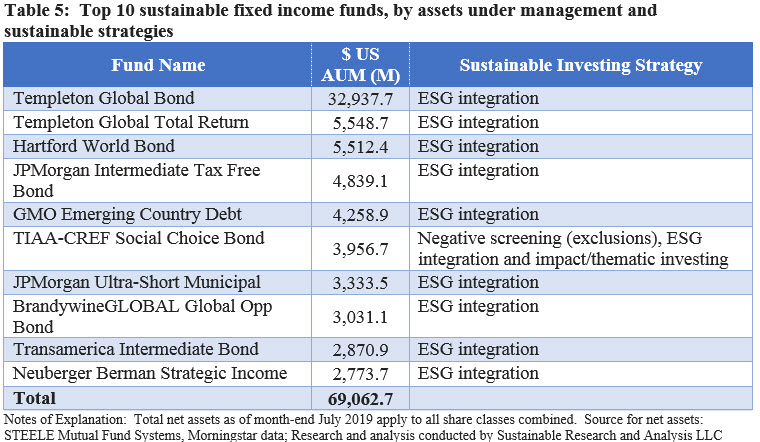

Assets attributable to sustainable funds add another $18.4 billion end July at another new high level of $781.1 billion in assets under management

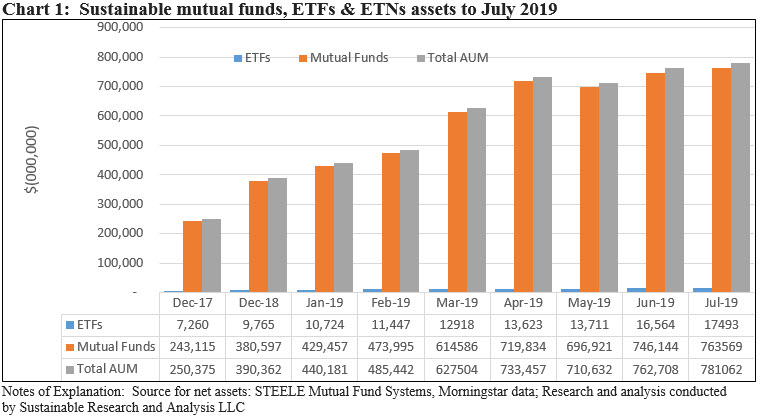

Adding to June’s $52.08 billion in assets under management, sustainable funds, including mutual funds, ETFs and ETNs, registered a net increase of $18.4 billion in assets under management, or 2.4%. The increase benefited from positive net cash inflows in the amount of $4.81 billion which offset last month’s net outflow in an equivalent amount. Market movement contributed modestly to July’s gains, adding an estimated $1.99 billion as markets globally took a breather after last month’s strong market gains. Still, the combined increase of $6.8 billion due to market movement and net cash inflows was eclipsed again by the $11.56 billion added by re-branded funds. Refer to Chart 1.

Year-to-date, $387.9 billion in assets have been added to sustainable mutual funds and ETFs. Of this sum, $306.04 billion, or 78.9%, is attributable to re-branded funds while and estimated $9.99 billion, or 2.6%, is sourced to net inflows and $71.9 billion, or 18.5% is sourced to positive market movement. Refer to Chart 2.

Sustainable mutual funds versus ETFs: Mutual funds account for about 97.76% of assets

Mutual funds ended the month of July with $763.6 billion, or 97.76% of assets under management—unchanged relative to June. Sustainable ETFs gained $929 billion and inched up to $17.5 billion, or 2.24% of sustainable assets, up from $16.6 billion the prior month.

Fixed income assets ended the month of July with $131.9 billion in assets, or 16.9% versus equity and all other funds that closed June with $649.1 billion, or 3.1% of sustainable assets under management. Fixed income funds added $10.2 billion in July versus $8.2 billion sourced to equity and all other funds.

Institutional investors: No change in percentage of assets sourced to institutional investors that account for at least 45.2% of sustainable assets

Sustainable assets under management sourced to institutional investors expanded to a minimum of $344.7 billion, up from $337.5 billion the previous month. This segment makes up at least 45.2% of assets—the same level as in July. This is up from $93.0 billion, or 33.9% twelve months earlier, with the increase due largely to the re-brandings of funds catering to institutional investors.

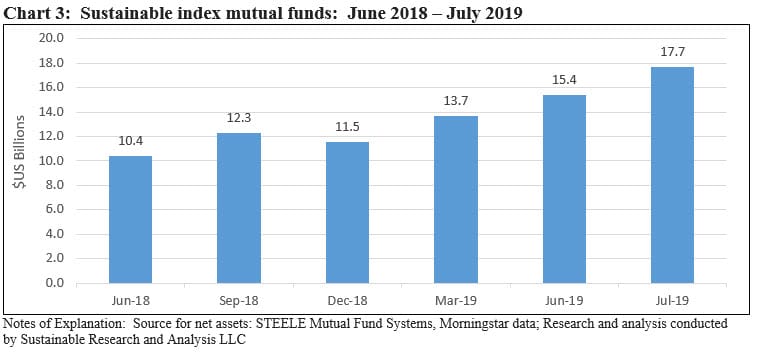

Sustainable Index funds gained $1.7 billion in July

Sustainable index mutual funds added $1.7 billion in net assets across 51 funds/share classes as of July 2019 to reach $1.7 billion.

One fund, the Vanguard FTSE Social Index Admiral Shares, gained $1.5 billion in assets and accounted for 90.2% of the category’s increase for the month. This fund was followed by Calvert US Large Cap Core Responsible Index that added $50.7 million and the Bridgeway Blue Chip Index Fund which recorded a gain of $17.5 million. This fund, which excludes tobacco companies, announced that it will cease to operate as an index fund effective July 31 when its name will change to the Bridgeway Blue Chip Fund. Refer to Chart 3.

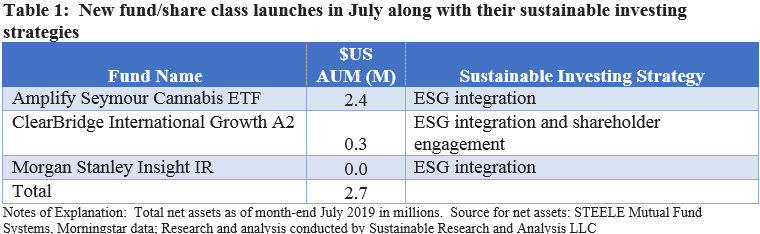

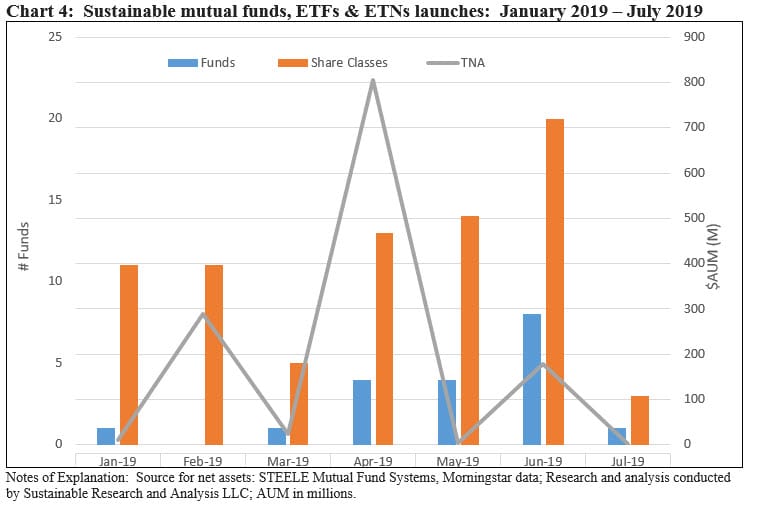

New Funds: One new ETF launched in July along with two new mutual fund share classes

One new ETF and two additional share classes were introduced in July as the number of new fund launches dropped from eight last month to 1 fund. Refer to Table 1. The new fund, the Amplify Seymour Cannabis ETF managed by Amplify Investments and sub-advised by Panserra Capital Management, was seeded with about $2.4 million. This actively managed ETF considers environmental, social, and governance scoring in the fund’s bottom-up factors considered in investment decisions. That said, further details regarding the ESG considerations are not provided. Refer to Table 1.

July’s one new fund formation falls below the average for the year-to-date interval. So far this year, an average of 2.7 new funds have been introduced per month and 11 new share classes on average per month. New funds range from a high of eight funds launched in June to 0 funds introduced in February of the year. $1.3 billion in additional assets has been added due to new fund and share class introductions. Refer to Chart 4.

Fund Closings: Four mutual funds offered by two firms shut down

Three sustainable funds managed by BNP Paribas and one fund managed by Pax World closed their doors in July. The boards of both firms approved plans of liquidation. The Pax Mid Cap Fund with two share classes and $89 million in net assets, of which $88.5 was sourced to one or more institutional investors, shuttered effective on or about July 15. The BNP Paribas AM Emerging Markets Total Return Fixed Income Fund, US Small Cap Equity Fund and Emerging Markets Equity Fund, with combined assets of $68.6 million, closed their doors on or about July 10. The funds comprised of nine share classes, have been in operation for short time intervals, having been launched in 2017 and 2018.

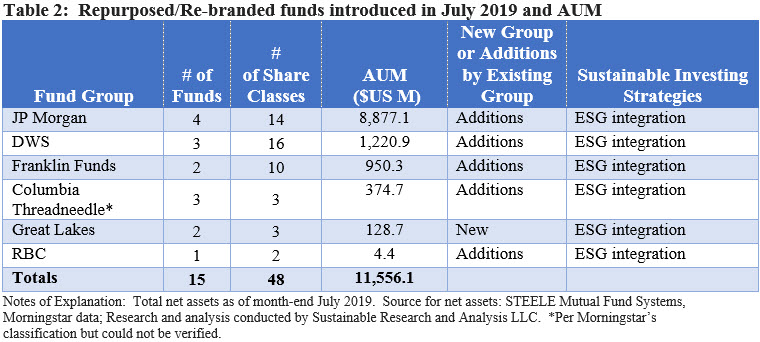

Repurposed or re-branded funds: Six firms, 15 funds, 48 share classes and $11.6 billion in assets

Six fund firms repurposed or re-branded existing funds in July, bringing along $11.6 billion in net assets. These included only one first time firm, Great Lakes Advisors, LLC that shifted just two funds with $128.7 million.

The five firms added to their roster of sustainable investing funds, including JPMorgan, DWS, Franklin, Columbia and RBC. In an unusual development, at least to-date, Columbia re-branded three exchange-traded funds (ETFs). Refer to Table 2.

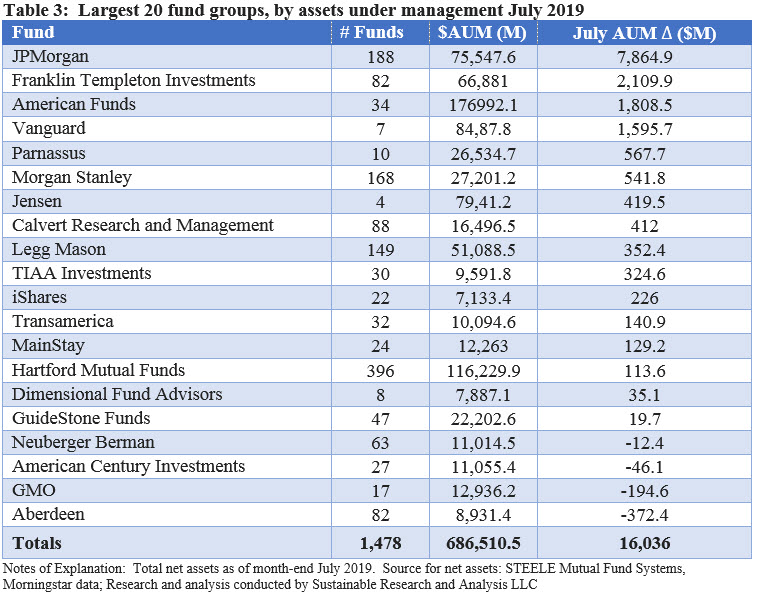

Largest Fund Groups: Top 20 sustainable fund groups = $686.5 billion and account for 87.9% of net assets

A total of 146 fund groups offered sustainable mutual funds and ETFs at July 2019, a gain of one fund group versus the prior month. Of these, the largest 20 fund groups account for $686.5 billion or 87.9% of net assets. Refer to Table 3.

There was no change this month in the positioning of the top 10 ranked firms. At the same time, TIAA-CREF, with the addition of $325 million in net assets, displaced Aberdeen which lost $372 million in net assets, and is now ranked 15th. Vanguard also improved its positioning among the top 20 firms, displacing Jenson and Dimensional Fund Advisors with the addition of $1.6 billion in sustainable net assets.

The top 20 firms added $16.0 billion in net assets, accounting for 88% of the net gain realized by the entire sustainable segment in the amount of $18.4 billion. The top gainers were bolstered by fund re-brandings and only four firms suffered drawdowns.

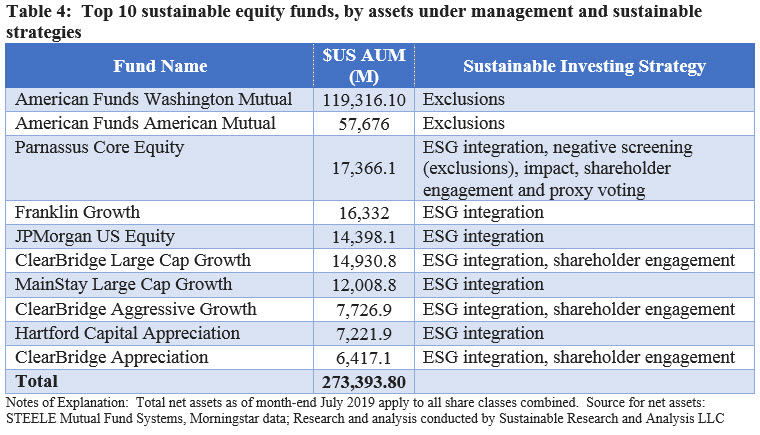

Largest Sustainable Equity Funds: ESG integration practiced by eight of the top 10 sustainable equity funds

The top 10 sustainable equity funds manage $273.4 billion in net assets and account for 35% of the segment’s total assets. As of the end of July, ClearBridge Appreciation, which integrates ESG and engages with portfolio companies, supplanted JPMorgan US Research Enhanced Equity.

The top two funds, both managed by American Funds with a combined total of $177 billion in net assets, restrict themselves to excluding companies that derive the majority of their revenues from alcohol or tobacco products. Otherwise, the remaining eight funds approach sustainable investing by formally integrating ESG; and in the case of four of these funds, sustainable investing extents to include shareholder engagement. One fund, Parnassus Core Equity employs a broader array of sustainable strategies. Refer to Table 4.

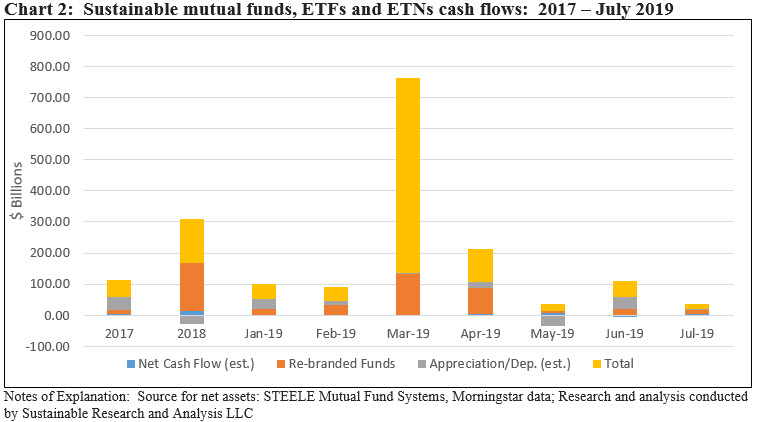

Largest Bond Funds: Top 10 sustainable bond funds account for $66.4 billion in assets or about 8.9% of the entire sustainable segment’s assets

Eclipsed by their equity fund counterparts, the largest 10 sustainable bond funds account for $69.1 billion in net assets and account for 8.8% of the segment’s assets under management. As of the end of July, two new funds made their appearance on the list, both managed by JPMorgan. The two funds, including the JP Morgan Intermediate Tax Free Bond Fund and Ultra-Short Municipal Fund and JPMorgan. Both funds were re-branded in July by formally adopting ESG integration language in their prospectuses. These funds displaced Transamerica Short-Term Bond Fund and American Century NT Diversified Bond.

All ten funds approach sustainable investing by formally integrating ESG. One fund, the TIAA-CREF Social Choice Bond Fund, employs a broader array of sustainable strategies. Refer to Table 5.