The Bottom Line: Thematic ETF equity index funds focused on clean energy, low carbon energy and alternative energy posted the best performance results in August.

Summary

Fueled by government stimulus, Federal Reserve liquidity and near zero interest rates, signs of an economic rebound and hopes for a coronavirus vaccine, the S&P 500 registered a strong 7.2% gain in August and the ESG equivalent was up 7.9%. Intermediate-investment grade bonds, however, recorded a decline of 80 basis points, the worst this year. Sustainable funds[1], a total of 4,660 funds/share classes, achieved an average gain of 3.2%. Within this universe, the top 10 performing funds, all thematic alternative energy and low carbon funds dominated by index funds, posted an average gain of 18.8%. On the other hand, the bottom performing funds, led by ESG integrators, dropped an average of -3.81%. Individual fund returns ranged from a high of 25.9% to a low of -18.95% posted by thematic Invesco Solar ETF and values-based Camelot Premium Return Fund I, respectively

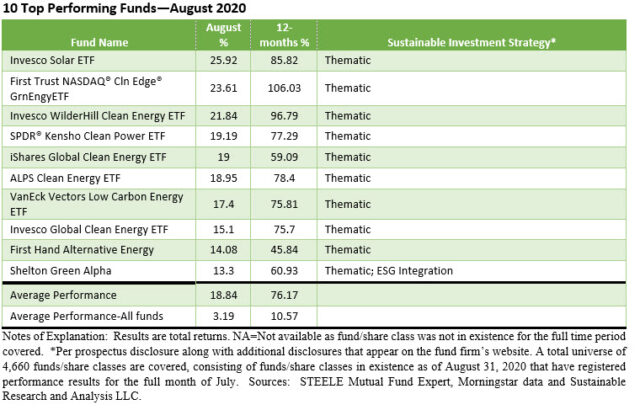

10 Top Performing Funds—August 2020

The 10 top performing mutual funds and ETFs in August, all but two passively managed funds, were comprised entirely of thematic equity funds focused on clean energy, low carbon energy and alternative energy funds that posted an average 18.8% total return and. Returns ranged from a high of 25.92% recorded by the $1.3 billion Invesco Solar ETF to 13.3% registered by the $91.5 million Shelton Green Alpha Fund.

The leading fund in August, Invesco Solar ETF, which also posted a gain of 85.82% over the previous 12-months, is focused on the solar industry and invests in solar power equipment producers, suppliers of raw materials, components or services to solar producers or developers, companies that produce solar equipment fabrication systems, companies involved in solar power system installation, development, integration, maintenance, or finance; or companies that sell electricity derived from solar power.

Shelton Green Alpha, actively managed by Shelton Capital Management and sub-advised by Green Alpha Advisors, invests primarily in stocks of companies that are believed to be leaders in managing environmental risks and opportunities, have above average growth potential and are reasonably valued. These firms are selected from a universe of green economy companies based on a proprietary set of Green Alpha Advisors qualitative criteria. According to the manager, a “green economy” company is one which Green Alpha Advisors believes works to improve human well-being and increase economic efficiencies, while significantly reducing environmental risks and ecological scarcities. Green economy companies provide products and services that help economies to adapt to, solve or mitigate the effects of key environmental and economic systemic risks, namely resource scarcity and climate change.

Shelton Green Alpha is the only fund that among the other thematic funds that factors in ESG considerations in making investment decisions. It is also one of seven top 10 funds to report a position in Tesla. Tesla gained 71.4% in August and likely contributed meaningfully to performance based on the percentage of assets linked to the fund’s Tesla holding. Tesla holdings averaged 6.2% across the seven funds with Tesla exposure, which ranged from 1.91% held in Invesco Global Clean Energy ETF to a high of 10.65% in VanEck Vectors Low Carbon Energy ETF. Shelton Green Alpha maintained a 9.26% position in Tesla.

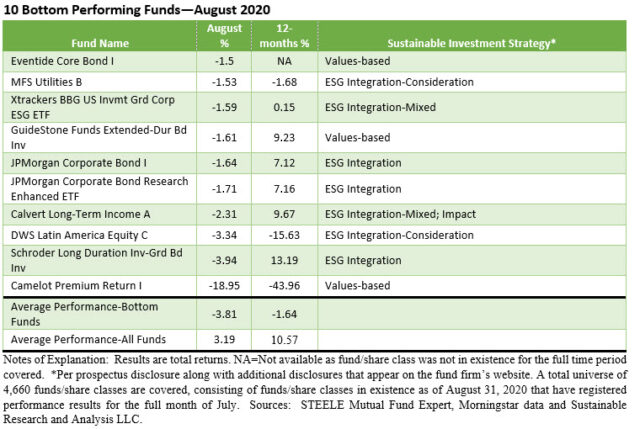

10 Bottom Performing Funds—August 2020

Unlike the uniformity in the profile of the top performing funds, the 10 bottom performing mutual funds/share classes and ETFs in August consist of a mix of equity and fixed income funds, including long-dated corporate bond funds, a utility, a Latin America equity fund and an options writing fund. The ten funds, dominated by three types of ESG integration approaches, recorded an average total return of -3.81%, with returns, all negative, ranging from -1.5% to an outlying -18.95%.

At one end of the range, the values-based Eventide Core Bond Fund I posted a decline of -1.5%. Bringing up the rear was another values-based fund, the Camelot Premium Return Fund I managed by Camelot Funds, LLC, that gave up -18.95%. The fund seeks to achieve its investment objectives primarily through equity-based option writing strategies including puts and covered calls against a portfolio consisting of 25-30 stocks that the manager believes present strong total return potential. When the outlier performance results are excluded from the average recorded by the 10 lagging funds, the average picks up 168 basis points to -2.13%.

Fund strategy definitions:

Values-based Investing. A strategy based on the guiding principle of investments that are based on a set of beliefs that contain a view toward achieving a positive societal outcome. Typically, this approach is executed via negative screening, divestiture or divestment.

Exclusionary Investing. The exclusions of companies or certain sectors from portfolios based on specific ethical, religious, social or environmental guidelines. Traditional examples of exclusionary strategies cover the avoidance of any investments in companies that are fully or partially engaged in gambling, sex related activities, the production of alcohol, tobacco, firearms, fossil fuels or even atomic energy. These exclusionary categories have been extended, in recent years, to incorporate serious labor-related actions or penalties, compulsory or child labor, human rights violations and genocide.

Impact Investing. A still relatively small but growing slice of the sustainable investing segment. Impact investments are investments directed to companies, organizations, and funds with the intention to achieve measurable social and/or environmental impacts alongside a financial return. The direct capital in this strategy addresses challenges in sectors such as sustainable agriculture, renewable energy, conservation, microfinance, affordable and accessible basic services, including housing, healthcare, and education. Some funds may seek to achieve impact without necessarily making a commitment to achieve measurable outcomes.

Thematic Investing. An investment approach with a focus on a particular idea or unifying concept. Clean energy, clean tech and gender diversity are a few of the leading sustainable investing fund themes. Investing in green bonds or low carbon emitting stocks, bonds and funds also fall into the thematic investing category.

ESG Integration. The investment strategy by which environmental, social and governance factors and risks are systematically analyzed and, when deemed relevant and material to an entity’s long-term performance, influence the buy, hold and sell decision of a security. For these reasons, ESG integration is referred to as a value-based investing approach.

There are at least three distinct forms of ESG Integration: (1) ESG Integration-Consideration. ESG may be factored into investment decisions, (2) ESG Integration. ESG is accounted for in investment decision making and it may be accompanied by investee engagement and proxy voting, and (3) ESG Integration-Mixed in which ESG Integration is the overarching strategy but additional approaches may also be employed, such as exclusionary investing or impact investing.

Engagement/Proxy Voting. Engagement/Proxy Voting leverage the power of shareholder ownership in publicly listed companies using action-oriented approaches that rely on influencing corporate behavior through direct corporate engagement, filing shareholder proposals and proxy voting. These tools may be employed as a complement to one or more of the five sustainable investing strategies set out above.

[1] While definitions continue to evolve, sustainable investing refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing and ESG integration. Shareholder/bondholder engagement and proxy voting may also be employed along with one of more of these strategies that are not mutually exclusive.

Sustainable funds performance scorecard: August 2020

The Bottom Line: Thematic ETF equity index funds focused on clean energy, low carbon energy and alternative energy posted the best performance results in August.

Share This Article:

The Bottom Line: Thematic ETF equity index funds focused on clean energy, low carbon energy and alternative energy posted the best performance results in August.

Summary

Fueled by government stimulus, Federal Reserve liquidity and near zero interest rates, signs of an economic rebound and hopes for a coronavirus vaccine, the S&P 500 registered a strong 7.2% gain in August and the ESG equivalent was up 7.9%. Intermediate-investment grade bonds, however, recorded a decline of 80 basis points, the worst this year. Sustainable funds[1], a total of 4,660 funds/share classes, achieved an average gain of 3.2%. Within this universe, the top 10 performing funds, all thematic alternative energy and low carbon funds dominated by index funds, posted an average gain of 18.8%. On the other hand, the bottom performing funds, led by ESG integrators, dropped an average of -3.81%. Individual fund returns ranged from a high of 25.9% to a low of -18.95% posted by thematic Invesco Solar ETF and values-based Camelot Premium Return Fund I, respectively

10 Top Performing Funds—August 2020

The 10 top performing mutual funds and ETFs in August, all but two passively managed funds, were comprised entirely of thematic equity funds focused on clean energy, low carbon energy and alternative energy funds that posted an average 18.8% total return and. Returns ranged from a high of 25.92% recorded by the $1.3 billion Invesco Solar ETF to 13.3% registered by the $91.5 million Shelton Green Alpha Fund.

The leading fund in August, Invesco Solar ETF, which also posted a gain of 85.82% over the previous 12-months, is focused on the solar industry and invests in solar power equipment producers, suppliers of raw materials, components or services to solar producers or developers, companies that produce solar equipment fabrication systems, companies involved in solar power system installation, development, integration, maintenance, or finance; or companies that sell electricity derived from solar power.

Shelton Green Alpha, actively managed by Shelton Capital Management and sub-advised by Green Alpha Advisors, invests primarily in stocks of companies that are believed to be leaders in managing environmental risks and opportunities, have above average growth potential and are reasonably valued. These firms are selected from a universe of green economy companies based on a proprietary set of Green Alpha Advisors qualitative criteria. According to the manager, a “green economy” company is one which Green Alpha Advisors believes works to improve human well-being and increase economic efficiencies, while significantly reducing environmental risks and ecological scarcities. Green economy companies provide products and services that help economies to adapt to, solve or mitigate the effects of key environmental and economic systemic risks, namely resource scarcity and climate change.

Shelton Green Alpha is the only fund that among the other thematic funds that factors in ESG considerations in making investment decisions. It is also one of seven top 10 funds to report a position in Tesla. Tesla gained 71.4% in August and likely contributed meaningfully to performance based on the percentage of assets linked to the fund’s Tesla holding. Tesla holdings averaged 6.2% across the seven funds with Tesla exposure, which ranged from 1.91% held in Invesco Global Clean Energy ETF to a high of 10.65% in VanEck Vectors Low Carbon Energy ETF. Shelton Green Alpha maintained a 9.26% position in Tesla.

10 Bottom Performing Funds—August 2020

Unlike the uniformity in the profile of the top performing funds, the 10 bottom performing mutual funds/share classes and ETFs in August consist of a mix of equity and fixed income funds, including long-dated corporate bond funds, a utility, a Latin America equity fund and an options writing fund. The ten funds, dominated by three types of ESG integration approaches, recorded an average total return of -3.81%, with returns, all negative, ranging from -1.5% to an outlying -18.95%.

At one end of the range, the values-based Eventide Core Bond Fund I posted a decline of -1.5%. Bringing up the rear was another values-based fund, the Camelot Premium Return Fund I managed by Camelot Funds, LLC, that gave up -18.95%. The fund seeks to achieve its investment objectives primarily through equity-based option writing strategies including puts and covered calls against a portfolio consisting of 25-30 stocks that the manager believes present strong total return potential. When the outlier performance results are excluded from the average recorded by the 10 lagging funds, the average picks up 168 basis points to -2.13%.

Fund strategy definitions:

Values-based Investing. A strategy based on the guiding principle of investments that are based on a set of beliefs that contain a view toward achieving a positive societal outcome. Typically, this approach is executed via negative screening, divestiture or divestment.

Exclusionary Investing. The exclusions of companies or certain sectors from portfolios based on specific ethical, religious, social or environmental guidelines. Traditional examples of exclusionary strategies cover the avoidance of any investments in companies that are fully or partially engaged in gambling, sex related activities, the production of alcohol, tobacco, firearms, fossil fuels or even atomic energy. These exclusionary categories have been extended, in recent years, to incorporate serious labor-related actions or penalties, compulsory or child labor, human rights violations and genocide.

Impact Investing. A still relatively small but growing slice of the sustainable investing segment. Impact investments are investments directed to companies, organizations, and funds with the intention to achieve measurable social and/or environmental impacts alongside a financial return. The direct capital in this strategy addresses challenges in sectors such as sustainable agriculture, renewable energy, conservation, microfinance, affordable and accessible basic services, including housing, healthcare, and education. Some funds may seek to achieve impact without necessarily making a commitment to achieve measurable outcomes.

Thematic Investing. An investment approach with a focus on a particular idea or unifying concept. Clean energy, clean tech and gender diversity are a few of the leading sustainable investing fund themes. Investing in green bonds or low carbon emitting stocks, bonds and funds also fall into the thematic investing category.

ESG Integration. The investment strategy by which environmental, social and governance factors and risks are systematically analyzed and, when deemed relevant and material to an entity’s long-term performance, influence the buy, hold and sell decision of a security. For these reasons, ESG integration is referred to as a value-based investing approach.

There are at least three distinct forms of ESG Integration: (1) ESG Integration-Consideration. ESG may be factored into investment decisions, (2) ESG Integration. ESG is accounted for in investment decision making and it may be accompanied by investee engagement and proxy voting, and (3) ESG Integration-Mixed in which ESG Integration is the overarching strategy but additional approaches may also be employed, such as exclusionary investing or impact investing.

Engagement/Proxy Voting. Engagement/Proxy Voting leverage the power of shareholder ownership in publicly listed companies using action-oriented approaches that rely on influencing corporate behavior through direct corporate engagement, filing shareholder proposals and proxy voting. These tools may be employed as a complement to one or more of the five sustainable investing strategies set out above.

[1] While definitions continue to evolve, sustainable investing refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing and ESG integration. Shareholder/bondholder engagement and proxy voting may also be employed along with one of more of these strategies that are not mutually exclusive.

Premium Articles Access Priority Support 1 Fixed Price

Access to All Data No Credit Card Required Cancel Any Time

Access to Premium Articles Priority Support Save 25%

$99

PER YEAR

Access to exclusive content

Premium Articles

Access 1 Fixed Price

Free Trial

30-Day

Access to exclusive content

Access to All Data No Credit card Required Cancel Any Time

$9.99

MONTHLY

Access to premium content

Access to premium Articles Save 25%

Sustainable Funds Monitor

Funds Glossary

Quarterly On-Line Briefings

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact