Synopsis: Equivalent to any other type of bonds except that the proceeds are earmarked toward financing projects with sustainable environmental benefits, green bonds are uniquely suited to meet the objectives of sustainable investors generally and impact oriented investors in particular. This article describes green bonds, how the market has grown and investing options for individual or institutional investors who may wish to invest in these instruments either directly or indirectly.

Introduction

Green bonds are equivalent to other fixed income securities, both taxable and tax-exempt, except that these types of bonds raise funds specifically to finance new and existing projects with environmental benefits. Green bonds include securities issued by sovereigns, development or supranational banks, corporations, states, cities and local government entities, such as water, sewer or transportation authorities. Green bonds are issued in the form of senior unsecured obligations, project finance or revenue bonds, notes as well as securitizations that collateralize projects or assets whose cash flows provide the first source of repayment. In the future, new green bond structures are likely to be introduced. Also, green bonds, like all other bonds, vary as to credit quality, ranging from investment grade to non-investment grade; and they are issued in varying maturities that can range from short-to-long term as well as different rates of interest or yields. Regardless of structure, green bonds are generally issued pursuant to a set of voluntary guidelines or a set of best practices in the form of a framework known as the Green Bond Principles (GBP)[1]. The GBP frame work, which emphasizes disclosure and transparency, includes guideposts for the use of proceeds, the issuer’s process for project evaluation, the management of proceeds and reporting both at the time of issue and on a periodic basis thereafter. Still, there are variations around the interpretation and application of these Green Bond Principles that could lead to some uncertainties. The green bond offerings can be informed and the potential uncertainties can be mitigated, but not necessarily eliminated entirely, by relying on external independent reviews for assurances or certifications.

Green bond proceeds may be used to finance a variety of project categories aimed at addressing key areas of environmental concern, such as climate change, natural resource depletion, loss of biodiversity and/or pollution control. While not limited to these, the following categories will generally qualify for the investment of green bond proceeds: renewable energy, energy efficiency, pollution prevention and control, sustainable management of living natural resources, terrestrial and aquatic biodiversity conservation, clean transportation, sustainable water management, climate change adaptation, and eco-efficient products, production technologies and processes.

For sustainable investors generally and impact oriented investors in particular, green bonds are uniquely suited to meet their objectives. This is because they are specifically intended to achieve positive environmental and other societal benefits, issuers make commitments to disclose the allocation of proceeds and their expected environmental impacts, either in quantitative and/or qualitative terms in the form of periodic reporting, usually annually, and their yields, as well as pricing, are equivalent to any other bond issued by the same issuer. Put another way, green bonds, at least in the primary market, trade in line with their non-green counterparts.

Green Bonds Growth and Development

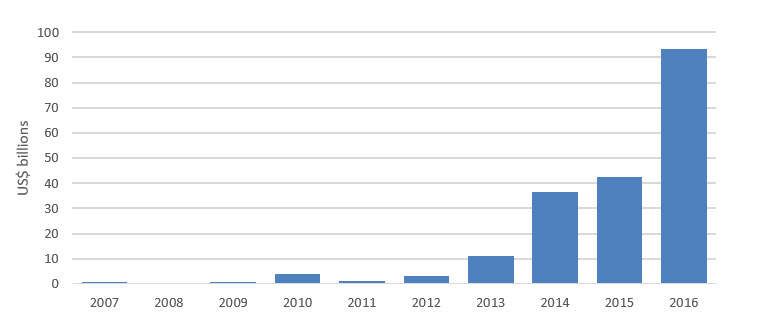

The issuance of green bonds across the world has been expanding rapidly in recent years, reaching an all-time high of around $93 billion in 2016. This represents a significant 120% or so increase from the approximately $42 billion issued in 2015 and $37 billion of green bonds that were issued in 2014. Since their introduction in 2007, about $194 billion in green bonds have been issued by hundreds of issuers across the globe. A total of 311 issuers worldwide, domiciled in 26 different countries in addition to development banks, such as the World Bank, brought green bonds to market in 2016. Of these, 73 issuers were located in the US. These include corporate and municipal issuers who came to market with about $14 billion, or 15%, of global green bond issuance.

Exhibit 1 Green Bond Issuances: 2007 – 2016

A key reason for the growth and development of green bonds is their role in mobilizing capital toward climate solutions. The success of the UN Paris climate agreement that was negotiated at the end of 2015 and went into effect in November 2016, which aims to reduce greenhouse gas emissions to net zero levels between 2055 and 2070 so as to achieve a targeted 2°/1.5° Centigrade limit on the warming of the earth’s surface temperatures to avoid catastrophic climate change, will require an unprecedented allocation of capital, measured in trillions of dollars a year. To this end, green bonds are gaining attention for their potential role in directing attention to climate change and mobilizing capital toward climate solutions. The need to finance climate solutions in combination with growing investor demand should continue to lift green bond issuance this year and beyond.

Acquiring Individual Green Bonds

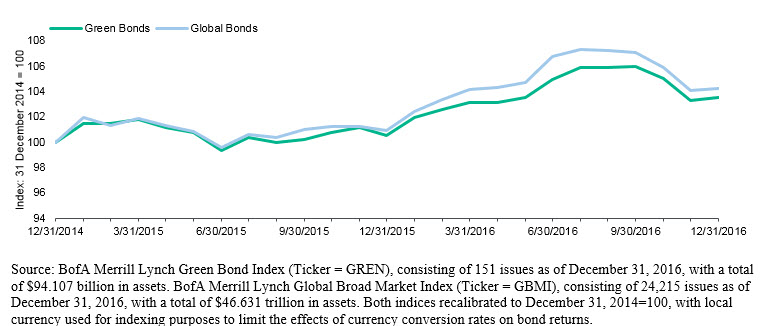

While generally issued to and purchased by institutional investors such as asset management firms, banks and insurance companies, individual or other institutional investors can purchase green bonds at the time of offer, or in the secondary market after they have been issued, directly through investment platforms available at financial firms such as Fidelity, Schwab and TD Ameritrade, to mention just a few. In this case, investors have to conduct their own research and qualify the bonds to suit their investment needs and risk profile, based on an evaluation of the issuer, credit rating, maturity, interest rate or yield, as well as the intended use of proceeds. Other considerations may also apply. Even more importantly, purchasing a single bond or a few bonds will expose investors to idiosyncratic risk or the risk of being exposed to the performance of a single company or a small group of companies which can only be eliminated from a portfolio by means of adequate diversification by investing in a sufficiently large number of bonds issued by different issuers or by hedging. This approach may be beyond the scope of some investors. At the same time, a sufficiently large and diversified portfolio of green bonds is expected to perform in line with the broader fixed income market, as illustrated in the graph below. Refer to Exhibit 2.

Exhibit 2: Performance of Green Bonds vs. Non-Green Bonds: 2014 – 2016

For example, in 2016, green bonds returned 2.9% while non-green bonds produced a total return of a slightly higher 3.3%. The small 0.4% differential could be attributable to any number of factors outside of the intrinsic performance of green bonds. While this could reflect some differential in the pricing of green bonds in the secondary market (vs. primary market), a more impactful contributing factor may be the difference in the maturity profiles of the comparative universes of green bond versus non-green bond securities.

Investing in Green Bonds Through Mutual Funds and ETFs

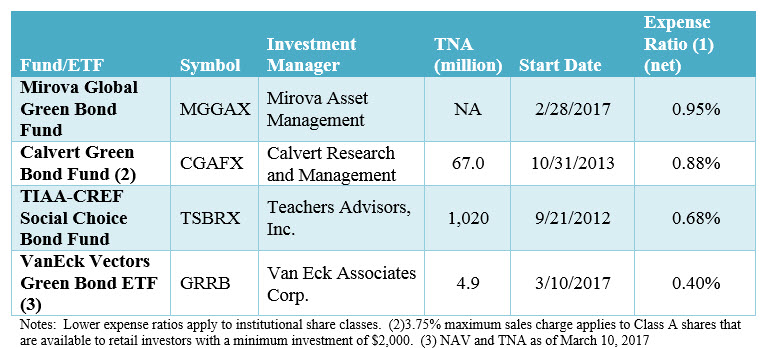

Rather than purchasing individual bonds, an alternative for investors is to invest in a green bond mutual fund or ETF. While investment options are likely to expand in the future, at present, individual or institutional investors interested in a dedicated green bond fund have access to a limited number of options. Beyond the just launched Mirova Global Green Bond Fund[2] (refer to Mirova New Product Profile), only two funds that are is invested in at least around 10% of net assets in green bonds are currently available in the market. These include the Calvert Green Bond Fund and the TIAA-CREF Social Choice Bond Fund. Refer to Exhibit 3. All three funds are actively managed. The TIAA-CREF Social Choice Bond Fund has the longest track record and offers the best management, performance and price combination, however, this fund is not a dedicated green bond fund and only about 9.5% of the fund’s total assets are currently invested in green bonds.

Moving beyond mutual funds, investors now also have access to the newly launched VanEck Vectors Green Bond ETF, a green bond index fund managed by New York-based Van Eck Associates. Listed on March 10, 2017, the fund features the lowest and most attractive expense ratio at 40 bps relative to available mutual funds. On the other hand, the fund is still very small and not as yet fully diversified. (Refer to VanEck New Product Profile).

Exhibit 3: Green Bond Mutual Funds

[1] Refer to Green Bond Principles (GBP). See http://www.icmagroup.org/Regulatory-Policy-and-Market-Practice/green-bonds

[2] At around the same time, an affiliate of the investment manager’s US arm announced the launch of the Natixis Global Asset Management target date funds that includes the Mirova Global Green Bond Fund option.