Introduction

A review and analysis of the top 10 stocks held by the largest actively managed sustainable investing funds as of September 30 or August 31, 2019, all members of the Sustainable (SUSTAIN) Large Cap Equity Fund Index, reflects higher levels of concentration, some consistency as well as variations in sectors and holdings relative to the S&P 500 Index. As well, the analysis show the consistent exclusions of at least three stocks that otherwise make up the top holdings in the conventional benchmark. These findings are reviewed and summarized in this research article.

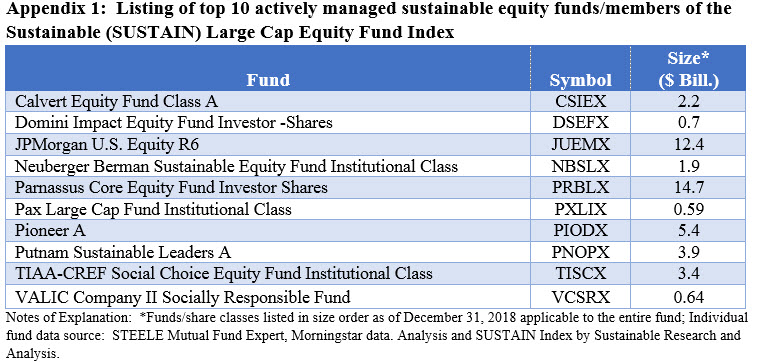

The universe of funds: 10 funds with $45.8 billion in AUM[1]

The review and analysis covers a universe of large cap sustainable equity funds that comprise the ten largest actively managed large cap domestic equity mutual funds. These funds employ a sustainable investing strategy beyond absolute reliance on exclusionary practices for religious, ethical or social reasons. While their sustainable investing methodologies vary, to qualify for inclusion in the index, funds in excess of $50 million in net assets must actively apply environmental, social and governance (ESG) criteria to their investment processes and decision making. In tandem with their ESG integration strategy, funds may also employ exclusionary strategies along with impact oriented investment approaches as well as shareholder advocacy. The index includes only the largest single fund or share class managed by an investment management firm and any fund with multiple share classes is only included in the index once, based on the largest share class in terms of net assets.

The combined assets associated with the ten funds stood at $45.8 billion as of December 31, 2018 and represent about 16.1% of the entire sustainable US equity sector that is comprised of 446 funds/share classes, including actively managed funds and index funds, with $283.8 billion in assets under management. Eight of the ten funds are large cap blended funds while the remaining two funds are growth-oriented funds. See Appendix 1 for a listing of the ten mutual funds.

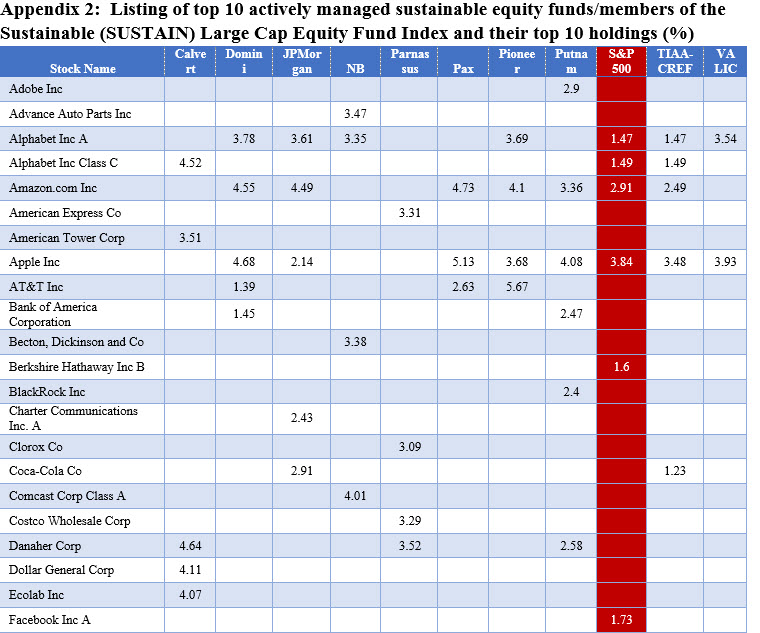

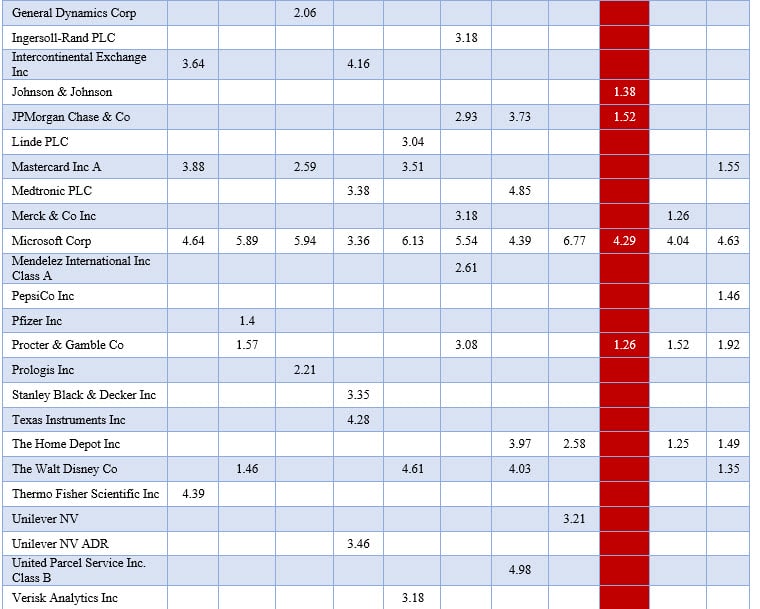

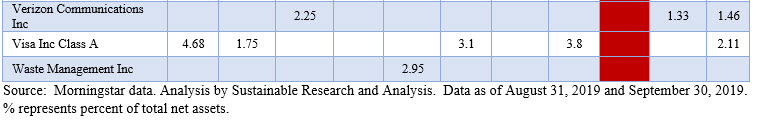

The universe of stocks: 46 different stock holdings/44 companies

The 10 funds hold 46 different stocks that make up their top ten holdings, including Alphabet Class A and C shares and Unilever NV and Unilever NV in the form of ADRs, for a total of 44 companies. Of these, a 39 stocks fall outside the range of the top 10 stocks that make up the S&P 500 Index. Refer to Appendix 2.

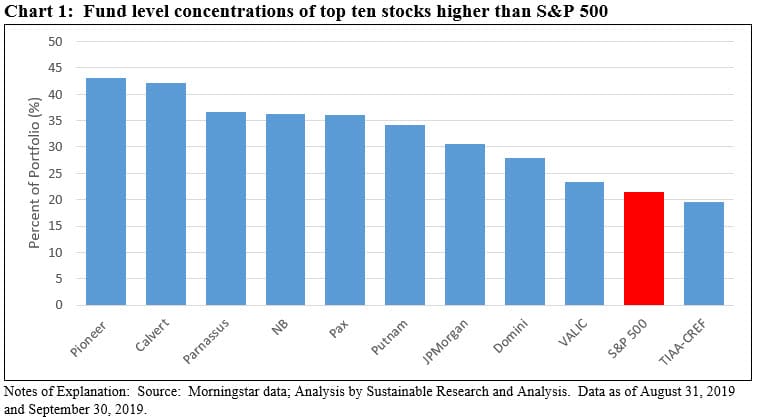

Concentration levels of top ten stocks higher than S&P 500

The top 10 sustainable investing funds are more concentrated in the top 10 stocks, on average, versus the S&P 500 Index. The average concentration of the top 10 stocks, which make up 21.5% of the S&P 500 Index, account for an average of 32.9% of the 10 sustainable equity funds, or 11.5% higher. Concentration levels range from 19.6% to a high of 43.1%. See Chart 1.

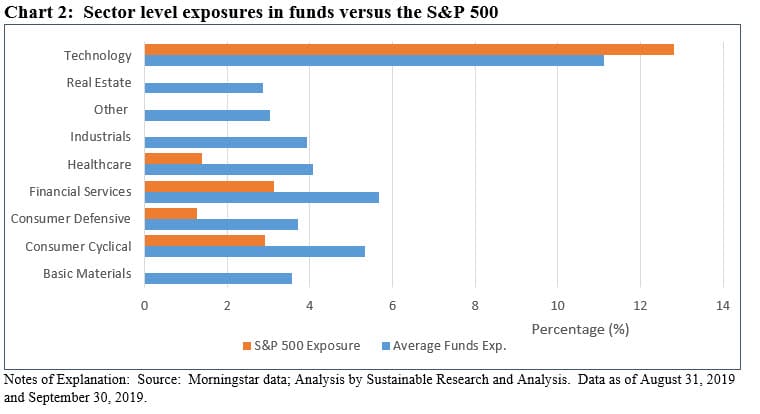

Sector exposures are also higher, but outside S&P 500 sectors

The top 10 sustainable investing funds with regard to the top 10 stocks also reflect greater variation in sector exposures, on average, versus the S&P 500 Index. The greatest sector exposure by both the top 10 funds and the S&P 500 is to the technology sector but at the same time the variation is the narrowest at 1.7%. That said, Parnassus Core Equity Fund maintains an underweight position of 6.1%. Otherwise, the widest variations, on average, can be observed in sector exposures that are absent in the top 10 holdings of the S&P 500. These include the Basic Materials sector, Industrials sector as well as three companies that are unclassified as to sector, including Verizon, AT&T and Comcast. See Chart 2.

Top 10 sustainable large cap equity funds all invest in Microsoft but don’t invest in Berkshire Hathaway, Facebook and Johnson and Johnson companies–members of the S&P 500

Only one company, Microsoft Corp. is held by all ten funds. The average exposure to Microsoft is 5.13% versus 4.29% for the S&P 500. Investments range from a low of 3.36% held by Neuberger Berman Sustainable Equity Fund to a high of 6.77% held by Putnam Sustainable Leaders Fund.

The next most widely held stock is Alphabet Inc. including both A and Class C shares, followed by Apple Inc. Amazon.com and Visa Inc.

Three companies that fall within the S&P 500 top 10 holdings are entirely absent from the portfolios maintained by the top 10 funds. Sustainability factors alone might not have led to the omission of these companies as each of the firms might have been avoided due to ESG factors that, in the view of fund managers, might have had a material impact on the value of the companies and the decisions to sidestep these investments could have been based on a view regarding their value, risk and return potential. Still, each of these companies have some exposure to ESG issues in particular.

Johnson & Johnson

The company is embroiled in two major controversies. The first involves accusations and lawsuits alleging that its talc products contain asbestos, which caused many women to develop ovarian cancer. The other pertains to accusations that the company, along with other firms, responsible for fueling the state’s opioid epidemic.

Facebook

Concerns about Facebook are not new, as social factors regarding the adequacy of controls, protecting privacy and data security have been known for some time. This is also the case for the company’s governance structure, since Mark Zuckerberg, the firm’s founder, also acts as Chairman and CEO and given the company’s dual class structure, through his control of the company’s Class B common stock is able to exercise voting rights with respect to a majority of the voting power of the firm’s outstanding stock and therefore has the ability to control the outcome of matters submitted to our stockholders for approval, including the election of directors and any merger, consolidation, or sale of all or substantially all of our assets.

Berkshire Hathaway Inc.

Berkshire Hathaway has been cited of its average to below average management and governance structure, and poor disclosure on its governance, environment and social policies. Recently, its low score under the United Nations Global Compact (UNGC) rankings excluded the company’s eligibility as a member in the newly launched S&P 500 ESG Index. The UNGC scores companies on the basis of the Ten Principles of the UNGC which are, in turn, derived from the Universal Declaration of Human Rights, the International Labour Organization’s Declaration on Fundamental Principles and Rights at Work, the Rio Declaration on Environment and Development, and the United Nations Convention Against Corruption.

[1] Includes all share classes, as of December 31, 2018