Summary

The effectiveness of divestment strategies aside, index fund investors who may wish to avoid investments in the stocks and bonds of weapons manufacturers and retailers in light of recent mass shootings in Florida, may be challenged to do so. Alternative investment vehicles are not readily available. In the absence of arms-free indexes, alternative near-term strategies for index fund investors could include encouraging index fund managers to engage with firearm manufacturers and retailers and/or to contribute a percentage of an investor’s capital appreciation and dividends derived from index fund investments to organizations of their choice engaged in advancing more restrictive gun legislation. If their concerns extend to retailers, engaging with these retail establishments or even boycotting their stores may represent yet another or a complementary option.

One of the Deadliest Mass Shootings in Parkland Florida Prompts Calls for Divestment

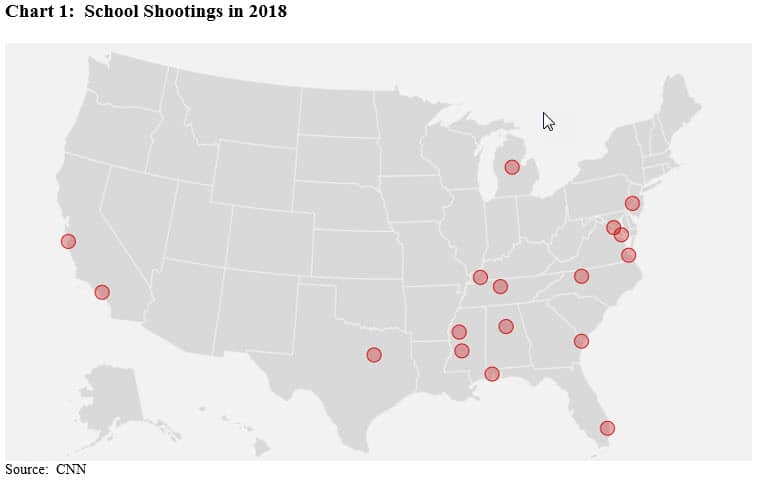

Public attention on firearm manufacturers, retailers and even financial institutions has once again been galvanized following the most recent and one of the deadliest mass shooting in the United States when on February 14, 2018 17 people were killed at a high school campus in Parkland, Florida by a former student armed with an AR-15 semi-automatic style weapon. This was the deadliest school shooting since 2012 when 26 people were killed at the Sandy Hook Elementary School in Connecticut, also involving a semi-automatic rifle. The attack at the Parkland Marjory Stoneman Douglas High School was the sixth school shooting incident this year that has either wounded or killed students. So far this year through March 24 there have been 17 school shootings where someone was hurt or killed or an average of 1.4 shootings a week[1]. Last year, an attack on a concert in Las Vegas left 58 dead, the worst mass shooting in the U.S., and this again raised questions about civilian gun ownership, and in particular, the types of weapons and their public accessibility; and also thoughts about introducing tougher controls aimed at limiting the manufacture, sale and possession of some types of semi-automatic firearms. Such weapons are often referred to as assault weapons and include the AR-15 assault style rifle. The latest shooting also renewed calls for institutional investors to sever their ties to the firearms industry and prompted both retail, high net worth and institutional investors to ponder whether they should take action to avoid investing in the stocks and, to a lesser degree, bonds of firearms manufacturers and possibly even firearms retailers as well as financial institutions doing business with firearm manufacturers and retailers. While the effectiveness of divestment, whether focused on genocide, fossil-fuel companies, gender diversity or firearms, and its economic implications for investors continues to be debated, such a path is most challenging in particular for investors and managers of index funds that allocate assets to U.S. and foreign stocks and bonds. This is the case regarding divestment from the firearms industry which largely and directly impacts mid-cap and small-cap indexes and perhaps less so foreign indexes (world ex-US) which have exposure to four arms manufacturers. Also by extension, these holdings spread to indexes that encapsulate mid-cap and small-cap stocks such as total stock market indexes, growth/value configurations and other variations based on the same fundamental indexes. But if divestment is also extended to include firearms retailers, of which there could be at least three, this course of action also impacts large-cap stock and corporate bond indexes. In the absence of arms-free indexes, alternative near-term strategies for index fund investors, through mutual funds and exchange traded funds (ETFs), could include encouraging index fund managers to engage with firearm manufacturers and retailers and/or to contribute a percentage of an investor’s capital appreciation, dividends and interest derived from index fund investments to organizations of their choice engaged in advancing more restrictive gun legislation. If their concerns extend to retailers, engaging with these retail establishments or even boycotting their stores may represent yet another or a complementary option.

Divestment Has Attracted the Attention of Public Funds

Some high profile institutional investors and in particular public pension funds were early on proponents of divestment from the firearms industry following the Sandy Hook shooting. The earliest of these included the California State Teachers’ Retirement System (CalSTRS) and California Public Employees’ Retirement System (CalPERS) that in 2013 announced plans to divest from companies that manufacture firearms classified as illegal for sale or possession in California. These actions were followed by other state and city governments, including New York State, Chicago, New York City, and Philadelphia, to mention just a few. Moreover, some calls for divestment have been extended to include the disposition of shares of retailers, such as Walmart, Inc. (WMT), Kroger Co. (KR), Dick’s Sporting Goods Inc. (DKS), and Sears, through which civilian firearms are sold. Further, some student organizations have advocated for divestiture on the part of university endowments and foundations.

Following the latest shooting, additional announcements regarding divestiture have been made. One of the latest is the New Jersey’s Treasury Department’s announcement last week that the public pension fund had sold off its last investment in a manufacturer of automatic and semi-automatic weapons for civilian use. No stranger to divestiture initiatives, the New Jersey Division of Investment has been winding down investments in gun makers for some time. Also recently, the Legislature of the Commonwealth of Massachusetts was taking up a bill that would require the state’s public pension fund to divest from companies that manufacture guns and ammunition to include “all publicly-traded securities from any ammunition, firearm and firearm accessory manufacturing companies that derive 15% or more of their revenues from the sale or manufacture of ammunition, firearms or firearm accessories for civilian purposes.”

Of note is the fact that divestment actions, and this extends to exclusionary practices as well, can vary based on how manufacturers, firearms and holdings are defined. Variations can arise based on how manufacturers are qualified with regard to weapon types and ammunition, a percentage of revenues derived from the relevant firearms, related activities and the target market, i.e. civilian versus military. As well, divestitures can be implemented across direct holdings while investments in manufacturers of weapons and ammunition held in index funds may be challenging to avoid and might, therefore, continue to be held. In the end, the effectiveness of divestment strategies continues to be debated.

The U.S. Arms Industry

An average of 3.4 million rifles, shotguns, revolvers and pistols are manufactured in the U.S. every single year. According to research conducted by the Pew Research Center, 42% of households had at least one gun in their possession and three-in-ten American adults say they currently own a gun, while another 11% say they don’t personally own a gun but live with someone who does.

Arms and small arms, in particular, represent a huge business. Based on statistics covering authorized trade of small arms and light weapons, the industry generates revenues estimated to be $11.0 billion. More than 1,000 companies from nearly 100 countries produce small arms and light weapons. Many of these firms are privately held and some, outside the U.S. are state-owned. Privately held firms in the U.S. and overseas include Remington Outdoor Brands, the manufacturer of AR-15 style assault weapon used in the Sandy Hook attack that filed for bankruptcy on April 1, 2018, Marlin, Mossberg, and Smith & Wesson, to mention just a few. In the U.S. alone, by some accounts, there may be as many as 465 manufacturers of weapons and ammunition and almost 51,000 retail gun dealers.

Publicly Listed U.S. Firms that Manufacture Firearms, Weapons and Ammunition

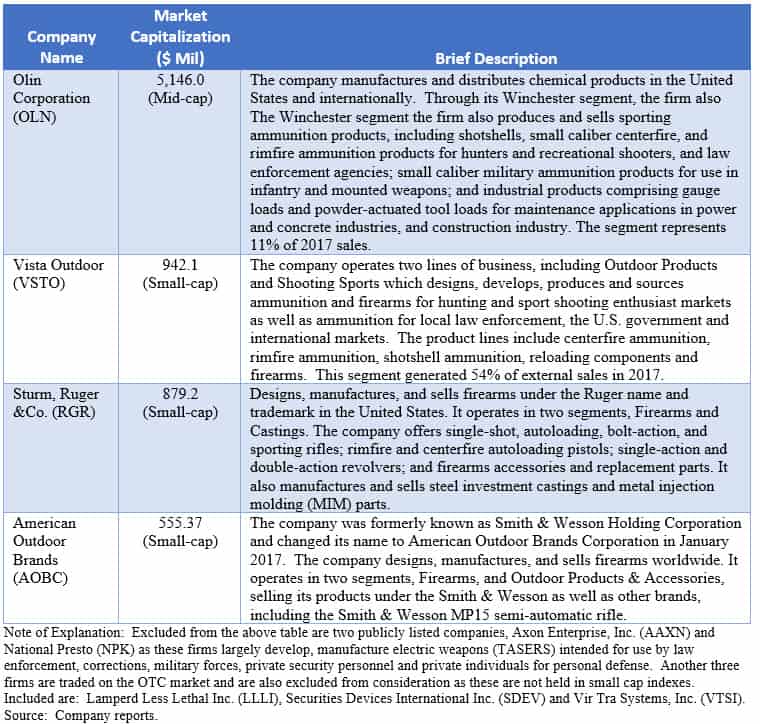

Publicly listed U.S. firms that manufacture firearms, weapons and ammunition are few in number. Within this segment, research turns up nine publicly listed companies that trade on the NYSE, NASDAQ or on the OTC market. Of these, only four companies, either because of the nature of their lines of business or market capitalization, are likely to be found within the holdings of U.S. oriented stock market indexes and corresponding index mutual funds and ETFs. These firms are American Outdoor Brands, Olin Corp., Sturm, Ruger and Vista Outdoor. Of these, Olin’s weapons segment generates 11% of sales, still higher than the commonly used 5% threshold for determining eligibility across a large number of sustainable funds. Refer to Table 1.

Table 1: Manufacturers of Firearms, Weapons and Ammunition in the U.S. (Listed by Market Capitalization)

Because of their respective sizes based on market capitalization, the four companies listed above are found in indexes that seek to replicate the performance of mid-cap and small-cap indexes and, by extension, indexes that encapsulate these segments into boarder parts of the capital markets, growth/value derivations as well as other variations such as equal weighting constructs. The most popular of the mid-cap and small-cap indexes are the S&P SmallCap 600 Index and S&P MidCap Index, Russell 2000 Index and the Russell Midcap Index. The most popular extension indexes would include the Total Market Index, Russell 3000, S&P 1500 Index and the series of corresponding growth and value indexes.

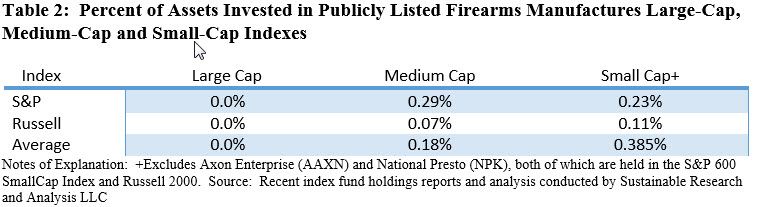

An analysis limited to the stock holdings of the most fundamental mid-cap and small-cap indexes (i.e. S&P and Russell) reveals that investors in corresponding index mutual funds and ETFs are exposed to the stocks of the four weapons companies noted above. Exposures range from an average of 0.18% held in mid-cap indexes to 0.385% held in small-cap indexes. This is illustrated in Table 2. To the extent that investors at the same time invest in the popular extension indexes and their variations, their aggregate exposures to these firms would expand.

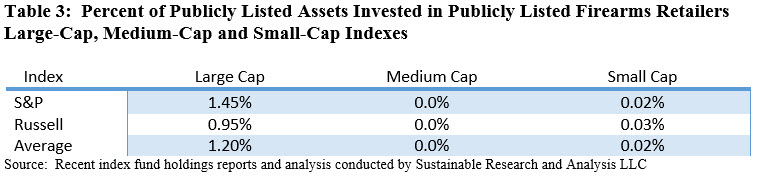

As noted above, firearms are sold through almost 51,000 licensed gun stores, sporting goods outlets and pawnshops. But if the universe of excluded investments is expanded beyond firearms manufacturers to include publicly listed U.S. firearms retailers, the largest of which include Walmart, Inc., Kroger (selling firearms through its Fred Meyer branded store), and Dick’s Sporting Goods, Inc., the universe of index investors includes large-cap indexes, such as the S&P 500 and Russell 1000 as well as small-cap indexes and, by extension, indexes that encapsulate these segments into boarder segments of the capital markets, growth/value configurations and other variations. Moreover, these firms, in particular, Walmart and Kroger, are also held as investments in various investment-grade corporate bond indexes, ranging from the broadest Bloomberg Barclays U.S. Aggregate Bond Index to narrower-based indexes constrained by sector as well as maturity.

An analysis limited to the stock holdings of the most fundamental large-cap mid-cap and small-cap indexes reveals that investors in corresponding index mutual funds and ETFs are exposed to the stocks of the three retailers above. Exposures range from an average of 0.02% held in small-cap indexes to 1.20% held in large cap-indexes while none are held in mid-cap indexes. This is illustrated in Table 3. To the extent that investors at the same time invest in the popular extension indexes, their aggregate exposures to these firms would expand.

It should be noted that Dick’s Sporting Goods announced that it will stop selling semi-automatic rifles like the type used in the mass shooting at the Marjorie Stoneman Douglas High School while Walmart, which stopped selling modern sporting rifles in 2015, announced that it was raising the age restriction for purchase of firearms and ammunition to 21 years of age. Kroger, which sells its firearms thorough its Fred Meyer chain, also said that it would raise the minimum age to buy firearms and ammunition to 21 years. Kroger sells firearms at 43 locations in Idaho, Oregon, Washington and Alaska. Kroger stopped selling assault-style rifles at its Fred Meyer stores in Oregon, Washington and Idaho several years ago, and will stop accepting special orders of those kinds of weapons in Alaska, according to a Kroger spokesperson. Along a similar vein but representing a new level of corporate activism on this issue, Citigroup introduced last week a new set of rules on March 22, 2018 to restrict gun sales by Citi’s clients to customers who have not passed a background check or who are younger than the age of 21. It will also bar the sale of bump-stocks and high-capacity magazines.

Finally, combining index fund exposures to firearms manufacturers along with firearm retailers shows that investors in large-cap, medium-cap and small-cap index funds would be exposed to this sector in a range from a low of 0.02% to a high of 1.20% of portfolio assets. Here to the aggregate levels of exposure increase based on additional investments in the popular extension indexes and variations to these.

Options for Consideration by Index Fund Investors

U.S. focused index fund investors who invest directly or through 401k plans in the most widely held index options are restricted in their arms-free options across the spectrum of large-cap, mid-cap, small-cap and corporate bond index mutual funds and ETFs. Just within the universe consisting of the largest 20 index funds, a segment with some $2.1 trillion in assets under management, 17 of the funds should be expected to have varying levels of exposure to the manufacturers of weapons and the three retailers enumerated above. By way of scale, this is equivalent to 11% of the assets under management[2] attributable to the entire long-term mutual fund and ETF industry. A process of screening the universe of sustainable index mutual funds and ETFs, the ones most likely to exclude weapons manufacturers as well as retailers, based on a set of criteria that includes years of operation, size, performance track record and low expense ratios, produces only three mutual fund and ETF alternative investment options equivalent to the S&P 500 index fund, but none, at this point, to small and mid-cap index funds. These include: (1) Vanguard FTSE Social Index Fund, (2) iShares MSCI KLD Social ETF, and (3) iShares USA Select ESG ETF. As for fixed income alternatives derived from the Bloomberg Barclays U.S. Aggregate Bond Index, only the following two ETFs are available: (1) iShares ESG 1-5 Year USD Corporate Bond ETF and (2) iShares ESG USD Corporate Bond ETF. At That said, it should be noted that these two ETFs are small, with less than $50 million each as of March 31, 2018. In the near future, some managers may also be able to offer newly developed index fund options that completely screen out firearms manufacturers and retailers.

While high net worth investors may qualify based on assets under management for the establishment of index tracking separate accounts that can be structured to eliminate arms manufacturers and related parties, this may not be an option for many individual investors in or outside 401k plans. In the absence of arms-free indexes, alternative near-term strategies for index fund investors could include encouraging index fund managers to engage with firearm manufacturers and retailers in line with announced plans on the part of BlackRock (manager of iShares) as well as active manager Capital Group to do so. Also, investors can opt to contribute a percentage of an investor’s capital appreciation, dividends and interest derived from index fund investments to organizations of their choice engaged in advancing more restrictive gun legislation. If their concerns extend to retailers, engaging with these retail establishments or even boycotting their stores may represent yet another or a complementary option.

[1] Source: CNN

[2] Based on assets as of 12/31/2017 and February 2018; excluding money market funds.