Municipal bond funds that have adopted sustainable investing strategies grew significantly since the start of 2019

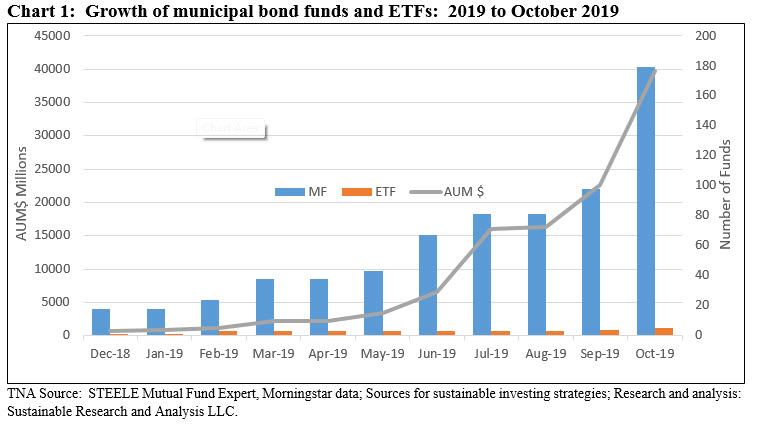

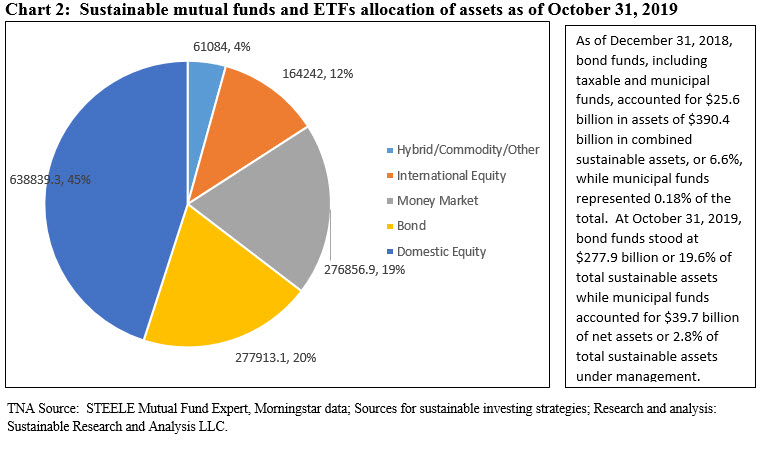

The volume of fund re-brandings during 2019 and, in particular, in the month of October, has brought about a transformation in the profile of assets attributable to sustainable funds(1), including mutual funds and ETFs. This has been especially notable in terms of money market funds and bond funds, including municipal bond funds. In fact, sustainable fund assets invested in the municipal sector reached $39.7 billion at the end of October, up from just $711.8 million at the end of 2018, for a 56X increase in just a short ten month interval. See Charts 1 and 2. 15 firms now offer a combined total of 51 funds consisting of both mutual funds and ETFs that cover varying segments of the municipal market. These funds now comprise 2.8% of the $1.4 trillion in sustainable assets at the end of October. Also, while these funds have adopted a variety of sustainable investing strategies, the approach that dominates is ESG integration pursuant to which relevant and material environmental, social and governance factors are factored into investment decision making. That said, four firms equivocate on their approach to ESG integration. It’s likely entirely coincidental, but this uptick correlates with the recognition that US local governments are exposed to more frequent and severe extreme climate events such as heatwaves, droughts and wildfires which vary widely by state. Even though these are not necessarily showing up in muni bond pricing as yet, climate risks, in particular, are more often now cited in documents that accompany the issuance of municipal bonds. According to an article in the November 11th issue of Bloomberg Businessweek, investment banks have begun to quietly sound alarm bells about climate change and their worries are showing up in documents that accompany the municipal bonds they underwrite even as such disclosures are still insufficient.

Municipal funds: 15 firms, 51 funds and $39.7 billion in assets under management

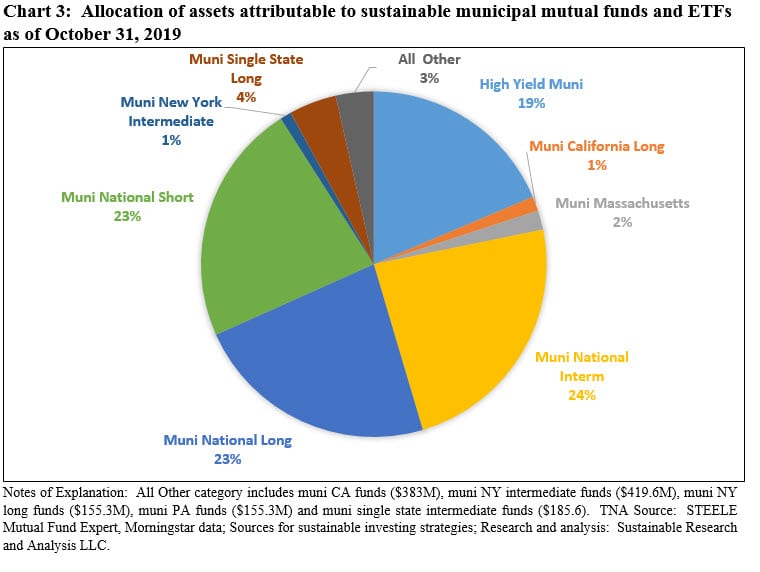

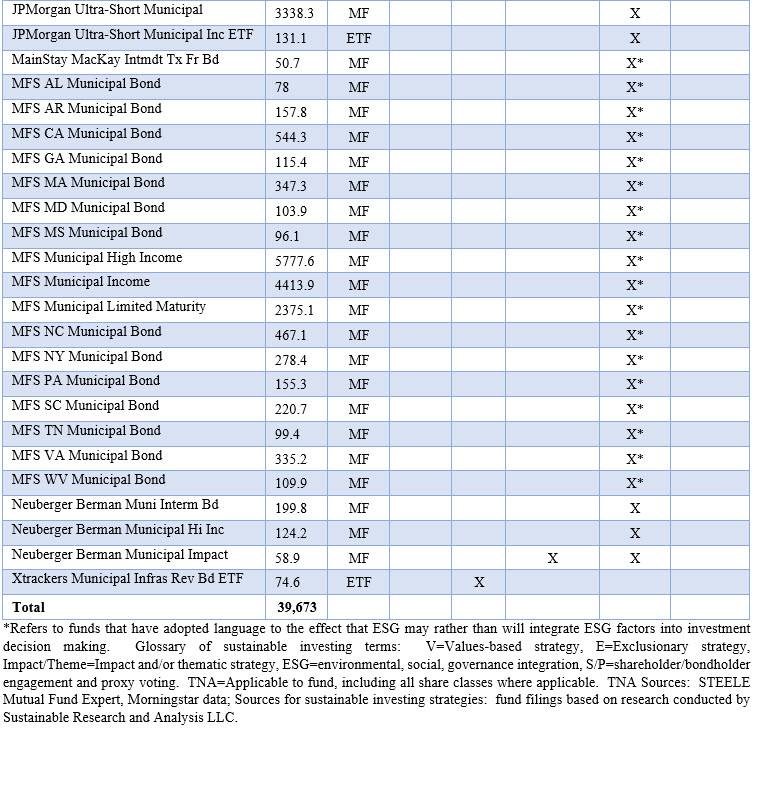

Municipal funds that pursue a sustainable investing approach are now offered by 15 firms, with two of these firms in particular contributing to the expansion of the municipal bond sphere by re-branding existing funds. In October, MFS re-branded 16 municipal bond funds offered via 70 share classes with combined assets of $11.3 billion. In June of this year alone, J.P. Morgan re-branded 4 municipal bond funds with $8.9 billion in total net assets. Together, these firms offer 51 separate funds/179 share classes, including five ETFs, that range from broad-based investment-grade funds across varying maturities to state specific funds as well as high yield funds linked to a variety of tax profiles. Over 50% of the municipal fund assets are concentrated in three categories of short, intermediate and long-term municipal funds that have sourced $27.7 billion in net assets and account for 69.9% of the total. A fourth category consists of high yield municipal funds with $7.5 billion in net assets and account for almost 19% of the segment’s total assets. Refer to Chart 3.

Sustainable investing strategies: ESG integration dominates while four firms also focus on impact

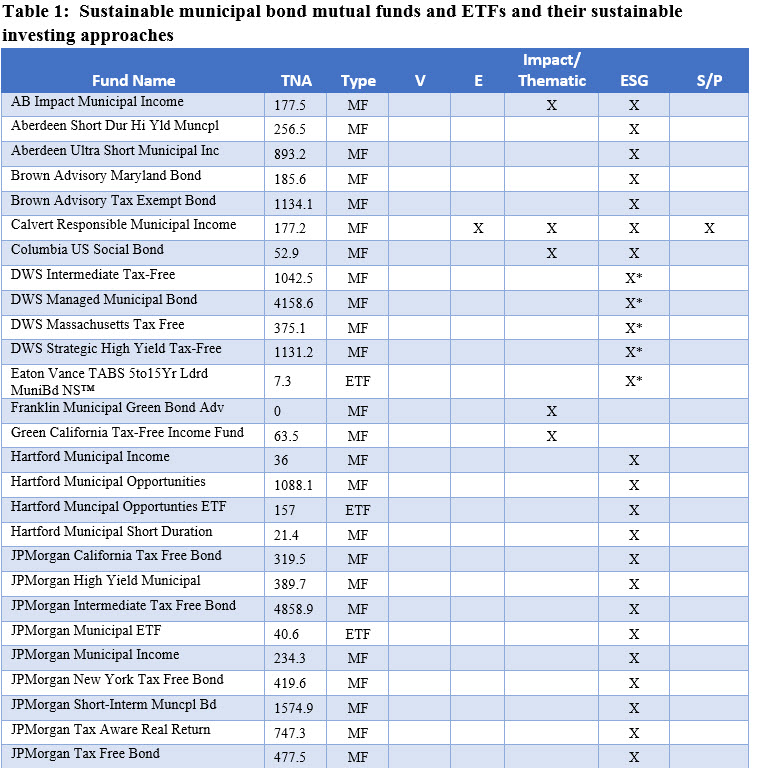

The most dominant strategy across five categories of sustainable investing approaches is the integration of ESG factors into investment decision making. Forty-eight funds have adopted this approach either exclusively or in combination with other sustainable strategies. Of these, forty-four funds employ an ESG integration approach exclusively. A potentially worrisome development is that within this segment four firms offering 23 funds have formally declared, by means of prospectus language, that they may reflect ESG considerations in their investment evaluations. This type of equivocation may be perceived as “green washing.” Also within this segment, four funds employ ESG integration along with one or more additional strategies. These funds focus on the achievement of impact, but in the case of the Calvert Responsible Municipal Income Fund, negative screening (exclusions) and company engagement also form part of the fund’s approach to sustainable investing. While levels of detail vary, two of these funds provide annual impact reports. These include the Columbia US Social Bond Fund and the Neuberger Berman Municipal Impact Fund. Finally, two funds pursue a green thematic approach, including a newly launched municipal green bond fund now offered by Franklin Templeton, while only a single fund relies entirely on exclusions. Refer to Table 1.

(1) While the definition of sustainable investing continues to evolve, today it refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing, ESG integration and shareholder/bondholder engagement and proxy voting. These are not mutually exclusive.