The Bottom Line: Sustainable funds related events or developments in October 2020 numbered 33, including two M&A transactions involving Eaton Vance and Truvalue Labs, Inc.

October 2020 Events Summary

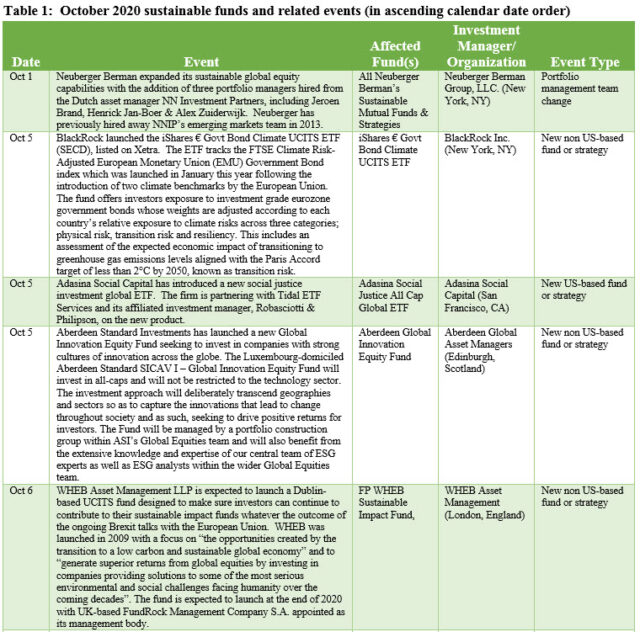

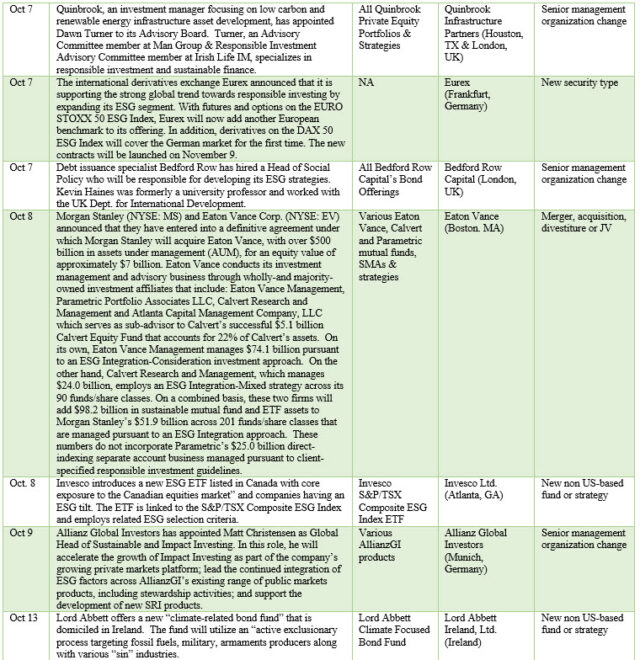

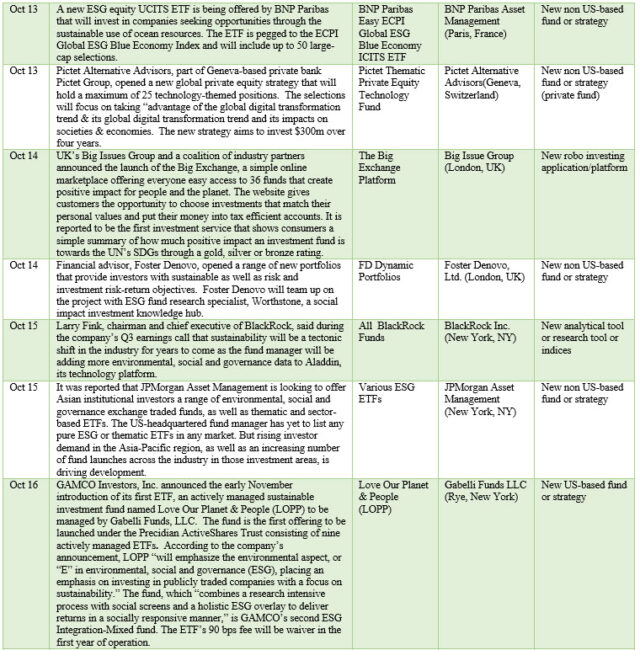

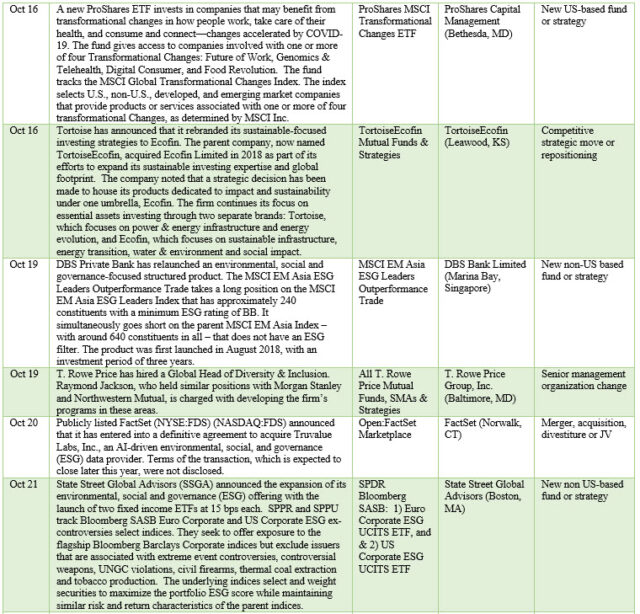

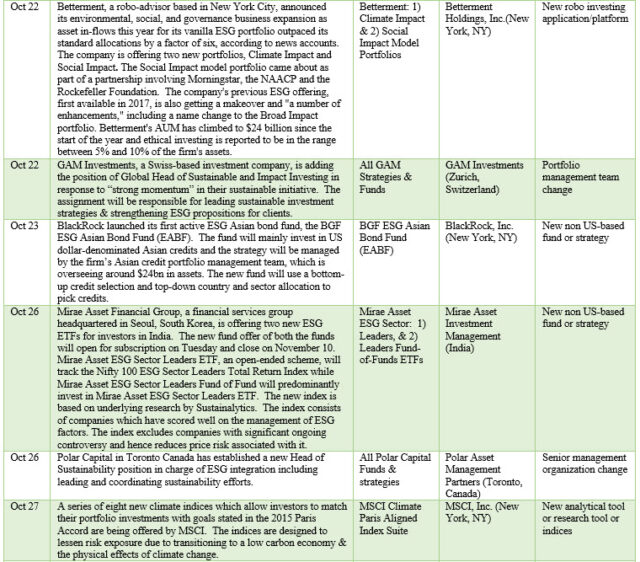

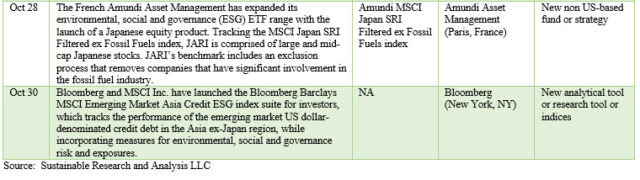

During October 2020 we identified 33 sustainable fund related events or developments. These include the following:

- 18 events involved the launch of new US and non US-based mutual funds or ETFs.

- 15 non US-based mutual fund and ETFs

- 3 US-based mutual fund and ETFs

- 5 senior management organization changes

- 3 new analytical tool or research or indices

- 2 merger, acquisition, divestitures or JVs

- 2 portfolio management team changes

- 3 other events, including a new security type, new robo investing application/platform and a competitive strategic move or repositioning.

Events highlight

Two M&A transactions were announced in October. The first on October 6 involved Morgan Stanley (NYSE: MS) and Eaton Vance Corp. (NYSE: EV) who announced that they have entered into a definitive agreement under which Morgan Stanley will acquire Eaton Vance. Eaton Vance conducts its investment management and advisory business through wholly-and majority-owned investment affiliates that include: Eaton Vance Management, Parametric Portfolio Associates LLC, Calvert Research and Management and Atlanta Capital Management Company, LLC. On a combined basis, these two firms will add $98.2 billion in sustainable mutual fund and ETF assets to Morgan Stanley’s $51.9 billion across 201 funds/share classes that are managed pursuant to an ESG Integration approach. These numbers do not incorporate Parametric’s $25.0 billion direct-indexing separate account business managed pursuant to client-specified responsible investment guidelines.

The second transaction which was announced on October 20 involved publicly listed FactSet (NYSE:FDS) (NASDAQ:FDS). The firm announcement that it has entered into a definitive agreement to acquire Truvalue Labs, Inc., an AI-driven environmental, social, and governance (ESG) data provider. Terms of the transaction, which is expected to close later this year, were not disclosed.

Refer to Table 1.