Model portfolios: All three sustainable portfolios post strong performance results but two of three lag their conventional benchmarks in June with returns ranging from 2.36% to 6.52%

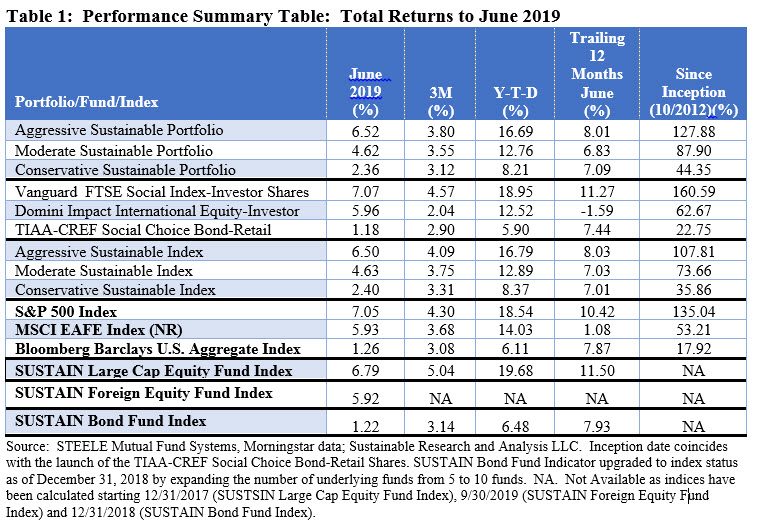

The June performance results posted by the three sustainable model portfolios benefited from the gains achieved by global markets across all major asset classes. Results ranged from 2.36% to 6.52%, however, only the Aggressive Sustainable Portfolio (95% stocks/5% bonds) managed to exceed the total return of its corresponding conventional index for the month. The Portfolio, which benefited from the slight excess performance achieved by the Vanguard FTSE Social Index Fund-Investor Shares relative to the S&P 500, recorded a gain of 6.52% versus 6.50% for the Aggressive Sustainable Index, or a differential of 2 basis points (bps). The Moderate Sustainable Portfolio (60% stocks/40% bonds) and Conservative Sustainable Portfolio (20% stocks/80% bonds) recorded total returns of 4.62% and 2.36%, respectively and trailed their corresponding conventional indices by 1 bps and 4 bps. Refer to Table 1.

Each of the three underlying sustainable funds that comprise the model portfolios produced strong results in June. That said, the Vanguard FTSE Social Index Investor Shares was the only fund to eclipse its benchmark, exceeding the S&P 500 by 2 bps. TIAA-CREF Social Choice Bond Fund and Domini Impact International Equity Investor Shares lagged by 8 bps and 54 bps, respectively.

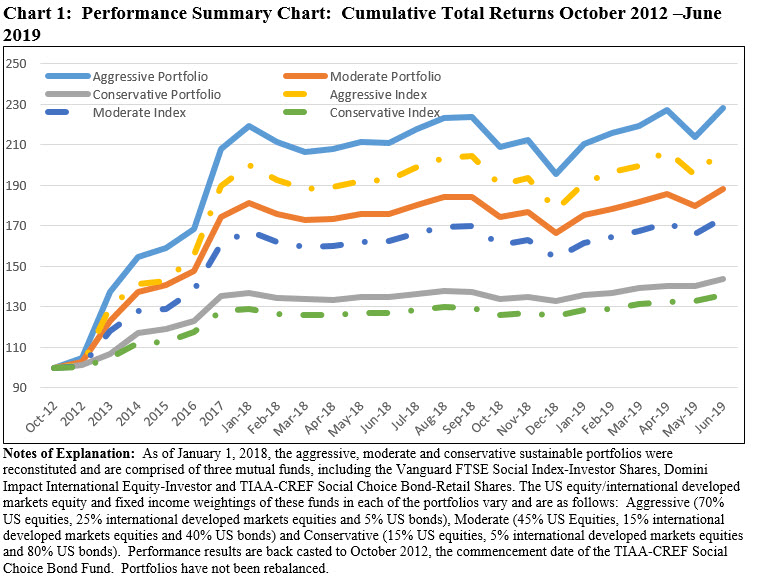

While the absolute performance results in the short-term posted by each of the three sustainable model portfolios have been strong, relative results for the trailing 3-month, year-to-date and twelve month intervals have largely lagged their designated conventional benchmarks. That, however, is not the case with regard to results since the inception of these portfolios as of October 2012 during which interval they continue to maintain a strong lead over their designated benchmarks. These cumulative leads are 8.49% for the Conservative Portfolio, 14.24% for the Moderate Portfolio and 20% for the Aggressive Sustainable Portfolio. Refer to Chart 1.

Global markets across all major asset classes posted gains in June

The sustainable model portfolios posted strong gains against a backdrop of global market gains across all major asset classes in June. Notwithstanding trade concerns and fears of an economic slowdown, stocks and bonds in the US and overseas recovered from May’s declines to produce strong returns in June, ranging from a low of -0.27% posted by the MSCI India (NR) Index to highs of 12% or so for energy and biotechnology stocks (some commodities aside) and lift second quarter and year-to-date results. The S&P 500 Index, which gained 7.05% in June versus a decline of -6.35% the month prior, also advanced the three-month total return results to 4.30% and the year-to-date increase to 18.54% thanks, in part, to a perceived shift in the Federal Reserve Banks’ ‘s appetite for interest-rate cuts. In early June Federal Reserve Chairman Jerome Powell addressed the fears of how the continuing trade squabble with China could hurt the economy, saying the central bank was closely monitoring the escalation in tensions and indicating it could respond by cutting rates if the economic outlook deteriorated. Investors reacted positively to the news, extending a rally that propelled the S&P 500 to record highs. The Dow Jones Industrial Average gained 7.31% while the tech heavy Nasdaq Composite added 7.51% and shares of smaller companies, based on the Russell 2000 Index, posted results more or less in line with large caps with an increase of 7.07%.

Mounting fears of an economic slowdown served to push bond yields down globally and bond prices higher, contributing to the 1.26% June uptick in the Bloomberg Barclays US Aggregate Index. The yield on the 10-year U.S. Treasury closed the quarter at 2%, nearly a half-percentage-point drop from the end of March, a downward roll that took many investors by surprise.

Outside the US, share prices also rose. The MSCI All Country World Index, ex US (NR) gained 6.02% in June and stands 13.60% higher since the start of the year. In Europe, stocks responded to hints of further monetary easing made by Mario Draghi, the European Central Bank President, who also called for a common Eurozone budget as an additional economic shock absorber. In China, notwithstanding trade tensions and signs that China’s economy may be slowing, the MSCI China (NR) Index was up 8.03%.