and its two share classes have achieved these results at lower levels of volatility relative to the MSCI World index and notwithstanding higher expense ratios relative to other sustainable index mutual funds. The Glenmede Women in Leadership Fund, an actively managed fund utilizing proprietary, multi-factor, sector-specific models to rank stocks within each sector, also outperformed its Russell 1000 benchmark during the previous twelve months by a margin of 85 basis points, even with its steep 1% expense ratio. The same can’t be said about the three other funds that over the twelve month period ended November 30, 2017 have lagged the S&P 500 Index by margins ranging from a low of 2.3% recorded by the Workplace Equality ETF to a high of 7.85% achieved by the Barclays Women’s Leadership ETN. Except for The Workplace Equality Portfolio ETF that also carries a high 0.75% expense ratio relative to other sustainable ETFs, these returns have been achieved with lower levels of volatility relative to the S&P 500 Index. It should be noted that unlike an ETF, an ETN is a senior unsecured obligation of the issuer, Barclays Bank PLC, and investors are exposed to the creditworthiness of the issuer for any payments due in addition to the performance risk of the index.

[1] Barron’s, Tipping Point, November 6, 2017.

[2] Vanguard Shareholder Letter dated October 13, 2017.