Vanguard Social Index Fund Summary

Assessment:High Conviction

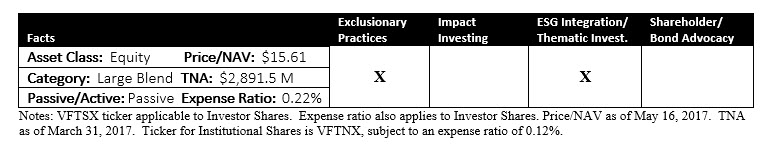

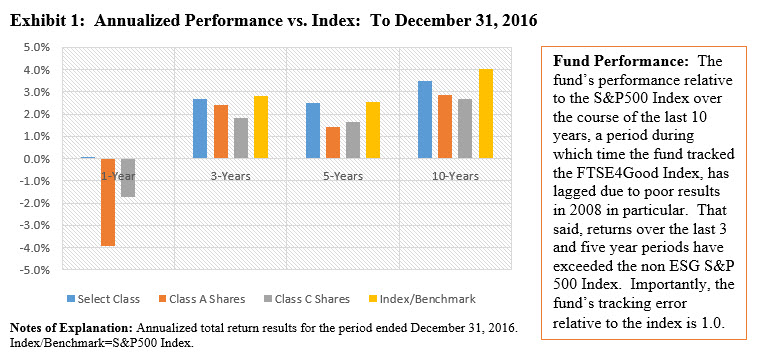

Advised by the Vanguard Group, Inc., this index tracking fund offers an effective US equity-focused sustainable strategy that combines an exclusionary approach along with the integration of environmental, social and governance (ESG) factors. The fund has been in existence since May 2000, although its current underlying index, the FTSE4Good US Select Index, was adopted as of December 16, 2005. It is a liquid, large sized fund at around $2.9 billion that tracks the performance of a cross section of tradable US stocks with a combined retail and institutional investor base. Importantly, the fund is offered at a low fee (expense ratio) of 0.22% (Investor Shares) and an even more attractive 0.12% (as of December 22, 2016) for institutional investors subject to a minimum investment of $5.0 million (VFTNX). The fund has produced a strong track record relative to the non-ESG S&P 500 Index over the previous three and five years while lagging somewhat over the previous ten years due to poor relative performance in the early years. As an index vehicle, the fund also benefits from lower turnover (16% over the last physical year) and tax efficiencies.

VFTSX Review and Analysis

This $2.9 billion fund, advised by the world’s second largest asset manager with about $3.8 trillion in assets under management as of September 30, 2016, offers two share classes: Investor Shares subject to a $3,000 minimum investment and Institutional Shares subject to a minimum investment of $5.0 million. Originally launched in August 2000 to track the Calvert Social Index, the fund adopted the current FTSE index as of December 16, 2005.

The fund seeks to track the performance of the FTSE4Good US Select Index, a benchmark that is composed of the primarily large and mid-cap tradable stocks of US companies that are screened for certain social and environmental criteria, related to the environment, human rights, health and safety, labor standards and diversity. The fund attempts to replicate the index by investing all, or substantially all, of its assets in the stocks of companies that make up the index.

The FTSE 4Good Index is derived from a selection of constituents that comprise the FTSE ESG ratings universe. As of September 2014, FTSE implemented a new ESG assessment methodology. The new model contains over 300 Indicators, 14 Themes and 3 Pillars, including governance, social and environmental considerations. Environmental themes include climate change, water use, biodiversity and pollution and resources as well as supply chain considerations. Social themes include customer responsibility, human rights and community, labor standards, health and safety and supply chain considerations; and the governance theme includes corporate governance, risk management, tax transparency and anti-corruption.

Based on publicly available data, each company in the research universe is given an FTSE ESG Rating ranging from 0 to 5, with 5 being the highest rating. From June 2015 companies with an FTSE ESG Rating of 3.3 and above have been added to the index, subject to any additional requirements that comprise the overall methodology. FTSE intends to revise down the inclusion threshold to 3.0 over time. Constituents of the FTSE4Good Index with an ESG Rating below 2.5 are at risk of deletion from the FTSE4Good Index.

Ready To Gain A Competitive Edge? In-depth sustainable investment management analysis, research, opinions and sustainable fund ratings

Companies which manufacture the following products are excluded from the FTSE4Good Index Series: Tobacco, weapons systems, components for controversial weapons; cluster munitions, anti-personnel mines, depleted uranium, chemical/biological weapons and nuclear weapons as well as coal companies. FTSE includes other screens around controversies, water, nuclear power and manufacturing of infant formula, to ensure that these meet certain health and safety as well as customer responsibility criteria.

Vanguard ESG Total Return Performance Results

Expense Ratios

The fund’s expense ratios covering both its Retail Shares and Institutional Shares are classified as lowest and lower, respectively. The Retail Shares expense ratio, at 0.22%, falls well within the first quartile and significantly below the median expense ratio of 0.55% for a universe of equity index mutual funds. The Investor Shares expense ratio, at 0.12%, is classified as moderate as it falls right on the 0.12% median expense ratio for institutionally oriented equity index mutual funds. Still, the fund’s performance over the last three-to-five years justifies its selection as a stand-alone product offering or a core component in a sustainable portfolio.

Bottom Line

This index tracking fund offers an effective US equity-focused sustainable strategy that combines an exclusionary approach along with the integration of environmental, social and governance (ESG) factors that are considered in a comprehensive and transparent manner. The fund has closely tracked the index, with a tracking error (R2) of 1.0. Importantly, it has delivered strong results over the last three to five years, bolstered by lower to the lowest expense ratios applicable to it’s institutional and retail share classes. The fund qualifies as a core position in any sustainable investment strategy or a stand-alone holding.