Summary

- The SUSTAIN Large Cap Equity Fund Index registered a decline of -3.72% in February, or 3 basis points behind the S&P 500 Index. Four of 10 funds that comprise the index outperformed the non-ESG S&P 500 Index.

- During the nine-day stock market correction starting January 29th and continuing to February 8th, the SUSTAIN index members were not spared but they did, on average, beat the S&P 500 by 39 basis points.

- While also negative, February’s results achieved by sustainable corporate intermediate-term bonds exceeded by 20 basis points the BB U.S. Aggregate Bond Index.

SUSTAIN Index Declines -3.72% in a Volatile Month, Almost in Line with the S&P 500 Which Ended the Month Only 3 Basis Points Higher

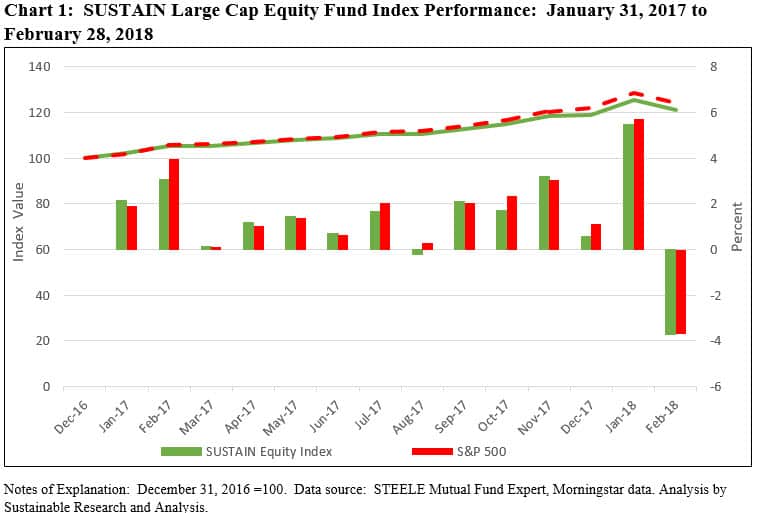

The SUSTAIN Large Cap Equity Fund Index, which tracks the total return performance of the ten largest actively managed large cap U.S. oriented equity mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices, gave up -3.72% in February versus a decline of -3.69% for the S&P 500 Index. Refer to Chart 1.

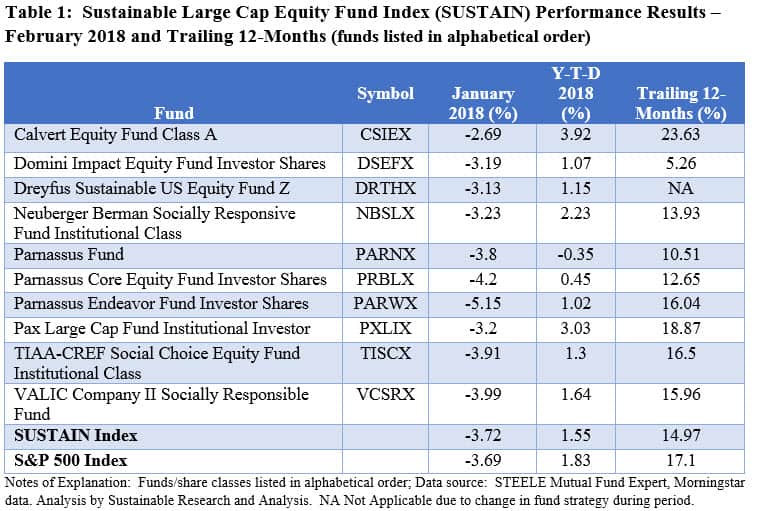

None of the funds recorded positive results for the month. Total returns ranged from a low of -5.15% registered by Parnassus Endeavor Investor Shares to a high of -2.69% posted by Calvert Equity A. Four of the 10 funds that comprise the index, however, beat the S&P 500 Index. Refer to Table 1.

Calvert Equity A continues to lead the index on a one-month (-2.69%), year-to-date (3.92%) as well as the trailing 12-month basis, during which time the fund was up a strong 23.63% and leads the second best performer by 4.76%. The fund’s growth orientation and Technology sector overweighting contributed to the fund’s performance while avoidance of both the Energy and Real Estate sectors limited the drag on February’s results.

While also benefiting from its absence of exposure to the Energy and Real Estate sectors, the Parnassus Endeavor Investor Shares concentrated exposure to the Healthcare sector, it value orientation, combined with an average price drop of -9.5% afflicting the fund’s top 4 stocks that together recently accounted for almost 30% of portfolio asset contributed to the fund’s poorer relative results.

After a volatile month, nine of the ten index members still display positive year-to-date results ranging from 0.45% attributable to Parnassus Core Equity Investor to a high of 3.92% posted by Calvert Equity A. Only the Parnassus Fund failed to achieve a positive year-to-date return, having dropped -0.35%.

During the Brief Stock Market Correction, Sustainable Funds were not Spared, however, their Average Performance Beat the S&P 500 by 39 Basis Points.

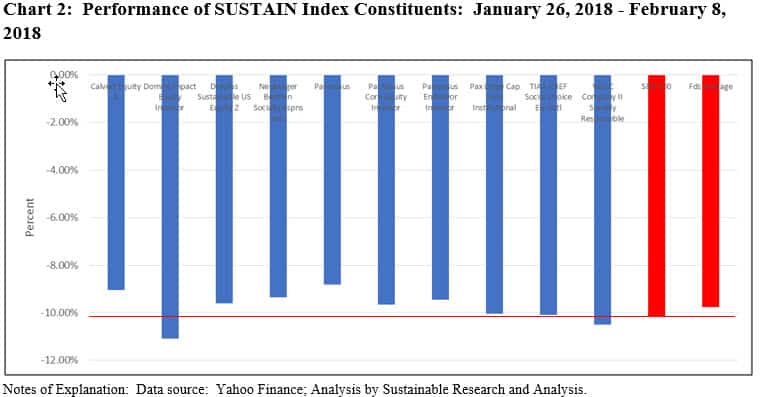

Both the S&P 500 Index and the SUSTAIN Large Cap Equity Fund Index managed to stage a partial recovery from the short-lived stock market correction experienced during 9 trading days that commenced on January 27th and ended on February 8th, coincident with the passage and approval in Washington of a short term spending bill through March 23rd, during which time stocks declined -10.2%. The selloff, which also took the Dow Jones Industrial Average even lower to -4.26%, marked a break with the tranquility that had characterized financial markets for much of the past two years, however, the immediate cause for the abrupt selloff was not abundantly clear, especially given the speedy partial reversal that continued into March. Some analysts speculated that investors got worried following the release of the February 2nd employment and rising average hourly earnings report by the U.S. Bureau of Labor Statistics that showed unexpected wage growth and led to renewed concerns that the Federal Reserve, which expects to raise interest rates three times this year, will raise rates more than expected. Continuing U.S. political turmoil could also have played a role and we are likely to experience more of that in the future. Others tied the decline to technical factors, such as the collapse of volatility tied strategies that came under stress as stock volatility ticked up. By the end of February, however, sentiment shifted and the S&P 500 was able to notch a 5.1% gain during the remainder of the month and erase some of the earlier losses.

During the brief interval during which stocks recorded a correction, sustainable funds were not spared but they did, on average beat the S&P 500 by 39 basis points. The ten funds that comprise the SUSTAIN index posted an average decline of -9.77% versus a drop of -10.16% recorded by the S&P 500 Index. Eight of the ten funds sustained unrealized losses that fell short of the S&P 500 Index. Refer to Chart 2.

Sustainable Bond Funds Eclipse the Performance BB U.S. Aggregate Bond Index in February

The Sustainable (SUSTAIN) Bond Fund Indicator, a cohort of five sustainable bond funds consisting of similarly managed funds that, like the equity index counterpart, employ sustainable investing strategies beyond absolute reliance on exclusionary practices that track the BB U.S. Aggregate Bond Index, posted a February decline of -0.75%, exceeding the non-ESG benchmark by 20 basis points and an even wider 51 basis points over the previous 12-months.

SUSTAIN Large Cap Equity Fund Index Declines -3.72% in February, Almost in Line with S&P 500

Summary The SUSTAIN Large Cap Equity Fund Index registered a decline of -3.72% in February, or 3 basis points behind the S&P 500 Index. Four of 10 funds that comprise the index outperformed the non-ESG S&P 500 Index. During the nine-day stock market correction starting January 29th and continuing to February 8th, the SUSTAIN index…

Share This Article:

Summary

SUSTAIN Index Declines -3.72% in a Volatile Month, Almost in Line with the S&P 500 Which Ended the Month Only 3 Basis Points Higher

The SUSTAIN Large Cap Equity Fund Index, which tracks the total return performance of the ten largest actively managed large cap U.S. oriented equity mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices, gave up -3.72% in February versus a decline of -3.69% for the S&P 500 Index. Refer to Chart 1.

None of the funds recorded positive results for the month. Total returns ranged from a low of -5.15% registered by Parnassus Endeavor Investor Shares to a high of -2.69% posted by Calvert Equity A. Four of the 10 funds that comprise the index, however, beat the S&P 500 Index. Refer to Table 1.

Calvert Equity A continues to lead the index on a one-month (-2.69%), year-to-date (3.92%) as well as the trailing 12-month basis, during which time the fund was up a strong 23.63% and leads the second best performer by 4.76%. The fund’s growth orientation and Technology sector overweighting contributed to the fund’s performance while avoidance of both the Energy and Real Estate sectors limited the drag on February’s results.

While also benefiting from its absence of exposure to the Energy and Real Estate sectors, the Parnassus Endeavor Investor Shares concentrated exposure to the Healthcare sector, it value orientation, combined with an average price drop of -9.5% afflicting the fund’s top 4 stocks that together recently accounted for almost 30% of portfolio asset contributed to the fund’s poorer relative results.

After a volatile month, nine of the ten index members still display positive year-to-date results ranging from 0.45% attributable to Parnassus Core Equity Investor to a high of 3.92% posted by Calvert Equity A. Only the Parnassus Fund failed to achieve a positive year-to-date return, having dropped -0.35%.

During the Brief Stock Market Correction, Sustainable Funds were not Spared, however, their Average Performance Beat the S&P 500 by 39 Basis Points.

Both the S&P 500 Index and the SUSTAIN Large Cap Equity Fund Index managed to stage a partial recovery from the short-lived stock market correction experienced during 9 trading days that commenced on January 27th and ended on February 8th, coincident with the passage and approval in Washington of a short term spending bill through March 23rd, during which time stocks declined -10.2%. The selloff, which also took the Dow Jones Industrial Average even lower to -4.26%, marked a break with the tranquility that had characterized financial markets for much of the past two years, however, the immediate cause for the abrupt selloff was not abundantly clear, especially given the speedy partial reversal that continued into March. Some analysts speculated that investors got worried following the release of the February 2nd employment and rising average hourly earnings report by the U.S. Bureau of Labor Statistics that showed unexpected wage growth and led to renewed concerns that the Federal Reserve, which expects to raise interest rates three times this year, will raise rates more than expected. Continuing U.S. political turmoil could also have played a role and we are likely to experience more of that in the future. Others tied the decline to technical factors, such as the collapse of volatility tied strategies that came under stress as stock volatility ticked up. By the end of February, however, sentiment shifted and the S&P 500 was able to notch a 5.1% gain during the remainder of the month and erase some of the earlier losses.

During the brief interval during which stocks recorded a correction, sustainable funds were not spared but they did, on average beat the S&P 500 by 39 basis points. The ten funds that comprise the SUSTAIN index posted an average decline of -9.77% versus a drop of -10.16% recorded by the S&P 500 Index. Eight of the ten funds sustained unrealized losses that fell short of the S&P 500 Index. Refer to Chart 2.

Sustainable Bond Funds Eclipse the Performance BB U.S. Aggregate Bond Index in February

The Sustainable (SUSTAIN) Bond Fund Indicator, a cohort of five sustainable bond funds consisting of similarly managed funds that, like the equity index counterpart, employ sustainable investing strategies beyond absolute reliance on exclusionary practices that track the BB U.S. Aggregate Bond Index, posted a February decline of -0.75%, exceeding the non-ESG benchmark by 20 basis points and an even wider 51 basis points over the previous 12-months.

Premium Articles Access Priority Support 1 Fixed Price

Access to All Data No Credit Card Required Cancel Any Time

Access to Premium Articles Priority Support Save 25%

$99

PER YEAR

Access to exclusive content

Premium Articles

Access 1 Fixed Price

Free Trial

30-Day

Access to exclusive content

Access to All Data No Credit card Required Cancel Any Time

$9.99

MONTHLY

Access to premium content

Access to premium Articles Save 25%

Sustainable Funds Monitor

Funds Glossary

Quarterly On-Line Briefings

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact