The Bottom Line: US green bond funds are on the cusp of reaching and exceeding $1.0 billion in assets under management for the first time.

November Summary

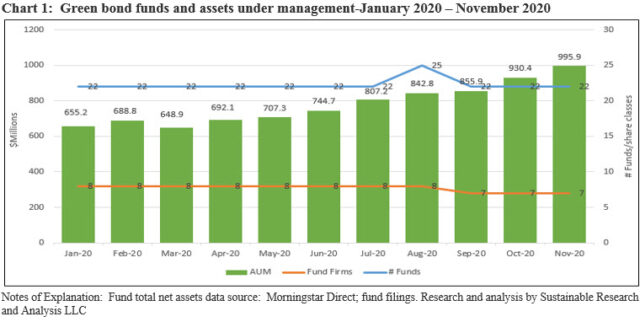

Seven or so years after the launch of the first green bond fund, funds in the US that primarily invest in environmentally beneficial securities are on the cusp of reaching and exceeding $1.0 billion in assets under management for the first time. With the addition of November’s $65.5 million in net new money, the seven funds in operation, 22 funds/share classes in total including two ETFs, ended the eleventh month of the year with $995.9 million, an increase of 7%. This was the second best gain this year, next only to October’s $74.5 million increase, propelled by gains achieved by the largest three funds in the category. On a combined basis, these funds delivered $61.7 million or 94.1% of the total gain for the month. The same three funds, the Calvert Green Bond Fund, iShares Global Green Bond ETF and VanEck Vector Green Bond ETF also generated the lowest comparative returns for the 30-day period. During the same month when assets ticked up, the volume of green bond issuance, based on preliminary data, dropped to $16.8 billion from $27 billion in October. Year-to-date issuance, which has been held in check due to an expanding number of sustainable bond issuances due to COVID-19, reached $214.8 billion.

Fund flows: Green bond mutual funds and ETFs added $65.5 million in net assets

All but one fund, the Mirova Global Green Bond Fund, experienced cash inflows. Market factors contributed an estimated $11.09 million while cash inflows added an estimated $54.4 million. On a net basis, green bond funds gained $65.5 million in assets, with at least 52% of that sum sourced to institutional investors, to end November at $995.9 million. Refer to Chart 1.

The largest and oldest green bond fund, the Calvert Green Bond Fund, added $41.4 million, almost entirely attributable to the fund’s institutional share class while the iShares Global Green Bond ETF saw $11.5 million in net inflows. This BlackRock managed ETF was launched in November 2018 and has been expanding steadily since that time. The fund, according to 13D filings, benefited from new investments by UBS, Bank of America and Jane Street Group. The third fund, the VanEck Vectors Green Bond ETF, gained $8.7 million.

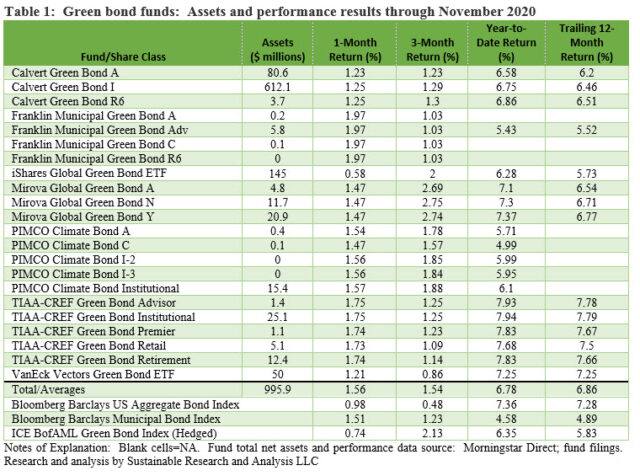

Fund Performance: Green bond funds recorded an average gain of 1.56% in November

Across the board, green bond funds recorded an average gain of 1.56% in November. This compares to 0.98% registered by the Bloomberg Barclays US Aggregate Bond Index and 1.51% achieved by the Bloomberg Barclays Municipal Bond Index, a broad-based municipal bond index that serves as the more appropriate primary benchmark for the Franklin Municipal Green Bond Fund. Even if the Franklin Municipal Green Bond Fund is omitted from the average, the remaining group of six green bond funds is still up 1.46%. By way of further comparison to a narrower-based index, the ICE BofAML Green Bond Index (Hedged) was up 74 basis points.

All but one fund beat the broad-based intermediate investment-grade Bloomberg Barclays US Aggregate Bond Index as well as the narrower ICE BofAML Green Bond Index. The one exception is the iShares Global Green Bond ETF that was up 58 bps. The fund also trails on a 12-month basis with its last place return of 5.73%. At the other end of the range, the Franklin Municipal Green Bond Fund, including its four share classes, was up 1.97% in November, beating the Bloomberg Barclays Municipal Bond Index by 46 bps. Refer to Table 1.

A smaller number of funds in operation for a full twelve-month interval to the end of November were up an average of 6.86%, as compared to 7.28% and 5.83% for the Bloomberg Barclays US Aggregate Bond Index as well as the narrower ICE BofAML Green Bond Index. The leading fund over the trailing twelve-months is the TIAA-CREF Green Bond Fund Institutional shares, up 7.79%

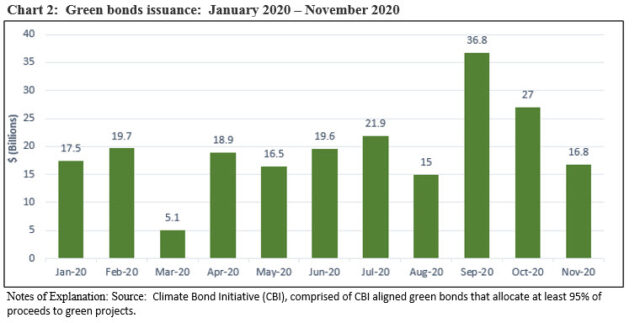

Green bonds issuance volume declined in November to $16.8 billion

Based on preliminary data, green bond issuance volume declined in November to $16.8 billion as compared to $27 billion in the previous month. A cumulative total of $214.8, also preliminary, has been issued on a year-to-date basis. Refer to Chart 2.

Of total global bond issuance, $1.1 billion was issued by US entities, or 6% of global issuance. Thirteen issuers accounted for the new issue volume, dominated by 12 municipal issuers. The three largest issuers, including the New York MTA, Arroyo Energy Investors and the Sunnyvale Financing Authority, raised $950.1 million and made up 88% of the volume. The MTA issued the bonds to refund certain outstanding revenue transportation bonds while Arroyo Energy Investors, an independent investment managed focused on power and energy infrastructure assets in the U.S., Mexico and Chile, was refinancing loans on two of its renewable energy assets. These include a solar plant and a wind farm providing green electricity to the Minera Los Pelambres copper mine located in Chile, one of the largest in the world. The Sunnyvale Financing Authority in California issued its $131.2 million green bond to finance the first phase of the City of Sunnyvale Civic Center modernization project along with other improvements that were designated as green.

New green investment/security types introduced in November

-The first reportedly green interest rate swap transaction in the Asia-Pacific region was arranged by the Crédit Agricole Corporate and Investment Bank. The inaugural green interest rate swap worth HK$590 million (US$64.5 million) was structured for logistics property group Goodman Interlink. The transaction is subject to a preferential fixed interest rate paid by the borrower that is linked to the underlying facility’s green credentials based on the satisfaction of two requirements. The facility is required to maintain a silver certificate from the US Leadership in Energy and Environmental Design (LEED) and a gold certificate of the Building Environmental Assessment Method (BEAM) from the BEAM Society, an organization specializing in green certification for Hong Kong buildings. The borrower’s fixed rate steps up to a non-preferential rate if the green condition fails.

-The Citi Treasury and Trade Solutions group within Citibank launched a fixed-term green deposit product that allows clients to invest their short-term liquidity in environment-friendly projects. According to the bank’s announcement, investments in the green deposit solution will be used to finance or refinance a portfolio of green projects that meet the environmental finance eligibility criteria defined in the Citi Green Bond Framework. The framework is aligned with the recommendations of the International Capital Market Association (ICMA) Green Bond Principles 2018and is aimed at helping advance the United Nations’ Sustainable Development Goals.