Summary

The Sustainable Large Cap Equity Fund Index (SUSTAIN Index) registered a strong gain of 3.20% in November versus the S&P 500 Index which generated a 3.07% total return. The SUSTAIN Index, up 18.34% year-to-date, continues to trail the S&P 500 Index that recorded a gain of 20.49% since December 31, 2016.

SUSTAIN Large Cap Equity Fund Index Gains Ground in November With Its Strong 3.2% Return

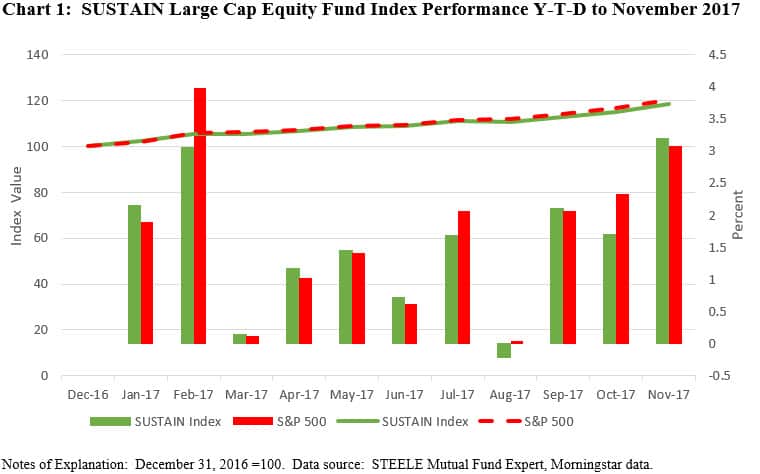

The SUSTAIN Large Cap Equity Fund Index, which tracks the total return performance of the ten largest actively managed large-cap US oriented equity mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices, registered a strong gain of 3.20% in November versus the S&P 500 Index which generated a 3.07% total return. This was the best monthly gain achieved by the SUSTAIN Index so far this year, powered by the 6.06% increase recorded by the Parnassus Endeavor Fund Investor Shares along with four other funds whose November returns exceeded that of the S&P 500 Index. On a year-to-date basis, the SUSTAIN Index continues to lag the S&P 500 Index by 2.1%, however, the spread between the two indexes narrowed slightly. Refer to Chart 1.

Five Funds Record Gains in Excess of the S&P 500 Index

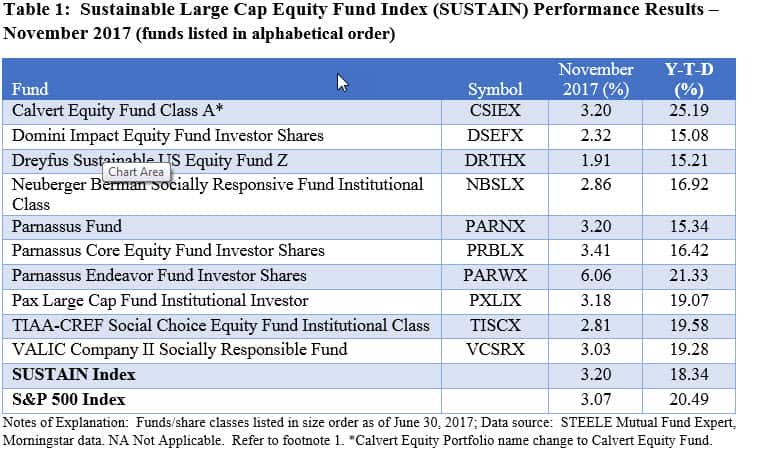

Five funds outperformed the S&P 500 Index during the month while across the ten index component funds returns for the month ranged from a low of 1.91% to a high of 6.06% delivered by the Parnassus Endeavor Fund-Investor Shares. The $5.2 billion fund, which is highly concentrated in a limited number of companies and sectors, invests in large-capitalization companies that represent Parnassus’ clearest expression of ESG consisting of companies that “must offer outstanding workplaces, and must not be engaged in the extraction, exploration, production, manufacturing, or refining of fossil fuels.” As of November 30, the fund held 31 securities, of which the top 2, including Qualcomm Inc. (10.7%) and Gilead Sciences, Inc. (10.2%) accounted for 20.9% of assets while the top 10 companies represented 55.3% of net assets. This benefited the fund in the latest month as Qualcomm, which had been down some 20% over the last year, gained around 25%, in part, on the basis of reports that Broadcom may considering a deal to acquire the company. The fund is also highly concentrated in 2 sectors, including Health Care (31%) and Information Technology (29%), both of which gained during the month. At the other end of the range, the Dreyfus Sustainable US Equity Fund Investor Shares which is a successor to the Dreyfus Third Century Fund that was added to the index last month as a replacement for the merged Sentinel Sustainable Core Opportunities Fund Class A shares, trailed the group with its 1.91%. Refer to Table 2.

Sustainable Funds Trail the S&P 500 Index by 215 bps Since Start of Year

The strong performance of the Parnassus Endeavor Fund-Investor Shares, which almost topped the list of all sustainable funds for the month, also fueled its year-to-date performance results to end November up 21.33%. This is second only to Calvert Equity Fund Class A shares that outperformed the S&P 500 Index in November and contributed to the retention of its year-to-date lead position with a return of 25.19%. Domini Impact Equity Investor, with its year-to-date return of 15.08% ranks last among the ten SUSTAIN Index constituents. Refer to Table 2.

The Sustainable Large Cap Equity Fund Index (SUSTAIN Index) Explained

The index, which was initiated as of June 30, 2017 with data back to December 31, 2016, tracks the total return performance of the ten largest actively managed large cap domestic equity mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices for religious, ethical or social reasons. While methodologies vary, to qualify for inclusion in the index, funds must actively apply environmental, social and governance (ESG) criteria to their investment processes and decision making. In tandem with their ESG integration strategy, funds may also employ exclusionary strategies along with impact oriented investment approaches as well as shareholder advocacy.

Multiple funds managed by the same management firm may be included in the index, however, a fund with multiple share classes is only included in the index once, based on the largest share class in terms of assets. The index is equally weighted, it is calculated monthly and rebalanced once a year as of December 31.

The combined assets associated with the ten funds stood at $21.2 billion and represent about 13.7% of the entire sustainable US equity sector that is comprised of 220 funds/share classes, including actively managed funds and index funds, with $154.4 billion in assets under management[1].

[1] With all share classes combined, total net assets=$30.8 billion or 20% of the sustainable US equity sector.

SUSTAIN Large Cap Equity Fund Index in November Registers Best Monthly Gain in 2017 and Exceeds S&P 500 Index

Summary

Share This Article:

Summary

The Sustainable Large Cap Equity Fund Index (SUSTAIN Index) registered a strong gain of 3.20% in November versus the S&P 500 Index which generated a 3.07% total return. The SUSTAIN Index, up 18.34% year-to-date, continues to trail the S&P 500 Index that recorded a gain of 20.49% since December 31, 2016.

SUSTAIN Large Cap Equity Fund Index Gains Ground in November With Its Strong 3.2% Return

The SUSTAIN Large Cap Equity Fund Index, which tracks the total return performance of the ten largest actively managed large-cap US oriented equity mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices, registered a strong gain of 3.20% in November versus the S&P 500 Index which generated a 3.07% total return. This was the best monthly gain achieved by the SUSTAIN Index so far this year, powered by the 6.06% increase recorded by the Parnassus Endeavor Fund Investor Shares along with four other funds whose November returns exceeded that of the S&P 500 Index. On a year-to-date basis, the SUSTAIN Index continues to lag the S&P 500 Index by 2.1%, however, the spread between the two indexes narrowed slightly. Refer to Chart 1.

Five Funds Record Gains in Excess of the S&P 500 Index

Five funds outperformed the S&P 500 Index during the month while across the ten index component funds returns for the month ranged from a low of 1.91% to a high of 6.06% delivered by the Parnassus Endeavor Fund-Investor Shares. The $5.2 billion fund, which is highly concentrated in a limited number of companies and sectors, invests in large-capitalization companies that represent Parnassus’ clearest expression of ESG consisting of companies that “must offer outstanding workplaces, and must not be engaged in the extraction, exploration, production, manufacturing, or refining of fossil fuels.” As of November 30, the fund held 31 securities, of which the top 2, including Qualcomm Inc. (10.7%) and Gilead Sciences, Inc. (10.2%) accounted for 20.9% of assets while the top 10 companies represented 55.3% of net assets. This benefited the fund in the latest month as Qualcomm, which had been down some 20% over the last year, gained around 25%, in part, on the basis of reports that Broadcom may considering a deal to acquire the company. The fund is also highly concentrated in 2 sectors, including Health Care (31%) and Information Technology (29%), both of which gained during the month. At the other end of the range, the Dreyfus Sustainable US Equity Fund Investor Shares which is a successor to the Dreyfus Third Century Fund that was added to the index last month as a replacement for the merged Sentinel Sustainable Core Opportunities Fund Class A shares, trailed the group with its 1.91%. Refer to Table 2.

Sustainable Funds Trail the S&P 500 Index by 215 bps Since Start of Year

The strong performance of the Parnassus Endeavor Fund-Investor Shares, which almost topped the list of all sustainable funds for the month, also fueled its year-to-date performance results to end November up 21.33%. This is second only to Calvert Equity Fund Class A shares that outperformed the S&P 500 Index in November and contributed to the retention of its year-to-date lead position with a return of 25.19%. Domini Impact Equity Investor, with its year-to-date return of 15.08% ranks last among the ten SUSTAIN Index constituents. Refer to Table 2.

The Sustainable Large Cap Equity Fund Index (SUSTAIN Index) Explained

The index, which was initiated as of June 30, 2017 with data back to December 31, 2016, tracks the total return performance of the ten largest actively managed large cap domestic equity mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices for religious, ethical or social reasons. While methodologies vary, to qualify for inclusion in the index, funds must actively apply environmental, social and governance (ESG) criteria to their investment processes and decision making. In tandem with their ESG integration strategy, funds may also employ exclusionary strategies along with impact oriented investment approaches as well as shareholder advocacy.

Multiple funds managed by the same management firm may be included in the index, however, a fund with multiple share classes is only included in the index once, based on the largest share class in terms of assets. The index is equally weighted, it is calculated monthly and rebalanced once a year as of December 31.

The combined assets associated with the ten funds stood at $21.2 billion and represent about 13.7% of the entire sustainable US equity sector that is comprised of 220 funds/share classes, including actively managed funds and index funds, with $154.4 billion in assets under management[1].

[1] With all share classes combined, total net assets=$30.8 billion or 20% of the sustainable US equity sector.

Premium Articles Access Priority Support 1 Fixed Price

Access to All Data No Credit Card Required Cancel Any Time

Access to Premium Articles Priority Support Save 25%

$99

PER YEAR

Access to exclusive content

Premium Articles

Access 1 Fixed Price

Free Trial

30-Day

Access to exclusive content

Access to All Data No Credit card Required Cancel Any Time

$9.99

MONTHLY

Access to premium content

Access to premium Articles Save 25%

Sustainable Funds Monitor

Funds Glossary

Quarterly On-Line Briefings

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact