Tax-Exempt Sustainable Bond by MBTA

The Massachusetts Bay Transportation Authority (MBTA) announced on September 18, 2017 that it is planning to issue about $574 million in bonds on Tuesday, September 26, 2017, consisting, in part, of Subordinated Sales Tax Bonds 2017 Series A in the combined amount of $232.7 million, including $100.1 million, or 43% of Series A, in Sustainable Bonds (Subseries A-1)[1]. This offering is the first of its kind tax-exempt sustainable bond transaction in the U.S. or elsewhere and it should receive a strong reception from a growing base of sustainable institutional and retail investors. Although likely overstated, according to US SIF demand for sustainable and impact investing is growing and investors now consider environmental, social and governance (ESG) factors across $8.72 trillion of professionally managed assets in the U.S.[2]

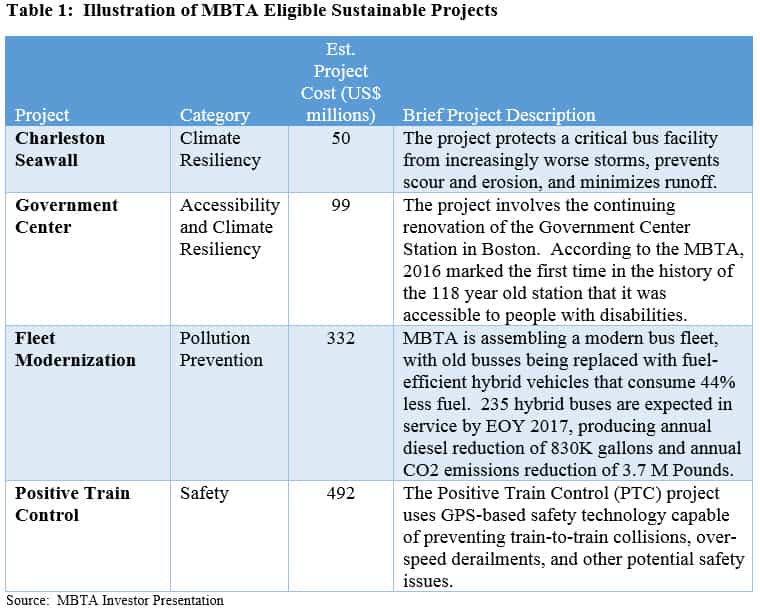

MBTA Eligible Sustainable Projects

The bond’s proceeds will be used by the MBTA to exclusively finance eligible projects as part of its capital investment program that provides environmental and/or social benefits. Social benefits may include but are not limited to access to essential services and affordable infrastructure, critical health and safety improvements, and socioeconomic advancement.

This offering, with its expected ratings of Aa3 from Moody’s Investors and AA from S&P Global, will be issued in multiples of $5,000 in principal amounts across varying maturities extending from 2025 to 2046 at rates and yields that are yet to be determined. Bonds maturing subsequent to 2027 are subject to early redemption.

What are Sustainable Bonds?

Sustainable bonds, which straddle green bonds on the one hand and social bonds on the other, are securities whose proceeds are exclusively applied to finance and re-refinance a combination of both green and social projects. Like green bonds and social bonds, sustainable bonds are generally issued pursuant to a set of voluntary guidelines or a best practices framework known as The Sustainable Bond Guidelines 2017. With the exception of the use of proceeds, these mirror the Green Bond Principles (GBP) administered by the International Capital Market Association (ICMA)[1]. Refer to Investing in Green Bonds. The GBP guidelines include criteria applicable to the use of proceeds, the issuer’s process for project evaluation, the management of proceeds and follow-on reporting on a periodic basis. Still, there are variations around the interpretation and application of the GBP guidelines which may be mitigated by relying on external independent reviews for assurances or certifications to the effect that the bonds are aligned with the GBP.

Sustainable bonds are equivalent to any other fixed income securities, both taxable and tax-exempt, except that these bonds raise funds specifically to finance new and existing socially oriented projects. While the proceeds from the issuances are earmarked for sustainable projects, the bonds themselves are serviced from the cash flows attributable to the entire operations of the issuer–not just the sustainable projects.

The first such bond was issued in the U.S. by Starbucks in May 2016. This was a $500 million, 2.45%, senior unsecured taxable bond maturing in 10-years with the proceeds earmarked to purchase sustainable coffee and make loans to coffee growers to help meet environmental and social standards developed by the firm. The bonds relied on an external reviewer’s opinion.

MBTA’s Sustainability Bond is Self-Designated

The MBTA issue is a self-designated sustainability bond, meaning that the MBTA has voluntarily adopted the set of standards and elected to conform to the Sustainable Bond Guidelines. The MBTA has established a framework for project evaluation and selection, to be conducted by a committee made up of internal stakeholders, directors and managers, management of proceeds and reporting on project impacts over time. The MBTA disclosed that it expects to allocate the proceeds of the bonds within 24-months bonds and that the funds may be reallocated to other eligible projects at any time during the term of the bond. Further, the MBTA expects to issue annual sustainable impact reports “using qualitative performance indicators and, where feasible, quantitative performance measures of the environmental and social objectives of the eligible projects.[2]” Methods and key underlying assumptions will also be provided, and such reports will be produced until such time as the proceeds have been fully allocated. At the same time, the MBTA has elected not to adopt the recommendation of The Sustainability Bond Guidelines to use an external reviewer to confirm the alignment of their sustainability bonds with key features of the guidelines.

According to the MBTA, its capital investments program covers some 200 projects. Of these, about 125 have been deemed to qualify as sustainable. While specific programs have not been directly linked to the anticipated $101.1 capital raise, the MBTA did provide some illustrations of eligible projects, as follows:

[1] Refer to Green Bond Principles (GBP).

[2] Source: Preliminary Official Statement dated September 15, 2017

[1] $281.7 million Subordinated Sales Tax Bond Anticipation Notes will also be offered.

[2] Source: The Forum for Sustainable and Responsible Investment, Report on US Sustainable, Responsible and Impact Investing Trends 2016.