Major Asset Classes End the Month of July Higher; U.S. Dollar Decline is the Exception

Except for the U.S. dollar that declined 2.9% in the month of July, major asset classes ended the month higher. The S&P 500 Index, which registered its second best monthly performance so far this year, gained 2.1% in July on a total return basis and pushed year-to-date results to 11.6%. It has already exceeded last year’s 9.3% and is within 36 bps of equaling the total return achieved in 2015. Expansion in the manufacturing sector, a strong labor market and low inflation with the headline CPI at 1.6%, coming in below the Federal Reserve’s 2% target, were likely contributing factors along with strong reported corporate earnings.

According to data from Thomson Reuters, based on reporting from almost 60% of the firms in the index through the end of July, earnings linked to S&P 500 companies are expected to rise 11% in the second quarter. This follows a 15% increase in the first quarter of the year. Should the reporting trend hold, S&P 500 member companies will post two consecutive quarters of double-digit profit growth for the first time since 2011. This is occurring even as initiatives intended to boost corporate bottom lines, namely corporate tax cuts and infrastructure spending, have been derailed so far. This has likely been fueling the rally in stocks which led to a Dow Jones Industrial Average record close of 21,891.12 on the last day of the month and a July gain of 2.5% achieved with low day-to-day volatility.

Rising stock prices, however, did not extent to tobacco stocks. The Food and Drug Administration announced at the end of the month that it wants tobacco companies to make all cigarettes with such low levels of nicotine that they would no longer be addictive. This pushed dramatically lower the share prices of otherwise profitable regular divided paying tobacco company stocks like Altria Group, maker of Marlboro, British American Tobacco PLC, maker of Camel, and Imperial Brands PLC, which sells Winston and Kool brands. The good news is that this likely had a positive impact on funds with a sustainable orientation and ETFs as these typically exclude tobacco stocks from their portfolios.

While not yet as strong overall as the U.S. economy, the Eurozone picked up its pace in the second quarter. Gross domestic product in the 19-country euro currency zone grew by 0.6% in the 3-months to June, an annualized rate of 2.3% and a slight improvement from the 0.5% expansion in the first quarter. Over the past 18 months the region has grown a little faster than the U.S. Against this backdrop, the MSCI EAFE Index, representing developed economies, gained 2.9%, for a year-to-date increase of 17.9% while its emerging markets counterpart, the MSCI Emerging Markets Index, was the best performing equity index globally, adding 6.0% in July and 25.5% year-to-date. Only crude oil ended the month higher, adding 9.1% (West Texas Intermediate spot price).

Turning to fixed income, government bonds traded in a narrow range in July with investors likely concluding that global central bankers will not rush to raise interest rates given soft inflation data. The yield on the 10-year U.S. Treasury note ended the month slightly lower at 2.292% versus 2.298% at the end of June while the Bloomberg Barclays U.S. Aggregate Bond Index edged up 0.4% and foreign investment grade corporate bonds added 4.1%. At this point, economists expect the Federal Reserve to tighten policy, starting the process of shrinking its balance sheet at its September policy meeting and raising further its federal funds rate target another quarter-point in December.

Sustainable Portfolios Performance Summary

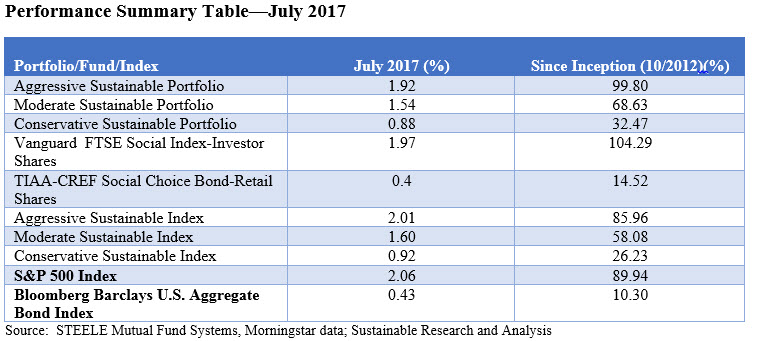

Positive rates of return, the best since February of the year, were generated by each of the sustainable portfolios due to the increases achieved by both the Bloomberg Barclays U.S. Aggregate Bond Index, up 0.43%, as well as the S&P 500 Index, up 2.06%, and the corresponding positive results delivered by the Vanguard FTSE Social Index Investor Shares and the TIAA-CREF Social Choice Bond Fund-Retail funds. In each instance, the funds lagged their corresponding indexes slightly, from 0.03% for the TIAA-CREF Social Choice Bond Fund-Retail to 0.09% for the Vanguard FTSE Social Choice Bond Fund Investor Shares. This, in turn, contributed to the slight underperformance of each of the sustainable portfolios relative to their benchmarks.

The Aggressive Sustainable Portfolio (95% stocks/5% bonds) produced a gain of 1.92% during the month of July and underperformed its designated index by 0.09% or 9 bps. The Moderate Portfolio and Conservative Portfolio also experienced gains, but lower than their benchmarks, recording increases of 1.54% and 0.88%, respectively.

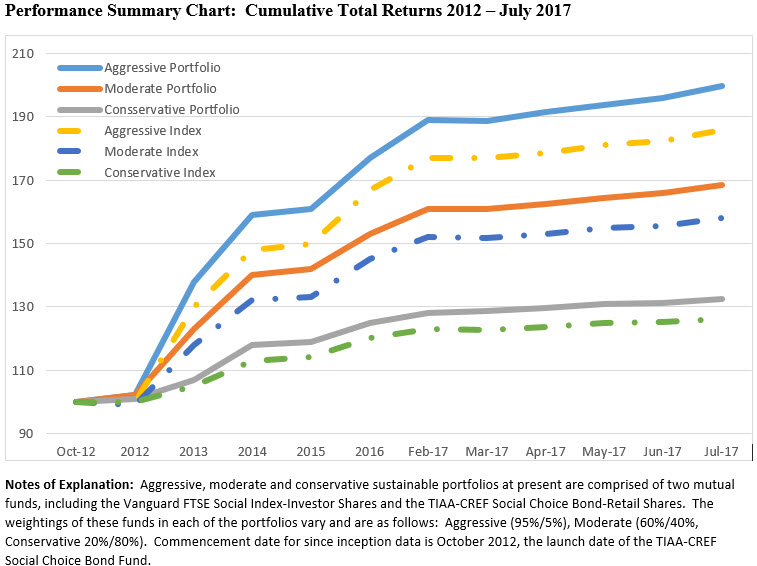

On a cumulative basis since October 2012, the three portfolios are up 99.8%, 68.38% and 32.47% respectively, comfortably in excess of their corresponding indexes that are up 85.96%, 58.08% and 26.23%.

Monthly Sustainable Fund Flows

Sustainable funds, including mutual funds, ETFs and ETNs, added $5.4 billion in July for an increase of 3%, closing the month at $216.6 billion. ETFs and ETNs stood at almost $6.0 billion as compared to $210.6 billion for mutual funds.

At the end of July, fixed income funds, including taxable, tax-exempt and money market funds, held about $17.9 billion in net assets while all other funds, consisting largely of equity funds, stood at $198.6 billion. Given the strong increase in the performance of the S&P500 Index which gained 2.06%, about 70% of the gain in assets under management is attributable to market movement during the month rather than net cash flows.

Sustainable Portfolios Performance Summary: July 2017

Major Asset Classes End the Month of July Higher; U.S. Dollar Decline is the Exception

Share This Article:

Major Asset Classes End the Month of July Higher; U.S. Dollar Decline is the Exception

Except for the U.S. dollar that declined 2.9% in the month of July, major asset classes ended the month higher. The S&P 500 Index, which registered its second best monthly performance so far this year, gained 2.1% in July on a total return basis and pushed year-to-date results to 11.6%. It has already exceeded last year’s 9.3% and is within 36 bps of equaling the total return achieved in 2015. Expansion in the manufacturing sector, a strong labor market and low inflation with the headline CPI at 1.6%, coming in below the Federal Reserve’s 2% target, were likely contributing factors along with strong reported corporate earnings.

According to data from Thomson Reuters, based on reporting from almost 60% of the firms in the index through the end of July, earnings linked to S&P 500 companies are expected to rise 11% in the second quarter. This follows a 15% increase in the first quarter of the year. Should the reporting trend hold, S&P 500 member companies will post two consecutive quarters of double-digit profit growth for the first time since 2011. This is occurring even as initiatives intended to boost corporate bottom lines, namely corporate tax cuts and infrastructure spending, have been derailed so far. This has likely been fueling the rally in stocks which led to a Dow Jones Industrial Average record close of 21,891.12 on the last day of the month and a July gain of 2.5% achieved with low day-to-day volatility.

Rising stock prices, however, did not extent to tobacco stocks. The Food and Drug Administration announced at the end of the month that it wants tobacco companies to make all cigarettes with such low levels of nicotine that they would no longer be addictive. This pushed dramatically lower the share prices of otherwise profitable regular divided paying tobacco company stocks like Altria Group, maker of Marlboro, British American Tobacco PLC, maker of Camel, and Imperial Brands PLC, which sells Winston and Kool brands. The good news is that this likely had a positive impact on funds with a sustainable orientation and ETFs as these typically exclude tobacco stocks from their portfolios.

While not yet as strong overall as the U.S. economy, the Eurozone picked up its pace in the second quarter. Gross domestic product in the 19-country euro currency zone grew by 0.6% in the 3-months to June, an annualized rate of 2.3% and a slight improvement from the 0.5% expansion in the first quarter. Over the past 18 months the region has grown a little faster than the U.S. Against this backdrop, the MSCI EAFE Index, representing developed economies, gained 2.9%, for a year-to-date increase of 17.9% while its emerging markets counterpart, the MSCI Emerging Markets Index, was the best performing equity index globally, adding 6.0% in July and 25.5% year-to-date. Only crude oil ended the month higher, adding 9.1% (West Texas Intermediate spot price).

Turning to fixed income, government bonds traded in a narrow range in July with investors likely concluding that global central bankers will not rush to raise interest rates given soft inflation data. The yield on the 10-year U.S. Treasury note ended the month slightly lower at 2.292% versus 2.298% at the end of June while the Bloomberg Barclays U.S. Aggregate Bond Index edged up 0.4% and foreign investment grade corporate bonds added 4.1%. At this point, economists expect the Federal Reserve to tighten policy, starting the process of shrinking its balance sheet at its September policy meeting and raising further its federal funds rate target another quarter-point in December.

Sustainable Portfolios Performance Summary

Positive rates of return, the best since February of the year, were generated by each of the sustainable portfolios due to the increases achieved by both the Bloomberg Barclays U.S. Aggregate Bond Index, up 0.43%, as well as the S&P 500 Index, up 2.06%, and the corresponding positive results delivered by the Vanguard FTSE Social Index Investor Shares and the TIAA-CREF Social Choice Bond Fund-Retail funds. In each instance, the funds lagged their corresponding indexes slightly, from 0.03% for the TIAA-CREF Social Choice Bond Fund-Retail to 0.09% for the Vanguard FTSE Social Choice Bond Fund Investor Shares. This, in turn, contributed to the slight underperformance of each of the sustainable portfolios relative to their benchmarks.

The Aggressive Sustainable Portfolio (95% stocks/5% bonds) produced a gain of 1.92% during the month of July and underperformed its designated index by 0.09% or 9 bps. The Moderate Portfolio and Conservative Portfolio also experienced gains, but lower than their benchmarks, recording increases of 1.54% and 0.88%, respectively.

On a cumulative basis since October 2012, the three portfolios are up 99.8%, 68.38% and 32.47% respectively, comfortably in excess of their corresponding indexes that are up 85.96%, 58.08% and 26.23%.

Monthly Sustainable Fund Flows

Sustainable funds, including mutual funds, ETFs and ETNs, added $5.4 billion in July for an increase of 3%, closing the month at $216.6 billion. ETFs and ETNs stood at almost $6.0 billion as compared to $210.6 billion for mutual funds.

At the end of July, fixed income funds, including taxable, tax-exempt and money market funds, held about $17.9 billion in net assets while all other funds, consisting largely of equity funds, stood at $198.6 billion. Given the strong increase in the performance of the S&P500 Index which gained 2.06%, about 70% of the gain in assets under management is attributable to market movement during the month rather than net cash flows.

Premium Articles Access Priority Support 1 Fixed Price

Access to All Data No Credit Card Required Cancel Any Time

Access to Premium Articles Priority Support Save 25%

$99

PER YEAR

Access to exclusive content

Premium Articles

Access 1 Fixed Price

Free Trial

30-Day

Access to exclusive content

Access to All Data No Credit card Required Cancel Any Time

$9.99

MONTHLY

Access to premium content

Access to premium Articles Save 25%

Sustainable Funds Monitor

Funds Glossary

Quarterly On-Line Briefings

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact