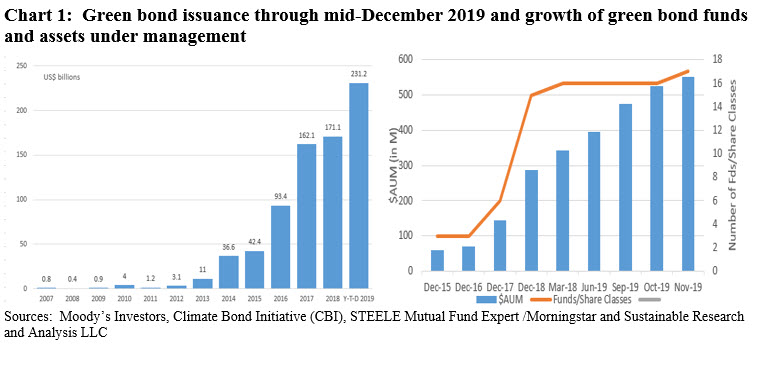

Growth of green bonds and green bond funds expected to reach new records: Green bonds volume expected to reach $250 billion in 2019 while green bond funds exceed $500 million

We are about to close calendar year 2019 with record green bond issuance that is expected for the first time to reach $250 billion worldwide, including an estimated $65 billion issued by various US corporations, financial institutions, state and local governments as well as in the form of ABS securities. At the same time, retail and institutional assets managed by US-based green bond mutual funds and ETFs that, in turn, invest in securities intended to finance projects with a positive environmental impact, are also expected to achieve another year-end record. Assets have already exceeded previous highs and in November reached $552.3 million. Also in 2019, the number of dedicated green bond fund has reached a new high with the latest launch of the Franklin Municipal Green Bond Fund by Franklin Templeton that brings the total number of available mutual funds and ETFs in the US to seven, up one this year, and a total of 20 funds/share classes. That said, green bond fund offerings differ from one another and as the number continues to expand and their track record seasons, the distinctions between them become more relevant for consideration by investors. This article examines four key qualities that portrays the differences between these funds, including investment strategies, fund expenses, performance results as well as disclosure of outcomes.

Growth of green bonds and green bond funds that now total seven funds/20 funds/share classes

Green bonds are bonds and related financial instruments that are no different than conventional bonds, except that their proceeds are earmarked and invested in various projects seeking to generate climate or other environmental benefits, such as renewable energy projects, various projects that seek to reduce greenhouse gas emissions, land conservation, and sustainable waste management projects to mention just a few.

So far this year through mid-December green bond issuance has already surpasses last year’s level to reach a new high of $231.2 billion. This represents a volume increase of $60.1 billion relative to last year’s $171.1 billion, for a gain of 35.1%. Green bond volume is expected to reach $250 billion by year-end, a new record that will add $78.9 billion if that level is achieved. Since their introduction in 2007 and continuing through mid-December, a combined total of about $758 billion in green bonds has been issued.

Ready To Gain A Competitive Edge? In-depth sustainable investment management analysis, research, opinions and sustainable fund ratings

Unless there is a dramatic shift between now and year-end, a record in assets under management is also expected to be set by dedicated green bond funds in the US. These have reached seven in number, consisting of five mutual funds and two ETFs, with total net assets in the amount of $552.3 billion through November 29, 2019. This represents an expansion in assets by $264.5 million or 92% since the start of the year. In addition, new fund/share class launches in 2019 included the new to market Franklin Municipal Green Bond Fund with its four share classes as well as a new share class R6 added to the existing Calvert Green Bond Fund. Refer to Chart 1.

Assets invested in these funds are largely sourced to institutional rather than retail investors[1]. At the end of November, green bond assets under management sourced to institutional investors represented $416 million or 75.3% of green bond assets. This is up from $187.8 million at the end of 2018 at which time institutional investors accounted for 65.4% of green bond assets.

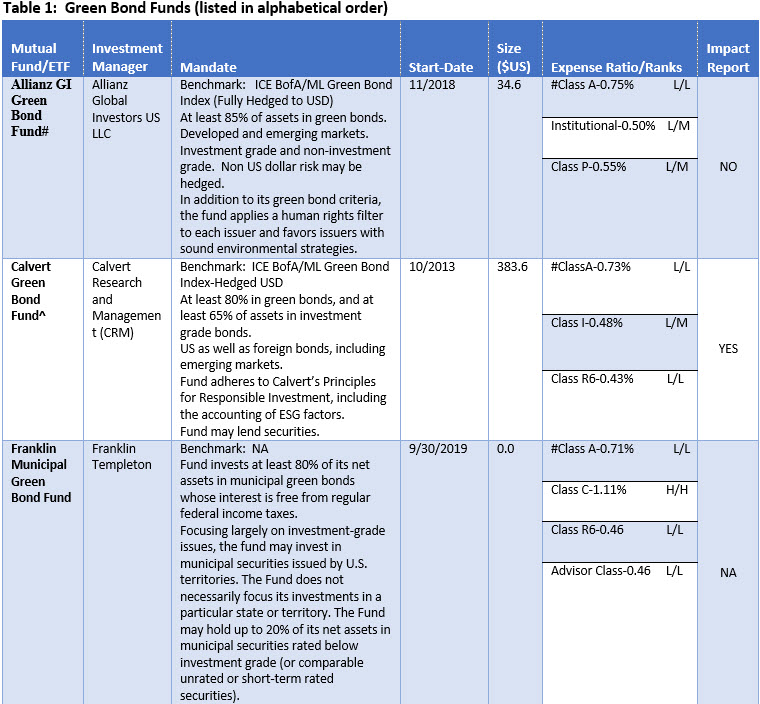

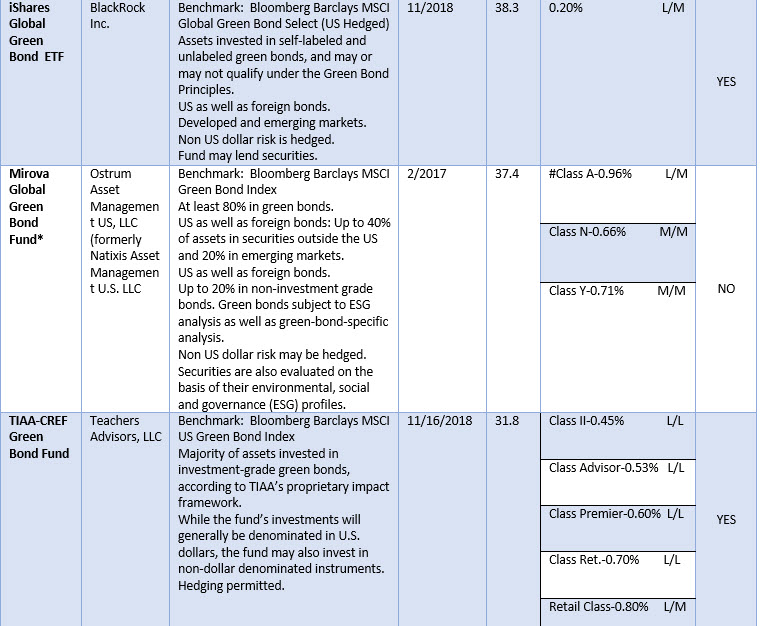

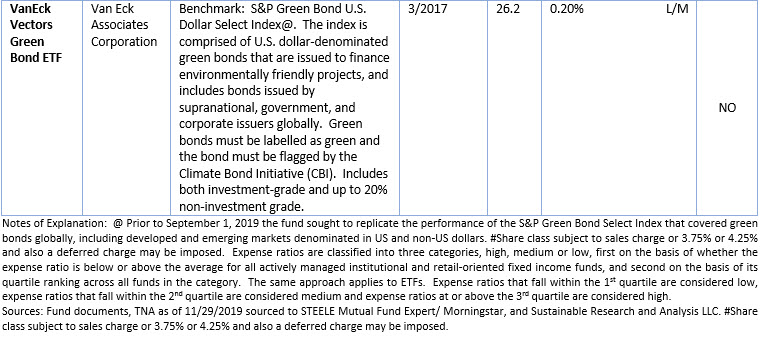

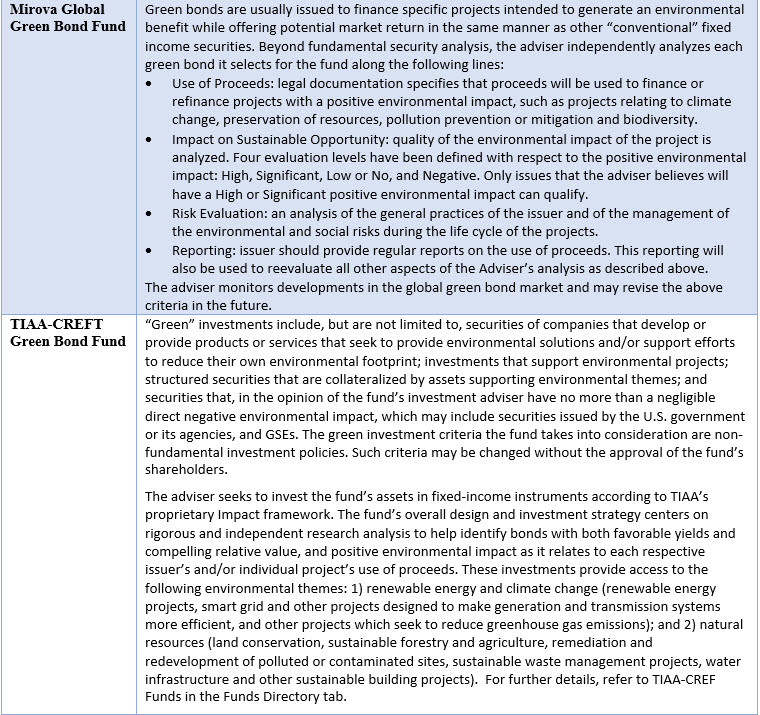

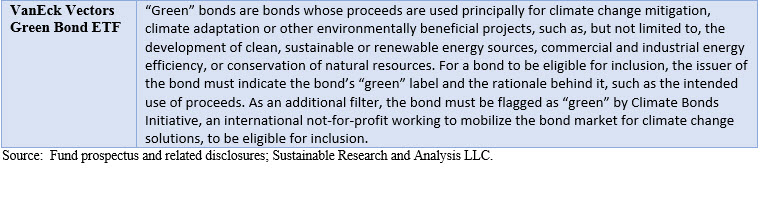

Green bond fund strategies vary across three strategy types

Seven green bond fund investment options are available to both retail and institutional investors. These include five actively managed mutual funds and two index tracking ETFs that can be further stratified into three broad categories: (1) Funds investing in green bonds across the globe, denominated in US and non-US currencies, issued by investment grade and some non-investment grade corporates, financial institutions, sovereigns, sub-sovereigns, supranational institutions, development banks, and various other types of issuers, including ABS securities. In each instance, non-US dollar risk may be hedged. For performance evaluation purposes, the ICE BofAML Green Bond Index-hedged USD Index is a useful benchmark, (2) Funds investing either entirely in US dollar denominated green bonds or exposures to non-US dollar green bonds are limited. These include the same US and non-US issuer types listed previously, however, the exposure to bonds denominated in non-US dollars may be more limited or avoided altogether, in which case the fund is not exposed to currency risk. For performance evaluation purposes, these funds are compared to the Bloomberg Barclays MSCI US Green Bond Index or an equivalent benchmark[2], and (3) Funds investing in US green bonds largely issued by municipal issuers, offering tax-exempt income. As of the date of this writing, only the Franklin Municipal Green Bond Fund, launched at the end of November, falls into this category. Refer to Table 1.

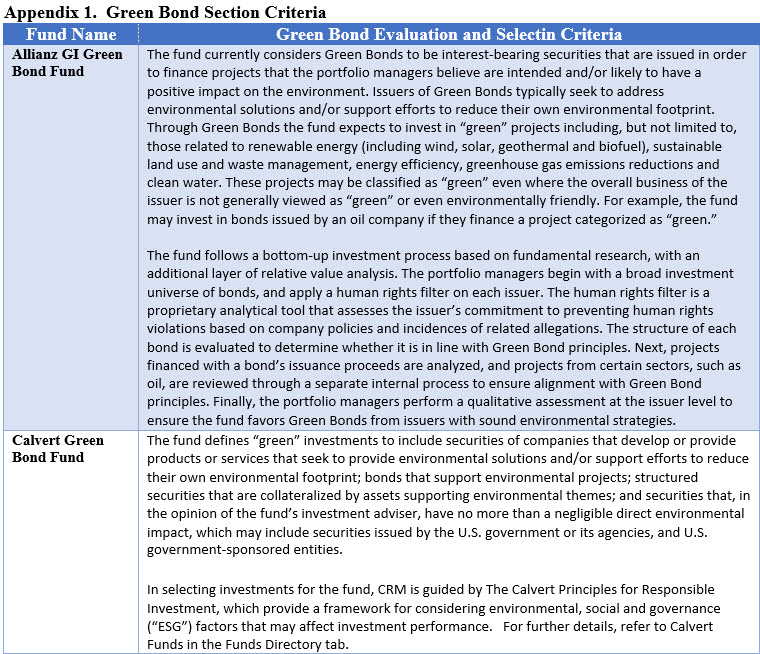

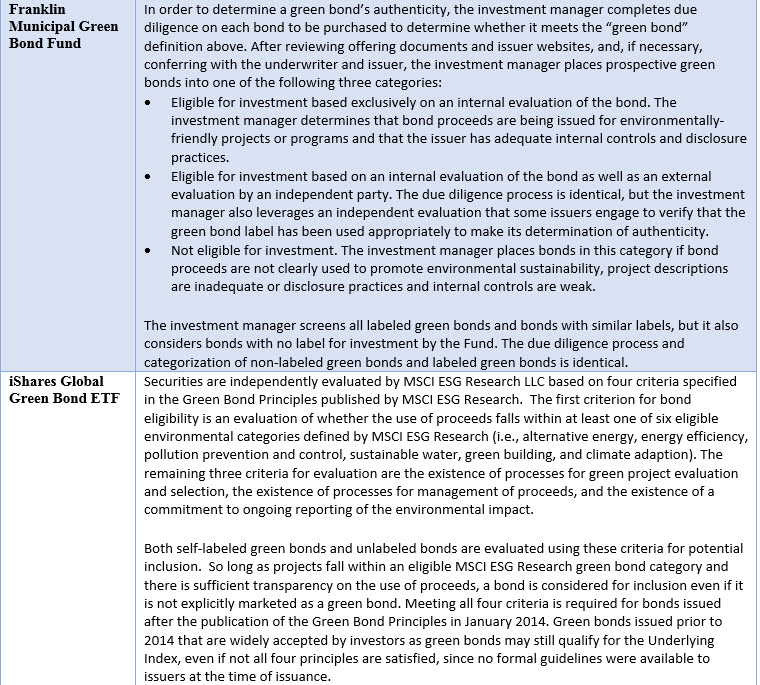

Within the constraints imposed on investors due to green bond issuance volumes, issuer types, sector, domicile, currency, credit ratings, and maturities, each fund manager has formulated its own proprietary green bond evaluation framework and investment selection criteria, including index tracking ETFs that default to the selection criteria imposed by the index provider. Above and beyond green bond selection criteria, three funds also superimpose additional sustainable investing considerations, such as environmental, social and governance (ESG) factors or more limited social filters. These are described in greater detail in Appendix 1.

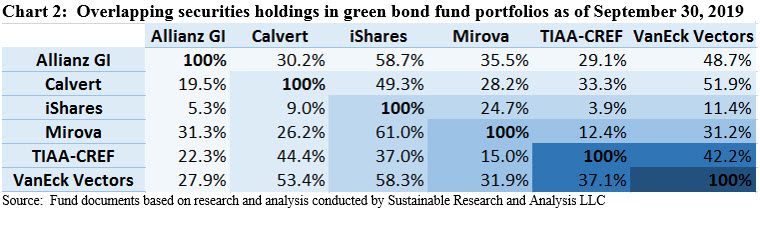

Moreover, actively managed funds position their portfolio on the basis of geopolitical, economic and fundamental considerations. That said, there is a surprising degree of diversity in the securities holdings across the six funds. A total of 265 distinct issuers were held in the six portfolios as of September 30, 2019 and only three issuers are common to all funds, including Apple, Asian Development Bank and Bank of America. The levels of overlapping securities range from a low of 5.3% to a high of 61%. Refer to Chart 2.

Expense ratios fall within a wide range that extends from a low of 20 bps to a high of 1.11%

Beyond four funds/share classes that are subject to upfront sales charges of 3.75% or 4.25% and possibly a deferred sales charge, expense ratios for both institutional funds and retail-oriented funds fall within a wide range that extends from a low of 20 bps to a high of 1.11%.

Across the seven green bond funds, the two green bond ETFs are subject to the lowest expense ratios. At 20 bps, the ETF expense ratios are the lowest by wide margins even as compared to fees applicable to institutional-oriented green bond funds/share classes and significantly more so as compared to retail-oriented green bond fund offerings. When compared to the entire universe of fixed income ETFs, the expense ratios levied by these funds are below the average of 0.32% charged by the universe of fixed income ETFs but are 5 bps above the 1st quartile cut-off at 0.15% used in this research article as the lowest fee segment.

Institutional funds, defined here as funds that require minimum investments in amounts greater than $10,000, range from 45 bps to 71 bps. Directly sold and indirectly sold retail-oriented funds are subject to expense ratios ranging from 73 bps to 1.11%, however, four of the five funds that fall into this category also levy front-end sales charges of 3.75% or 4.25% and may also impose a deferred sales charge.

Lowest cost options for retail investors, those who invest directly rather than doing so via financial advisors or retirement plans, are limited to three lowest cost options, including the two ETFs at 20 bps each and the retail oriented share class offered by TIAA-CREF Green Bond Fund offered at 80 bps as it does not impose a sales charge. While the 80bps is positioned below the average for fixed income mutual funds, it ranks above the first quartile and is considered, for purposes of this research article, a moderate fee.

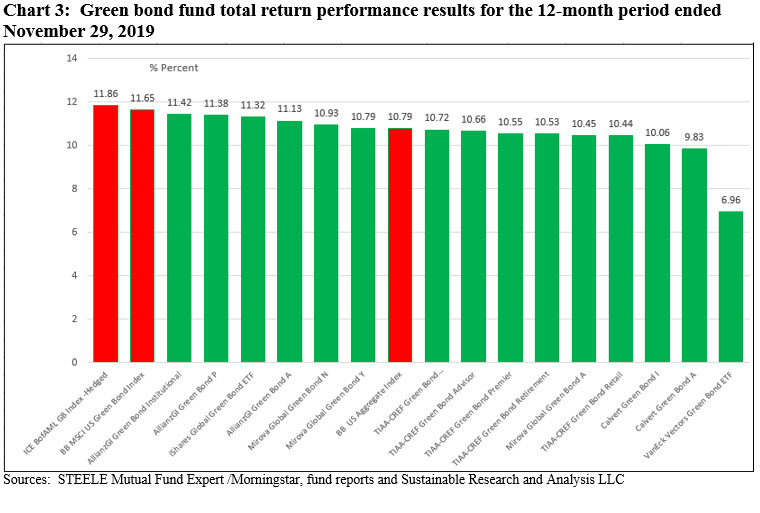

Total return performance results: Track record is limited but funds lag their designated benchmarks

The performance track record of green bond funds is limited. Of the seventeen funds/share classes available today only one fund, the Calvert Green Bond Fund, has achieved a three and five year track record. Launched in 2013, the fund has trailed its designated ICE BofAML Green Bond Index-hedged USD benchmark over the previous one-year, three-year and five-year time intervals. Excluding the impact of upfront sales charges, the fund lagged the benchmark over the last three and five-year intervals by an annualized average of 1.24% and 0.70%, respectively.

15 funds/share classes have established a performance track record covering a full trailing twelve-month cycle as of November 29, 2019. These funds generated an average return of 10.48% over the twelve month period, underperforming both the ICE BofAML Green Bond Index-hedged USD and the Bloomberg Barclays MSCI US Green Bond Index. This is also the case if one outlier result, explained below, is excluded. Still, results over the past year are clustered, with one exception, around the average and none of the funds, deviated from the average by more than 1%.

Further observations regarding the latest twelve-month performance results (Refer to Chart 3) are, as follows:

-

- None of the 15 funds/share classes in operation for the trailing 12-months beat their designated benchmark.

- Even as this is not their designated benchmark, for an additional comparison relevant to US intermediate investment-grade bond investors, six funds outperformed the Bloomberg Barclays US Aggregate Index.

- The best performing fund/share classes are the AllianzGL Green Bond Fund Institutional and P shares, posting returns of 11.42% and 11.38%. The funds/share classes lagged the performance of the ICE BofAML Green Bond Index-hedged USD by 44 bps and 48 bps.

- The next best performing fund is the iShares Global Green Bond ETF. The fund posted a return of 11.32%, trailing the index by 54 bps.

- The remaining funds/share classes investing in US and non-US dollar denominated bonds registered results within 73 bps and 1.80% of their relevant index. At the same time, funds investing exclusively or largely in US dollar denominated bonds registered results within 0.99% and 4.69% of the relevant benchmark.

- The VanEck Vectors Green Bond ETF was a performance outlier, falling short of its index by 4.69%. The fund registered the lowest return of 6.96% due primarily to negative currency returns. Since then, the fund has modified its investing approach by limiting green bond securities to US dollar denominated issues so as to eliminate the fund’s exposure to currency risk.

Reporting and Disclosure: Three funds produce useful impact reports

Thematic investors who invest for impact as well as financial results are likely to seek to understand the environmental outcomes achieved by their green bond fund investments, preferably in the form of measurable outcomes. Of the six funds in operation for at least a year, three funds produce useful impact reports that attempt to capture and disclose environmental outcomes. These include, for example, CO2 emissions avoided, air pollution reduced, energy saved, renewable energy capacity and generation, and water saved and treated, to mention just a few. The three funds that produce such reports annually, include: Calvert Green Bond Fund, iShares Global Green Bond ETF and TIAA-CREF Green Bond Fund.

[1] Defined here as funds with minimum direct investments ≥$10,000.

[2] VanEck Vectors Green Bond ETF seeks to replicate the performance of the S&P Green Bond U.S. Dollar Index.