Sustainable index funds at $35.1 billion represent just 3.1% of sustainable long-term fund assets versus 36.2% for conventional mutual funds and ETFs

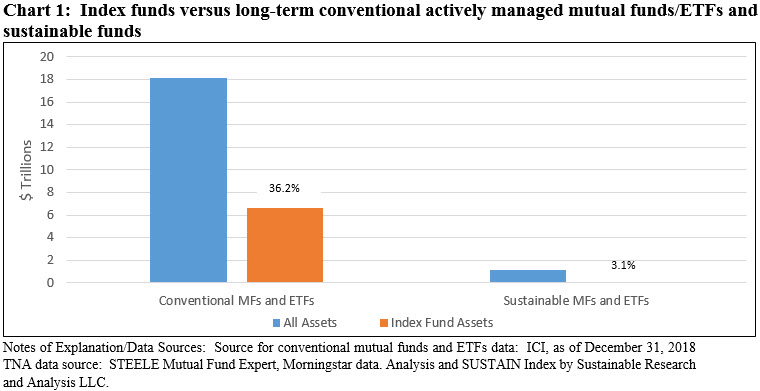

Sustainable index funds[1], including mutual funds and exchange-traded funds (ETFs) have achieved limited traction so far and stand in contrast to the popularity of index funds across the investment company landscape. At the end of 2018 index tracking mutual funds and ETFs held some $6.6 trillion in assets and accounted for 36.2% of long-term assets under management[2]. In contrast, sustainable index mutual funds and ETFs, using more current data as of October 31, 2019 even as they expanded by 71.5% in 2019, still have garnered just $35.1 billion in net assets[3]. These funds represent a significantly smaller 3.1% of long-term sustainable fund assets under management that reached $1.4 trillion at the end of October and $1.1 trillion when adjusted for recently added money market funds. That’s around 12X smaller than is the case for traditional funds. Refer to Chart 1. It could be argued that sustainable investments generally and sustainable index funds in particular are still in their formative period of development and that this investment category should be expected to pick up momentum over time. But the divergence, even during these early days, is pronounced and the slower pick up to-date may, upon reflection, may be attributed to at least three other factors. First, the growth in the sustainable funds segment has not been organic but rather growth has been fueled recently almost entirely by the re-branding of actively managed funds. As a result, this may be skewing, for the time being, the relationship between active and passive funds. Second, the names adopted by index funds and the construct of their underlying indices used in the creation of diversified sustainable equity and bond index funds in particular may be confusing to investors. This might be making it difficult for investors to understand and connect index funds to their own sustainable investing interests, goals and objectives. Third, investors, especially retail investors, may be further dissuaded from investing in these investment vehicles because of limited disclosures around investment process coupled with investment decisions and their impact on financial performance results as well as impacts or outcomes, if any, that might be achieved by investing in these investment funds. Indeed, this may actually have a compounding effect. In the absence of more effective ways of describing index funds that pursue a sustainable investing strategy, better explanations as well as disclosures, sustainable index funds may remain range bound for the time being.

Sustainable index funds: 112 funds with $35.1 billion in net assets

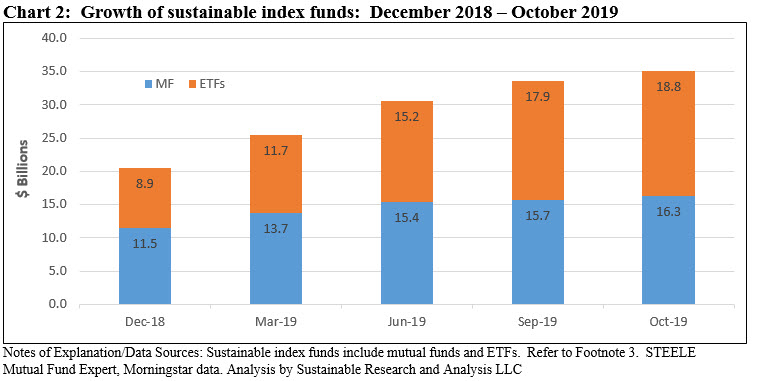

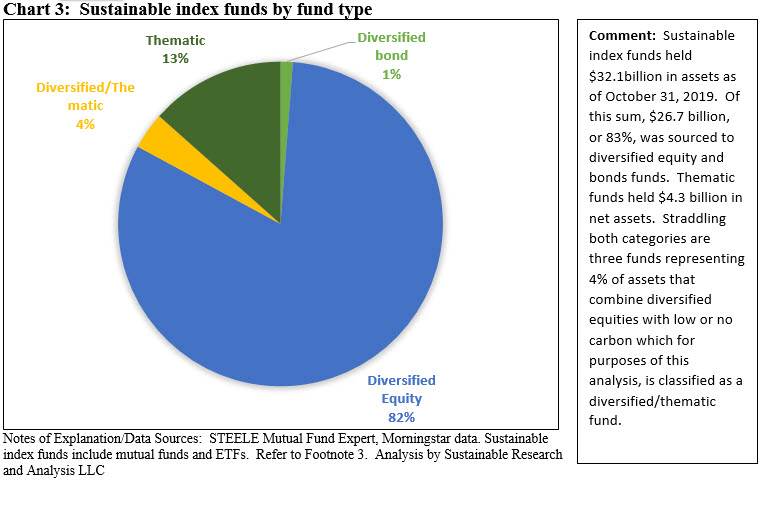

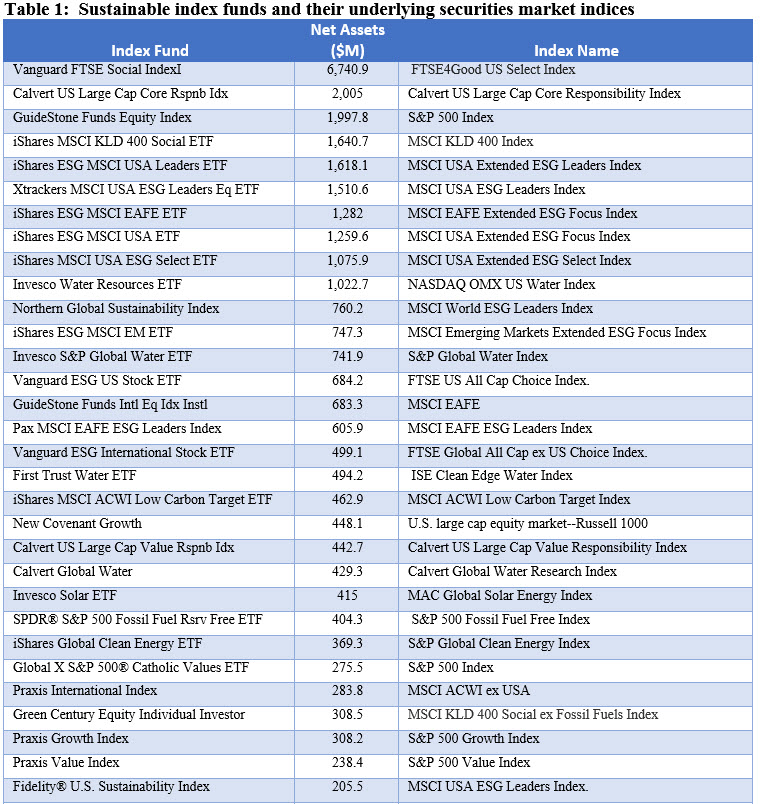

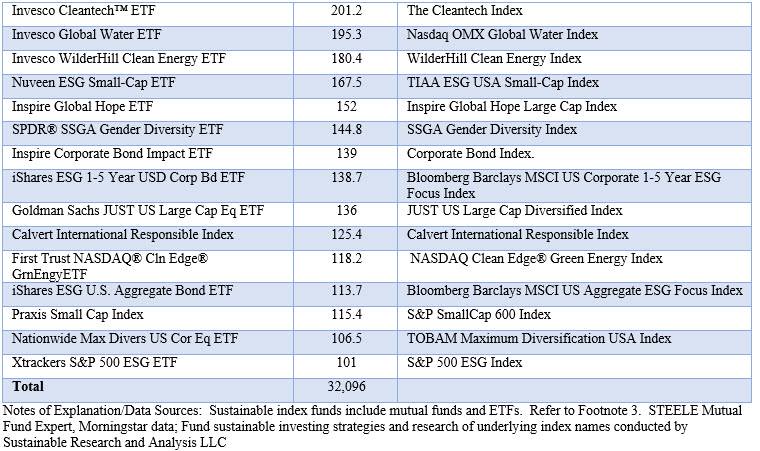

As noted, the universe of sustainable index funds has been expanding, with the addition of $14.6 billion in assets under management from $20.5 billion at the end of 2018. Refer to Chart 2. The universe of sustainable index funds is comprised of 25 mutual funds/50 share classes in total, representing $16.3 billion in net assets, and 87 exchange traded funds with $18.8 billion in net assets[4], for a combined total of 112 separate investment funds managing $35.1 billion. These funds are offered by 39 separate organizations and they range in size from the smallest, the Impact Shares Sustainable Development Goals Global Equity ETF with $1.1 million in net assets, to the largest and oldest index fund, the $6.7 billion Vanguard FTSE Social Index Fund. That said, the assets of these index funds are dominated by the largest investment funds. Funds with over $100 million in net assets, of which there are 46 with $32.1 billion, dominate the segment. These funds account for 90.4% of the segment’s assets. Refer to Table 1. Within this segment, diversified equity and bond funds and their corresponding indices dominate, accounting for 84% while thematic funds make up 13% of the total. Also, four index providers stand out, with MSCI, FTSE, Calvert and S&P, leading the field of index providers.

Fund re-brandings skew the sustainable investing funds landscape for now

Since the start of the year when sustainable investment funds stood at $390.4 billion, 332 funds (1,692 share classes) with a combined total of $932.4 billion in assets have been re-branded by formally amending fund prospectuses. With some minor exceptions involving ETFs, rebranded funds have consisted almost entirely of actively managed mutual funds. This is contributing to a skewing of the sustainable investment landscape in the near-term, at least, in a way that favors actively managed funds. That said, this will likely change over time as sustainable index funds evolve and actively managed diversified sustainable funds build their performance track record that is expected to align with returns that are comparable to traditional funds.

Diversified US and foreign equity as well as diversified bond index funds may be confusing investors

By virtue of their naming conventions, thematic funds, or funds that focus on a particular idea or unifying concept, for example funds that invest in solar energy, wind energy, clean energy, clean tech and even gender diversity, to mention just a few of the leading sustainable investing fund themes, more readily convey to investors not only the targeted investment universe but a level of expectation that can more easily be associated or aligned with an investor’s area of sustainable interest. This is generally not the case with diversified US, foreign equity as well as bond index funds, a segment that makes up 84% of the largest index funds by assets. Refer to Chart 3. While the largest diversified equity fund, the Vanguard FTSE Social Index fund, may be an exception, in part, by virtue of the reference to “social” in is name, most of other named funds offer an alphabet soup of terms that are difficult to unpack, including the meaning of ESG. At the same time, some of the indices vary only slightly from one another and the distinctions between one index and another are subtle and challenging to decipher. These factors may limit the ability of investors to align the name of a fund with their individual sustainable investing preferences. It’s true that investors and/or their financial intermediaries should conduct independent due diligence that generally starts with a review fund’s prospectus, Statement of Additional Information, periodic reports and other collateral materials. Yet even when consulting fund literature, beyond strict exclusionary practices, it can be challenging to sort out an index fund’s basis for qualifying and selecting eligible securities. While each index typically relies on third party methodologies and scoring, whether provided by MSCI, FTSE, Calvert or S&P, to mention the leading firms, the fundamentals behind their scoring decisions can be trying to decipher. Moreover, it’s also not easy to differentiate between the characteristics of similar indices.

This is illustrated using the iShares ESG MSCI USA Leaders ETF (SUSL) and the iShares MSCI USA ESG Extended ESG Select ETF (SUSA). First, investors are expected to understand the meaning of ESG even in the absence of a universally accepted definition of ESG, its evolving nature and an opinion based on the views of one firm that may not be universally shared. Second, exclusion factors aside, the distinction between these two index funds is somewhat nuanced. In the first instance, the MSCI USA Leaders Index targets companies that have the highest environmental, social and governance (ESG) rating in each sector of the parent MSCI index. On the other hand, the MSCI USA Extended ESG Select Index (which succeed the MSCI USA ESG Select Index after May 2, 2018) is designed to target companies with positive environmental, social and governance (ESG) factors while exhibiting risk and return characteristics similar to those of the MSCI USA Index. The index is constructed through an optimization process that aims to maximize its exposure to ESG factors, subject to tracking error limitations and other constraints. It is sector-controlled, and is designed to over-weight companies with high ESG ratings and under-weight companies with low ratings.

Disclosure practices around security selection and impacts/outcomes are limited

The observations described above are likely exacerbated by the fact that a limited number of index funds offer information in published reports or in supplemental materials that explain the basis for selecting and/or excluding certain securities from the portfolio or the outcomes or impacts that have been achieved by investing in the securities held by the fund. This is not limited to index funds and it must be acknowledged that such disclosures are not mandatory. There are, however, exceptions. For example, Calvert produces reports covering its index funds that describe some of the fund’s engagement outcomes and impact across what it considers important ESG factors, such as fossil fuel reserves, carbon emissions practices, toxic emissions, etc. Moreover, the report identifies specific company names that are excluded from the fund and the key reason for doing so. This when combined with the fund’s performance attribution report are very useful. BlackRock’s iShares now offers useful impact reports that describe the ESG profile of index member companies along with portfolio impacts, covering equity as well as fixed income funds, based on selected metrics, such as carbon footprint, gender diversity and sustainable impact linked to the UN Sustainable Development Goals. Beyond performance, these types of reporting helps investors understand the outcomes that have been achieved with their investment dollars—which is after all the reason for being attracted to these investment vehicles to begin with.

In the absence of more effective ways of describing sustainable index funds, better explanations as well as disclosures, sustainable index funds may remain range bound.

[1] While the definition of sustainable investing continues to evolve, today it refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing, ESG integration and shareholder/bondholder engagement and proxy voting. These are not mutually exclusive.

[2] Source: ICI Handbook 2018

[3] Adjusted for 3 Columbia ETFs with total net assets in the amount of $369 million, including EM Core Ex-China ETF, EM Consumer ETF and India Consumer ETF. The funds’ governing documents do not seem to disclose reliance on a sustainable investing approach.

[4] Refer to footnote 3.

Sustainable Index Funds Lag Behind Conventional Funds

Sustainable index funds at $35.1 billion represent just 3.1% of sustainable long-term fund assets versus 36.2% for conventional mutual funds and ETFs Sustainable index funds[1], including mutual funds and exchange-traded funds (ETFs) have achieved limited traction so far and stand in contrast to the popularity of index funds across the investment company landscape. At the…

Share This Article:

Sustainable index funds at $35.1 billion represent just 3.1% of sustainable long-term fund assets versus 36.2% for conventional mutual funds and ETFs

Sustainable index funds[1], including mutual funds and exchange-traded funds (ETFs) have achieved limited traction so far and stand in contrast to the popularity of index funds across the investment company landscape. At the end of 2018 index tracking mutual funds and ETFs held some $6.6 trillion in assets and accounted for 36.2% of long-term assets under management[2]. In contrast, sustainable index mutual funds and ETFs, using more current data as of October 31, 2019 even as they expanded by 71.5% in 2019, still have garnered just $35.1 billion in net assets[3]. These funds represent a significantly smaller 3.1% of long-term sustainable fund assets under management that reached $1.4 trillion at the end of October and $1.1 trillion when adjusted for recently added money market funds. That’s around 12X smaller than is the case for traditional funds. Refer to Chart 1. It could be argued that sustainable investments generally and sustainable index funds in particular are still in their formative period of development and that this investment category should be expected to pick up momentum over time. But the divergence, even during these early days, is pronounced and the slower pick up to-date may, upon reflection, may be attributed to at least three other factors. First, the growth in the sustainable funds segment has not been organic but rather growth has been fueled recently almost entirely by the re-branding of actively managed funds. As a result, this may be skewing, for the time being, the relationship between active and passive funds. Second, the names adopted by index funds and the construct of their underlying indices used in the creation of diversified sustainable equity and bond index funds in particular may be confusing to investors. This might be making it difficult for investors to understand and connect index funds to their own sustainable investing interests, goals and objectives. Third, investors, especially retail investors, may be further dissuaded from investing in these investment vehicles because of limited disclosures around investment process coupled with investment decisions and their impact on financial performance results as well as impacts or outcomes, if any, that might be achieved by investing in these investment funds. Indeed, this may actually have a compounding effect. In the absence of more effective ways of describing index funds that pursue a sustainable investing strategy, better explanations as well as disclosures, sustainable index funds may remain range bound for the time being.

Sustainable index funds: 112 funds with $35.1 billion in net assets

As noted, the universe of sustainable index funds has been expanding, with the addition of $14.6 billion in assets under management from $20.5 billion at the end of 2018. Refer to Chart 2. The universe of sustainable index funds is comprised of 25 mutual funds/50 share classes in total, representing $16.3 billion in net assets, and 87 exchange traded funds with $18.8 billion in net assets[4], for a combined total of 112 separate investment funds managing $35.1 billion. These funds are offered by 39 separate organizations and they range in size from the smallest, the Impact Shares Sustainable Development Goals Global Equity ETF with $1.1 million in net assets, to the largest and oldest index fund, the $6.7 billion Vanguard FTSE Social Index Fund. That said, the assets of these index funds are dominated by the largest investment funds. Funds with over $100 million in net assets, of which there are 46 with $32.1 billion, dominate the segment. These funds account for 90.4% of the segment’s assets. Refer to Table 1. Within this segment, diversified equity and bond funds and their corresponding indices dominate, accounting for 84% while thematic funds make up 13% of the total. Also, four index providers stand out, with MSCI, FTSE, Calvert and S&P, leading the field of index providers.

Fund re-brandings skew the sustainable investing funds landscape for now

Since the start of the year when sustainable investment funds stood at $390.4 billion, 332 funds (1,692 share classes) with a combined total of $932.4 billion in assets have been re-branded by formally amending fund prospectuses. With some minor exceptions involving ETFs, rebranded funds have consisted almost entirely of actively managed mutual funds. This is contributing to a skewing of the sustainable investment landscape in the near-term, at least, in a way that favors actively managed funds. That said, this will likely change over time as sustainable index funds evolve and actively managed diversified sustainable funds build their performance track record that is expected to align with returns that are comparable to traditional funds.

Diversified US and foreign equity as well as diversified bond index funds may be confusing investors

By virtue of their naming conventions, thematic funds, or funds that focus on a particular idea or unifying concept, for example funds that invest in solar energy, wind energy, clean energy, clean tech and even gender diversity, to mention just a few of the leading sustainable investing fund themes, more readily convey to investors not only the targeted investment universe but a level of expectation that can more easily be associated or aligned with an investor’s area of sustainable interest. This is generally not the case with diversified US, foreign equity as well as bond index funds, a segment that makes up 84% of the largest index funds by assets. Refer to Chart 3. While the largest diversified equity fund, the Vanguard FTSE Social Index fund, may be an exception, in part, by virtue of the reference to “social” in is name, most of other named funds offer an alphabet soup of terms that are difficult to unpack, including the meaning of ESG. At the same time, some of the indices vary only slightly from one another and the distinctions between one index and another are subtle and challenging to decipher. These factors may limit the ability of investors to align the name of a fund with their individual sustainable investing preferences. It’s true that investors and/or their financial intermediaries should conduct independent due diligence that generally starts with a review fund’s prospectus, Statement of Additional Information, periodic reports and other collateral materials. Yet even when consulting fund literature, beyond strict exclusionary practices, it can be challenging to sort out an index fund’s basis for qualifying and selecting eligible securities. While each index typically relies on third party methodologies and scoring, whether provided by MSCI, FTSE, Calvert or S&P, to mention the leading firms, the fundamentals behind their scoring decisions can be trying to decipher. Moreover, it’s also not easy to differentiate between the characteristics of similar indices.

This is illustrated using the iShares ESG MSCI USA Leaders ETF (SUSL) and the iShares MSCI USA ESG Extended ESG Select ETF (SUSA). First, investors are expected to understand the meaning of ESG even in the absence of a universally accepted definition of ESG, its evolving nature and an opinion based on the views of one firm that may not be universally shared. Second, exclusion factors aside, the distinction between these two index funds is somewhat nuanced. In the first instance, the MSCI USA Leaders Index targets companies that have the highest environmental, social and governance (ESG) rating in each sector of the parent MSCI index. On the other hand, the MSCI USA Extended ESG Select Index (which succeed the MSCI USA ESG Select Index after May 2, 2018) is designed to target companies with positive environmental, social and governance (ESG) factors while exhibiting risk and return characteristics similar to those of the MSCI USA Index. The index is constructed through an optimization process that aims to maximize its exposure to ESG factors, subject to tracking error limitations and other constraints. It is sector-controlled, and is designed to over-weight companies with high ESG ratings and under-weight companies with low ratings.

Disclosure practices around security selection and impacts/outcomes are limited

The observations described above are likely exacerbated by the fact that a limited number of index funds offer information in published reports or in supplemental materials that explain the basis for selecting and/or excluding certain securities from the portfolio or the outcomes or impacts that have been achieved by investing in the securities held by the fund. This is not limited to index funds and it must be acknowledged that such disclosures are not mandatory. There are, however, exceptions. For example, Calvert produces reports covering its index funds that describe some of the fund’s engagement outcomes and impact across what it considers important ESG factors, such as fossil fuel reserves, carbon emissions practices, toxic emissions, etc. Moreover, the report identifies specific company names that are excluded from the fund and the key reason for doing so. This when combined with the fund’s performance attribution report are very useful. BlackRock’s iShares now offers useful impact reports that describe the ESG profile of index member companies along with portfolio impacts, covering equity as well as fixed income funds, based on selected metrics, such as carbon footprint, gender diversity and sustainable impact linked to the UN Sustainable Development Goals. Beyond performance, these types of reporting helps investors understand the outcomes that have been achieved with their investment dollars—which is after all the reason for being attracted to these investment vehicles to begin with.

In the absence of more effective ways of describing sustainable index funds, better explanations as well as disclosures, sustainable index funds may remain range bound.

[1] While the definition of sustainable investing continues to evolve, today it refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing, ESG integration and shareholder/bondholder engagement and proxy voting. These are not mutually exclusive.

[2] Source: ICI Handbook 2018

[3] Adjusted for 3 Columbia ETFs with total net assets in the amount of $369 million, including EM Core Ex-China ETF, EM Consumer ETF and India Consumer ETF. The funds’ governing documents do not seem to disclose reliance on a sustainable investing approach.

[4] Refer to footnote 3.

Premium Articles Access Priority Support 1 Fixed Price

Access to All Data No Credit Card Required Cancel Any Time

Access to Premium Articles Priority Support Save 25%

$99

PER YEAR

Access to exclusive content

Premium Articles

Access 1 Fixed Price

Free Trial

30-Day

Access to exclusive content

Access to All Data No Credit card Required Cancel Any Time

$9.99

MONTHLY

Access to premium content

Access to premium Articles Save 25%

Sustainable Funds Monitor

Funds Glossary

Quarterly On-Line Briefings

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact